Chinese cars booming on back of sharp prices and generously equipped vehicles

China has overtaken Korea as Australia’s third largest source of new cars – and could challenge Japan’s dominance in just another half a decade.

Chinese cars are on course to dominate Australian roads.

After an aborted start more than a decade ago – due to quality and safety concerns – China has overtaken Korea as our third largest source of new cars behind Japan and Thailand.

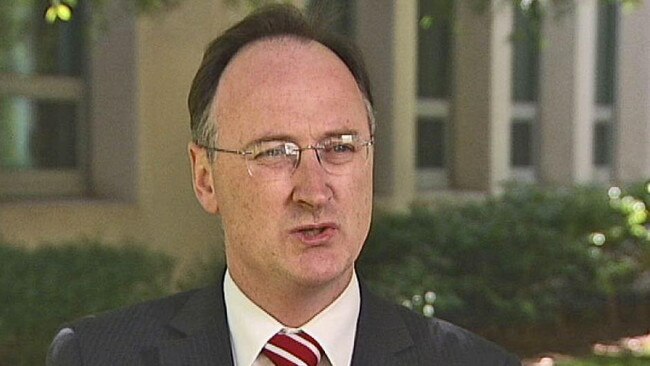

John Conomos, the key architect of Toyota’s rise to dominance in the Australian market, believes it is only a matter of time before China challenges Japan as our biggest automotive import market.

Mr Conomos, a 40-year car industry veteran who led Toyota Australia from its inception in 1981 until 2006, said the rise of Chinese cars in Australia was “inevitable”, but had happened more quickly than anyone had imagined.

“I could see it almost 10 years ago but I didn’t think the Chinese would move as quickly as they did. The speed has been breathtaking,” he said.

He believes they will challenge Japan’s dominance of the local market in “probably five to seven years”.

“This is just the beginning,” he said.

Chinese car sales have exploded since 2017, when they accounted for less than 5000 sales in a market of more than one million.

In the first nine months of this year, Australians have bought more than 145,000 Chinese vehicles – up 75 per cent on last year.

Brands such as MG, Great Wall, Haval, BYD and Chery – largely unheard of in Australia five years ago – are booming on the back of sharp prices and generously equipped cabins filled to the brim with desirable gear such as leather trim, sunroofs and the latest digital screens and technology.

For the price of an entry level model from a mainstream brand, buyers are treated to the features of a top-spec variant.

Mr Conomos said the big brands had been caught napping by the Chinese, deserting the lower end of the market to concentrate on larger SUVs and utes with bigger profit margins. Chinese brands have gladly picked up the slack.

Mr Conomos said their appeal to Australian buyers was obvious.

“The Australian mentality in purchasing is always wanting leading edge technology, but the one problem is we’re not prepared to pay for it,” he said.

Chinese cars offered the best of both worlds.

Federal Chamber of Automotive Industries chief executive Tony Weber said the surge in demand for electric vehicles would only hasten the growth in sales of Chinese cars, as they led the world in battery technology.

“It’s driven by their expertise in electrification and the economies of scale around having large factories that now supply both the domestic Chinese market and export markets around the world,” he said.

“They now provide quality vehicles at very economical prices,” he said.

He said the Australian appetite for Chinese cars had remained unaffected by diplomatic and trade tensions between the countries in recent years.

“I think Australian consumers are very broad-minded about products. Over generations we’ve learned to accept new products. Originally that came from Japan, and then you had the wave of Korean cars, and now we’re having the third wave of Chinese brands and Australians are very accepting of quality technology at the right price point,” he said.

It hasn’t all been smooth sailing for Chinese brands in Australia, though.

The first wave of Chinese brands, led by Great Wall Motors, arrived back in 2009, but Australian buyers steered clear of them, wary of disastrous crash test ratings, poor quality and embarrassing recalls.

Mr Conomos said the Chinese responded to the initial failure in export markets by embarking on a program of “hiring the best talent they could get worldwide”.

“It was inevitable with that amount of dollar horsepower, engineering resources and determination, sponsored by heavy subsidies, that they began to embark on building what are now very, very good machines,” he said.

He sees plenty of parallels between the rise of Toyota and the growth of Chinese brands.

“The parallel I see is that the early Japanese cars were scoffed at, then quickly the Corolla and the LandCruiser became synonymous with quality product. And then, after a number of generations of course, the reputation was born.”

Unlike their predecessors, the new breed of Chinese vehicles typically come with five-star independent crash ratings and long warranties – sometimes up to seven years – which go a long way to overcoming consumer misgivings.

The pandemic also helped Chinese brands gain a foothold.

When demand for new cars soared during lockdown, against all expectations, Japanese and Korean carmakers were caught short and encountered crippling supply issues. Earlier this month, Toyota stopped taking orders for its Camry sedan because waiting times have stretched out beyond two years.

The shortage of new cars pushed used car values up by as much as 40 per cent, which meant that many used cars from established brands cost more than new Chinese cars.

Mr Conomos said most of the people buying Chinese cars now were previously used car buyers, but that would change in the future, as Chinese cars moved up-market.

“Then those entry level Chinese cars will give way to Indian cars or Indonesian cars or other entry-level markets, which are clambering to have an automotive industry and giving huge subsidies,” he said.

More Coverage

Originally published as Chinese cars booming on back of sharp prices and generously equipped vehicles