Potential for lamb prices to improve

Farmers contemplating the pros and cons of sheep and lambs may find price trends for high value cuts exported to the United States encouraging.

Farmers contemplating the pros and cons of sheep and lambs may find the price trend line for high value cuts into the United States market encouraging.

It shows the lamb market from an export perspective is far from dead, with sale volumes improving and values to the key US market coming off highs but still at historically strong levels.

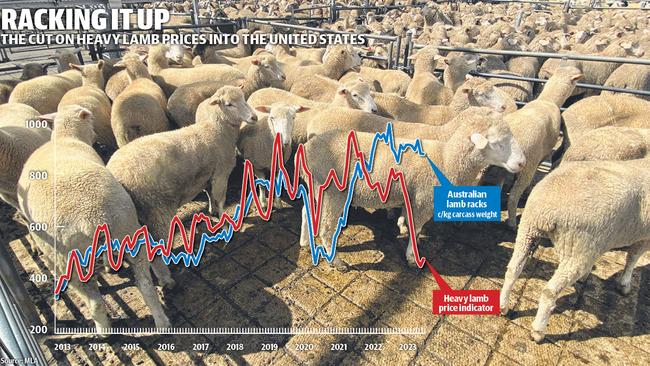

The oddity is the severe drop in heavy lamb prices in Australia, with the graphic below, showing how the saleyard price has become discounted from the trendline for lamb racks sold into the US.

The Weekly Times investigated building a price pattern for lamb to the US, similar to how the 90 chemical lean manufacturing beef price acts as a guide to the health of the cow market.

Using United States Department of Agriculture published data, the price is for Australian lamb racks exported to the US and converted into an average cents-a-kilogram rate using the trade value divided by volume.

Meat and Livestock Australia market analyst Tim Jackson worked through all the figures and found high value lamb racks gave the most consistent price trend, as this segment of the trade appears to have the most consistent USDA data.

And over time, there does appear to have been a strong correlation between the lamb rack price into the US and the saleyard indicator price for heavy processing lambs sold in Australia.

The data covers 10 years, dating back to 2013. Until around 2019, the price pattern was pretty tight before the trend line was hit by seasonal influences in Australia (drought to wet years) and the start of the Covid-19 pandemic.

The flock rebuild pushed heavy lamb prices higher, while Covid and global shutdowns of travel and restaurant and entertainment venues pushed the value of high value lamb racks (used mainly in food service) lower.

It is probably worth focusing on this aspect briefly, as buyers and meat wholesalers still maintain that the damage done to the lamb sector by the record price highs it hit of up to $10/kg carcass weight at a time when demand slowed is still being felt today.

Their argument is sales volumes dropped and customer support had to be rebuilt.

The graphic on this page illustrates how the pain of market distortion paint has been flipped from exporters in 2021-22 to producers in 2023 as bigger numbers of lambs became available to process.

There is now an extreme price difference between the trend line for lamb racks into the US compared to today’s saleyard price of about 480c/kg carcass weight for heavy prime lambs. The gap is more than 400c/kg carcass weight, which has never been seen before in the past decade.

It mirrors what has happened in the cow market, with the 90CL grinding beef price into the US tracking well ahead of ruling saleyard rates in Australia for slaughter cows.

There should be some comfort in these distortions for producers, as it shows meat companies are paying less for stock because they can (due to plentiful supplies), rather than because they have to due to low export sales and values.

The potential for prices to improve, both for lamb and cattle, is there once stock supply and fears around the market and season settle down.

In the past 10 days, the lamb and mutton market have shown glimpses of the possible price upside, mutton values briefly surging by up to $50 after the recent heavy rain. And at Bendigo on Monday decent sucker lambs gained $5 to $10 and up to $15 in places.

For lamb, there appears to be some momentum building for heavy stock, with lambs weighing above 26kg carcass weight now selling at modest premiums to trade weights which are more plentiful.

It shows up in the national price indicators with heavy lambs now at 484c/kg carcass weight compared to 454c/kg for trade weights, according to MLA data.

There are whispers that some exporters may be preparing to come to the market for some forward pricing for heavy lambs, amid concerns not enough are being shorn and prepared for the summer months which can be problematic for processors.