Margins producers make show true cost of young cattle

The margins for buying young cattle and selling heavy steers aren’t as outlandish as you may think. Expert livestock analyst Jenny Kelly breaks down the numbers.

Kicking yourself for not buying young cattle last year when the store market was ‘cheaper’?

Challenge those thoughts.

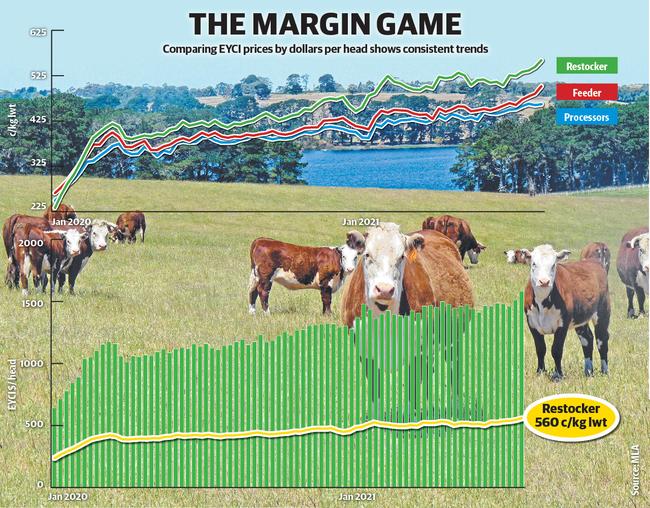

When you drill down into the data and look at not only store cattle prices but also their relationship to feeder and processor rates, trading conditions are only marginally more difficult now than they have been in the past 10 months.

Yes, prices for young store steers and heifers have lifted, but so have returns for heavier feeder slaughter cattle.

When converted to dollar-a-head, the average cost paid by a restocker for young steers and heifers included in the Eastern States Young Cattle Indicator calculation last week was $1583. It is the highest ever recorded.

In the same week, the average price paid by feedlots for young cattle in the EYCI was $1952, and processors $1977 — also the highest results.

As a simple comparison, it leaves a ‘gap’ or margin of $370 to $394 between the financial outlay for an average store calf in relation to the return for an average feeder or heavy slaughter animal (that is: $1977 - $1583 = $394).

This is not the tightest ‘margin’ there has been in recent months.

In late October (nearing the peak of the green feed in the south), the cost of a restocking calf on the EYCI was $1312 a head, while at the time the average feeder steer return was $1644. This meant a narrower margin of $332 existed at the time.

Another point of interest was when the cattle market took off to create a buzz in the New Year. At the end of January the average cost of a store calf on the EYCI was $1399, while the feeder steer average was $1801 — for a bigger margin of $400, at least on paper.

It just shows how hype and headlines can be misleading, as the talk around store cattle in January and February was that they were ridiculously expensive. A bit like now as the EYCI went close to $10/kg carcass weight equivalent.

In reality, store cattle values are moving in tandem with improved returns for finished stock, particularly the feeder market.

As the graph on this page illustrates, the price difference between store, feeder and processing cattle in the EYCI has stayed quite consistent since the drought broke.

And the current price points, while at an all time highs, are really no worse than what has been experienced in the past year or so.

Nutrien livestock agent Terry Ginnane, from Leongatha, said for farmers in the system the market was still delivering sound results.

“For people who have continued to trade the margins are still there,” he said.

He did note the influence the buoyant feeder market was having on the current industry, with producers cashing in heavy grown steers as feeders and coming back into the store market for lighter calves.

It partly explains the recent price rise for young steers and heifers weighing under 300kg liveweight, which created a lot of excitement at store sales such as Ballarat last Friday.

Agent reports had light steer weaners in the 200-300kg size bracket selling from $1450 to $1850 at Ballarat, averaging over 650c/kg liveweight.

The scenario being played out is that producers are selling heavy feeders at $2200 plus rather than taking them onto bullocks, and then coming back into the winter store market for younger replacements at $1700 to $1800.

“Feeder cattle are making so much that people are taking the money rather than carrying steers onto bullocks and taking their (gross) margin of $600, $700 now,’’ Mr Ginnane said.

And it has been lighter calves, particularly at northern sales in NSW and Queensland, which have boosted the EYCI in the past week.

For example, when the EYCI hit a peak of 988c/kg carcass weight last Wednesday, price results from the Roma Store sale accounted for 20 per cent of the rolling calculation. To put it in perspective, the highest ranked Victorian based yarding in the EYCI that day was Wodonga at 3.58 per cent.

It meant trading in the north had a big influence on the EYCI record.

At the Roma store sale in question there was 7000 cattle yarded, which included some feature runs of young weaners. The National Livestock Reporting Service listed an average of 600c/kg or $1455 a head for 642 young steer calves sold that averaged just 242kg liveweight.

Another graph on this page shows the rise of the EYCI price converted in cents per kilogram liveweight terms, compared against the average dollar per head outlay. As it illustrates, there has been a sharper upward swing in c/kg rates, showing how lighter weight calves are influencing results.

This is highlighted when data for vealers from the EYCI is isolated. Referring to when the EYCI hit the record of 988c/kg, the average price paid for the vealer steer component was over $11/kg carcass weight equivalent.

And while some of these light calves sound extremely expensive, agents said they were being purchased by producers confident of a good spring and the opportunity to add kilograms cheaply off grass.

Confidence is also carrying the store market after some very profitable trading as the beef market consistently performs in high price territory.

Ultimately farmers have to make their own decisions around the value of investing in cattle as the market hits new peaks this winter, but they should be wary of making decisions around headlines and hype that often don’t tell the full story.

MORE