Fewer than 20 Chinese EV brands will be profitable by 2030 but Beijing set to dominate global auto market

The rapid expansion of China electric vehicle industry is facing a major correction, with nearly nine in 10 existing brands on the chopping block.

The rapid expansion of China’s electric vehicle industry is facing a major correction by the end of the decade, with nearly nine in 10 existing brands on the chopping block.

Prominent consultancy firm AlixPartners has predicted just 19 of China’s 137 current EV brands will be profitable by 2030, forcing the remainder to close, consolidate or battle for minor market share, Bloomberg reports.

A price war between Tesla and cheaper rivals like BYD has already been running for nearly two years, squeezing margins at some Chinese manufacturers.

Average car sale prices in China fell 13.4 per cent in 2023, while at the same time average margins at Chinese automakers rose to 7.8 per cent, up from 6.3 per cent the prior year, according to AlixPartners, which said the cost cuts came as a result of squeezing suppliers and quickly bringing new models to market.

“As long as big players like BYD still have a gross margin, there’s always room for a further price war,” AlixPartners managing director Stephen Dyer told Bloomberg.

China is set to control 33 per cent of the global car market by 2030, up from 21 per cent forecast market share this year, according to AlixPartners’ Global Automotive Outlook report published last month, which warned traditional automakers must “urgently reinvent” themselves in the face of a rapid power shift.

Much of that growth will come from sales outside China, which are tipped to rise from three million units this year, or 3 per cent market share, to nine million by 2030, representing 13 per cent.

China’s dominance is forecast to be even greater in EVs, with a predicted 45 per cent of new-energy vehicle sales by 2030.

The rapid rise of China’s auto industry and particularly EVs has set off alarm bells in the west, where governments and industry have accused Beijing of using massive state subsidies to undercut competitors and flood global markets with artificially cheap vehicles.

The European Union this month imposed additional tariffs of up to 38 per cent on Chinese EVs, after the US in May announced it was quadrupling customs duties to 100 per cent. US President Joe Biden has also granted subsidies to America’s EV industry under his green energy plan, a move challenged by China in the World Trade Organisation in March.

As the tariff battle threatens to escalate into a full-blown trade war, AlixPartners has downgraded its forecast for China’s share of the European auto market from 15 per cent to 12 per cent by 2030, up from 6 per cent currently.

The strict trade barriers also mean Chinese brands are forecast to reach just 3 per cent market share in North America by 2030, largely in Mexico, compared with exponential growth in most other regions including Central and South America, Southeast Asia, the Middle East and Africa.

Within China, domestic brands are forecast to grow from 59 per cent to 72 per cent market share, as legacy manufacturers like General Motors lose ground to the likes of BYD, Geely and Nio.

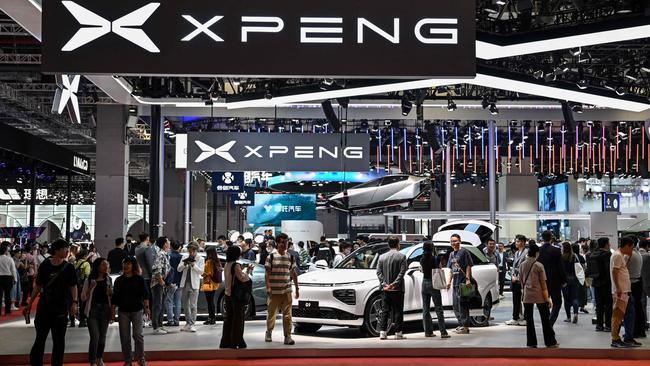

In Australia, Tesla remains the market leader in EVs but BYD is rapidly closing the gap. It is set to be joined soon by a host of other Chinese brands including XPeng, Zeekr and Aion.

Unlike the US and EU, Australia has no tariffs on Chinese-made EVs.

AlixPartners warned the global auto industry was facing another inflection point, similar to the emergence of Japanese production techniques in the 1970s, followed by the rise of South Korea, and more recently the disruption caused by Tesla.

China’s strength is in its ability to create vehicles that are faster to market, cheaper to buy, advanced on tech and design and more efficient to build, the firm said.

The report cites Chinese advantage in development time, creating new products in 20 months versus 40 months for traditional rivals, “mainly by designing and testing to sufficiently meet standards versus overengineering”.

AlixPartners also noted Chinese manufacturers had achieved better efficiency through organisational structure and an overtime work culture. Staff at Chinese EV companies can do up to 140 hours of overtime per month, compared with a maximum of 20 at legacy automakers.

Chinese brands enjoy a 35 per cent cost advantage, affording flexibility in Europe and elsewhere to lower prices to offset tariffs, the analysis found.

The “Made-in-China” advantage is built on lower labour costs as well as higher “vertical integration” in the supply chain, from raw materials to component suppliers to final assembly to selling to other automakers.

“Automakers expecting to continue operating under business-as-usual principles are in for more than just a rude awakening — they are headed for obsolescence,” Andrew Bergbaum, global co-leader of the automotive and industrial practice at AlixPartners, said in a statement.

“The revolution taking place in the global auto industry is driven by the incredible and once unthinkable maturation of Chinese automakers that do a number of things differently.

“Chinese brands put a higher value on features customers can actually experience, such as design and in-cabin tech.

“They are ruthlessly focused on maintaining their cost advantage even as they build factories abroad, and they have built a considerable lead in emerging NEV technologies — including battery production. Those capabilities have captivated China and will eventually define the global marketplace.”

It comes as China this week accused the US of implementing “discriminatory, protectionist” policies with its EV industry subsidies, amid its ongoing dispute before the WTO.

China’s Commerce Ministry said on Monday, following the failure of negotiations in Washington, it had asked the WTO to “set up a panel of experts” to probe the issue.

In 2022, the US announced a massive aid program to support companies in the energy transition sector and electric cars manufactured on American soil.

The move was meant to counter Beijing’s subsidies for EVs and the wider green industry within China, which has poured vast state funds into domestic firms as well as research and development.

China has denied its industrial policies are unfair and has repeatedly threatened retaliation to safeguard its companies’ legal rights and interests.

“No matter how one tries to package and embellish this law, it cannot change the discriminatory, protectionist [subsidies it calls for which violate WTO rules],” the Commerce Ministry said in a statement.

It added that the US law excludes “products from China and other WTO members, artificially sets trade barriers and pushes up the costs of the green energy transition”.

The WTO dispute comes at a time when Beijing and Washington are locking horns over a series of trade issues, including customs duties, cutting-edge technologies and a possible ban on social media site TikTok.

“We once again urge the US to abide by WTO rules and stop abusing industrial policies to undermine international co-operation on climate change,” the Commerce Ministry said.

— with AFP

Originally published as Fewer than 20 Chinese EV brands will be profitable by 2030 but Beijing set to dominate global auto market