Scanned-in-lamb ewe prices crash on two year comparison

Prices for scanned-in-lamb ewes have taken a hit with all breeds dropping up to 68 per cent of their value in the last two years. Our markets expert takes a deep dive on the issue.

Prices for scanned-in-lamb ewes have rolled back as the sheep industry grapples with issues on a number of fronts including producer confidence, the mutton market slump, the weather, cheap stock from Western Australia, the overall build-up of the flock and the lure of cropping.

All these factors were listed as reasons SIL ewes have become a cheaper and more difficult item to sell this autumn compared to recent years.

The Weekly Times understands selling was very tough at a small yarding of store sheep at Wycheproof last Friday, with good SIL ewes making $130 to $160.

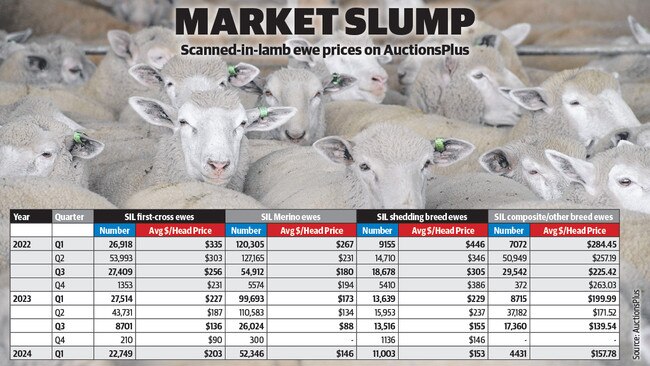

The three main categories of SIL ewes – crossbred, Merino and shedding breeds (mainly Dorpers) – have lost 40 per cent to 68 per cent of their value on two years ago, based on online sale transactions.

The table on this page shows the number sold and average quarterly price for SIL ewes sold on the AuctionsPlus network, broken down by breed.

The most dramatic change has been for shedding breed ewes which have gone from an average cost of $444 in January, February and March (the first quarter) of 2022 to be currently tracking at $145 this quarter. It marks a decrease in value of 68 per cent.

Having an impact on this breed is the build-up of numbers, particularly in the pastoral areas which was the driver behind their premium rates during the flock rebuild after the drought. As a breed type they have lost the most ground in the past 12 months.

For Merinos the interesting element is the cut in supply of SIL ewes this year, with numbers this autumn tracking well below the 100,000-plus levels of the previous two seasons.

Seasonal distortion and price were the reasons put forward for the anomaly. The floods and wet weather of spring 2022 caused more ewes to be carried and joined, boosting numbers of SIL stock this time last year. Move onto this year and the good summer rain across much of the pastoral country has allowed Merino producers to hold onto ewes rather than selling into the depressed restocking market.

Peter Head of Elders Hay, NSW, said people not under pressure to sell were trying to hold onto stock for a market kick.

“There hasn’t been a reason to push the sell button yet,” he said.

Like all livestock commodities, SIL ewes are at their lowest price points for a number of seasons.

Bill O’Brien of Nutrien Deniliquin, NSW, described prices for very good quality sound but aged Merino ewes in lamb as “ridiculously low”, with their values closely tied to mutton rates.

“There has been big heavy Merino ewes, ex WA sheep, sound mouth and due to start lambing in April and May selling at ridiculously low rates like $85 with meat processors taking them,” he said.

The poor performance of the mutton market has arguably taken the biggest toll on the breeding ewe market by stripping confidence from farmers and slashing the income to spend on younger replacements. It has also opened the door for more West Australian sheep to come into the eastern States, as mutton values in the West make the rates ewes have been making at places like Wagga Wagga, Bendigo, Ballarat and Hamilton look good.

The latest National Livestock Reporting Service market reporting from Katanning in Western Australia had all the sheep categories tracking under 100c/kg, or $20 to $38 for heavy ewes. And this Kattaning sale, held last week, was described as dearer thanks to the support of an additional buyer from the eastern states.

Both restockers and processors have been purchasing WA sheep with the freight costs home often more than the actual saleyard value of the animal.

The shock collapse of the mutton market, and the erratic and lower than expected price points for lamb, has been taking a toll on farmer commitment to sheep particularly for producers with the option to expand cropping, agents said.

This in turn feeds into less demand for SIL ewes.

“None of the station places are changing enterprise, but cropping is choking sheep out of the irrigation and trading areas,” Mr O’Brien said.

“Blokes that were running 800 to 1000 ewes are back to 500 and doing more cropping due to the erratic livestock market.”

It was a view mirrored by Mr Head: “A lot of places are putting more crop in rather than sheep as returns are still good for grain”.