Record livestock sell-off reshaping regional supply chains

Record livestock sales are reshaping regional supply chains, with cattle being churned from south to north. See what it means for cattle and lamb going forward.

The “churn” factor needs to be considered when analysing the current record sell-off of livestock and the ramifications for cattle and lamb going forward.

A significant percentage of the huge lamb and cattle numbers being seen at saleyards are being re-sold to restockers and feeders, finding new homes in other regions and states rather than leaving the meat supply chain entirely.

A lot of cattle are being churned over from the south to the north, while for lambs the trading churn is more to feeders who can see a margin thanks to the forward winter money of up to 900c/kg carcass weight being offered by export processors.

While there will be market distortions caused by the current situation, it is not as simple as saying ‘x’ numbers of stock are being sold now so only ‘y’ will be available later on. What’s happening is complex.

A look at the rolling seven day supply numbers behind the main store stock indicators published by Meat and Livestock Australia gives some insight into elevated levels of trading.

These are numbers collected from the major weekly prime markets – such as Wagga Wagga, NSW, which last week set new records for cattle numbers (8690 head) and sheep and lambs (76,100) sold at a single sale.

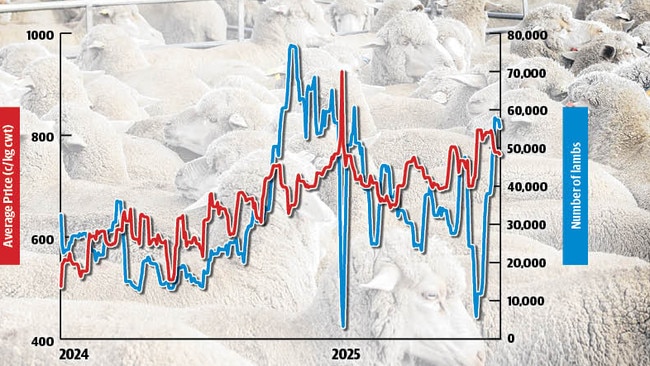

Store lamb (or restocker lamb) trading out of the weekly prime markets has hit nearly 58,000 in the past week, to be more than double what the general trend was this time last autumn (see graphic on this page). And this doesn’t take into account online transactions like AuctionsPlus.

There was more than 48,000 lambs and sheep listed on AuctionsPlus last week, a rise of 30 per cent. In its commentary AuctionsPlus noted how 40 per cent of the offering sold interstate with a lot of lambs and sheep moving from the south to the north.

The only time the industry has seen more store lamb trading in the past 12-months was during the spring and early summer flush when people were buying stock to put on stubbles and spring feed, which is a normal peak in demand. The current situation is distorted, but again pointing out that a lot of lambs are just moving around rather than being slaughtered out at record numbers.

Helping support the light lamb market is strong forward pricing for heavy prime stock which is above the ruling carcass price rate that it is possible to buy store stock for. It means feeders potentially have weight gain and a cents-a-kilogram bonus, which is the scenario needed when pouring feed into an animal.

As the graphic on this page shows, the averaging restocking price for mixed store lambs has dropped back to 762c/kg carcass weight at saleyards, below the 850-900c/kg winter contracts on the table.

Taking into account an eight to 12-week turnaround to feed lambs – depending on size going in and target weight – the high volume of trading should give processors some supply cover deep into winter.

The first looming problem period for processors considering no autumn break could be the crossover time from old lambs into new-season suckers, which is usually around September. With the majority of ewes on dryland lambing onto little or no paddock feed, the only good early suckers are likely to come off irrigation.

Looking forward, and with a lot to happen in coming weeks in regards to weather and the season, the lamb market could possibly be back ended again. That is, the highest priced month for prime lambs last year was in December due to the lack of condition and supply from southern areas such as the Western District.

For cattle the same high level of turnover is evident for young steers and heifers. So far this May the yearling store steer indicator has had rolling daily trade volumes of between 7500 to 9200 head out of prime markets. This is actually the highest trading levels recorded in this indicator for the past 12-months, according to MLA data.

Again, this indicator is merely a snapshot and doesn’t include the huge numbers being traded at major store sales or online.

There has been reports of more than 80 per cent of cattle from big Victorian store sales selling north into upper NSW and as far north as central Queensland.

It means in coming months the supply and pricing of feeder and finished prime cattle will become more focused out of northern areas and how their season performs. The sell-off of breeding cows, which are being slaughtered, is a separate issue and demand for replacement breeders will have to gain momentum eventually.

But one point to debate when looking at the current sell-off of cattle, which has reached unprecedented levels very quickly. How much of it is driven by the fact the cattle market has underperformed now for a couple of years, and feeding cows expensive hay or grain for an average weaner return of $1000 or less (heifers and steers sold after selling costs) is just not viable.

The willingness of farmers to dig-in and try and hold cattle doesn’t appear as strong as it once was, and maybe is a reflection of the amount of money which was burnt in recent years.