Tariffs and supply glut muddy cow market

Cow markets opened weaker this week as a lack of rainfall, potential tariffs and a build-up of grinding beef in the supply chain into the US take effect.

There is a negative swirl around the cow market.

It comes from seasonal pressure in Australia, forecast big volumes of grinding beef being shipped into the United States ahead of the New Year and tariff advantages for countries like Brazil.

There is also the suggestion of some market distortion from incoming President Trump’s claims he will impose a universal tariff of up to 20 per cent on all goods entering the US, and slap 60 per cent on Chinese manufactured goods.

The cow market opened 10-20c/kg weaker at saleyards on Monday, with the national price indicator slipping back to 267c/kg liveweight after peaking at close to 300c/kg just eight weeks ago.

The lack of rainfall and tightening season has been the main catalyst as cows are culled ahead of what looks like being a long summer of limited feed in many areas. It shows up in the data, with the latest seven-day rolling price average for cows having a count of just over 10,000 head in the calculation – double the supply of this time last year, according to Meat and Livestock Australia.

From a slaughter perspective, there were 64,467 females processed in the latest data for a female cattle slaughter ratio of nearly 46 per cent, up from 43.7 per cent a year ago.

The data shows the supply pressure.

On the export front, there is a build-up of grinding beef in the supply chain into the US as exporters position themselves ahead of the New Year.

A lot of tariffs work on the calendar year, and this is the case with the ‘Other Country’ beef supply quota into the US which covers countries like Brazil. Under this quota system Brazil can ship in around 65,000 tonnes of beef with no tariff, after this a 26.5 per cent rate kicks in.

US analysts like Steiner Consulting believe there is enough Brazilian beef in the supply chain, and going into bonded warehouses (stored with the permission of authorities with tariffs and fees suspended) for release in the New Year to fill the 65,000 tonne quota in record time.

The suggestion by Steiner is it could be filled by the end of January or early February in 2025.

The forecast is based on some big shipments out of Brazil recently, including a record month of beef sales to the US during October. Brazilian beef exports to the US last month were listed at 24,328 tonnes, up a huge 216 per cent on the 16,461 tonnes sent at this time last year.

On top of this, Australia has been targeting the US beef market and also had one of its highest beef shipments to the US during October.

It means the US market has been heavily supplied with grinding beef, putting a “soft undertone” into the manufacturing beef sector, according to Steiner.

The value of 90 chemical lean grinding beef (90 per cent red meat, 10 per cent fat blend) in the US is currently at its lowest price point since May, although it remains historically high when looked at over time.

But it means exporters are currently facing a more competitive environment when selling beef into the US.

In its latest update on the market Steiner wrote: “With all major suppliers putting record volumes (of beef) on the water and expected to have more supply to sell in early 2025, exporters are looking to stay competitive.

“In the short-term overseas suppliers are looking at a very competitive situation in the US market.”

Get deeper into next year and the US is still anticipating tighter cow-beef supplies as its herd remains low.

“Cow prices have the potential to be higher still next year as cow slaughter is expected to decline another 8 per cent to 10 per cent,” Steiner predicts.

But in the short-term the market intelligence around the cow market is it has some negative influences.

The other potential issue on the table for the industry is the possible ramifications from President Trump’s tariff plan if it is put into play.

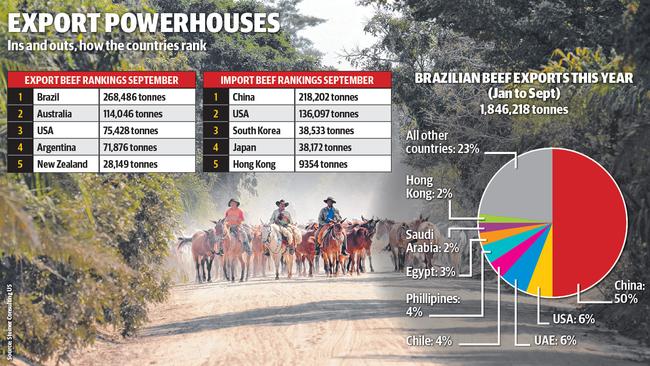

The table on this page shows the top five beef exporting and importing countries in September – the latest official data available. China is the biggest beef importer in the world, and the US is still in the top three or four exporters even on its reduced production. Brazil is the largest trader of beef on the world stage.

The scenario of Trump putting a 60 per cent tariff onto Chinese goods could be the big disrupter, depending on how China reacted and if it put in retaliatory measures – such as against US beef.