Year-on-year sales paint a tricky position for Euroa’s beef producers

The great cattle prices of recent history seemed to be good to be true — and they were. The figures from the latest Euroa EOFY sales make sobering reading.

The annual End of Financial Year cattle sales at Euroa last week created an opportunity to quantify the state of play in the store market compared to a year ago.

The figures read like an out-of-shape person: 15, 32 and 52.

Translated it showed a 15 per cent increase in young steer numbers compared to a year ago; a 32 per cent drop in interstate buying activity from NSW and Queensland, feeding into a 52 per cent price cut across the main weight categories of weaners.

It broadly mirrors the current industry problem of more cattle selling to fewer buyers at a lot less money.

Many calf breeders probably don’t want to look too closely at comparisons to a year ago, but they shed some light on how trading patterns have changed.

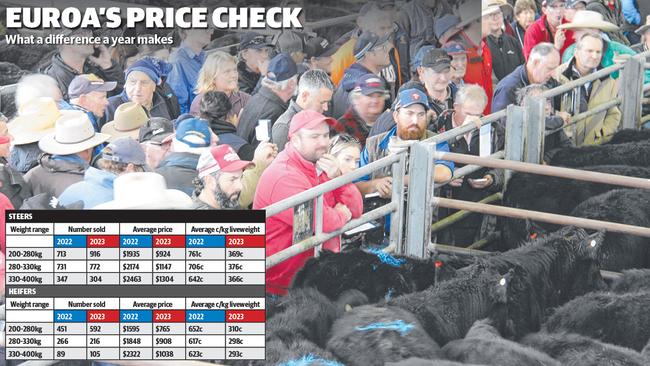

The table on this page shows the number of steers sold in each weight band at the Euroa End of Financial Year sales in 2022 versus 2023 and the price average in dollars per head and cents per kilogram liveweight – the data supplied by AgriNous which collects all sale results through its saleyard management system.

The biggest lift in supply has been for lightweight steer calves weighing from 200-280kg liveweight. It reflects producer confidence in terms of both season and future pricing, with agents telling The Weekly Times breeders were reluctant to keep carrying young stock after:

– some people were caught carrying weaners to heavier weights for no financial gain in the past six months as the market retreated under them; and

– the lower cents/kilogram rates had reduced the incentive to add weight.

A year ago, when young store steers were trending over 700c/kg liveweight adding 50kg or 100kg to a calf added up to significant money. On the current ballpark of 360c/kg, adding 50kg gives you just $180 against the risk the market could face more pressure in the spring if conditions abruptly go dry.

For buyers, the sweet spot in the market has become the middle run of steers, not as expensive as the lead pens in dollar-per-head terms but offering a bit more growth and frame at about $900 to $1200.

It shows up in the Euroa figures, with steers in the 280-330kg weight bracket achieving the highest liveweight average of 376c/kg last Wednesday.

In comparison, the lighter calves averaged slightly less at 369c/kg, marking a big turnaround on a year ago when there was a hefty 50c/kg premium in the market for small steers and heifers.

The other analysis AgriNous was able to provide was a breakdown by state of where the cattle went.

In June last year, 60 per cent of the yarding sold to producers in NSW and Queensland.

Last week this ratio was down to just 28 per cent, and it was noticeable that the steer sale last Wednesday needed more volume of interstate buyers to set the pace.

For example, a year ago, there were two NSW orders that purchased more than 250 calves each.

The Euroa steer sale last week was driven by a lot of agents and restockers from within a 150km radius of the centre who were mostly purchasing less than 50 each.

The table on this page also shows the income cut for southern breeders, with steers averaging about $1000 less last week compared to the previous June.

The issue starting to be talked about now is the inversion between the trend lines of income compared to costs of production.

Key inputs such as fertiliser, chemicals, grain and hay have reduced in price but not at anywhere near the same level as the cut to beef values.

The other significant pressure point is rising interest rates and much more costly finance when purchasing land, stock and machinery.