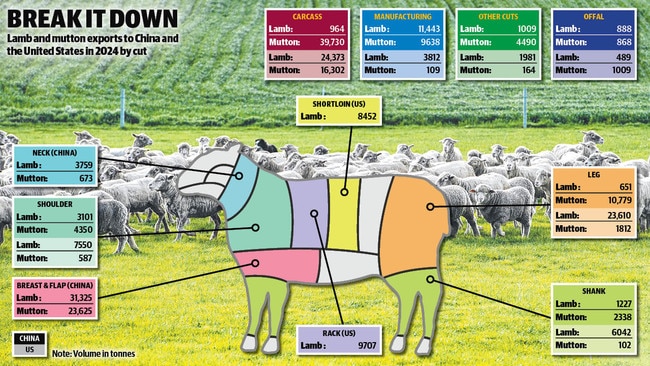

Lamb and mutton exports to China and USA by cut in 2024

We take a look at the head-to-head breakdown of lamb and mutton exports to China and the United States, and which cuts each country prefers.

Just like in farming, being able to find a viable outlet for everything produced from the shy feeder lambs that don’t gain weight to the best exports is what supports overall financial returns.

The same scenario applies to meatworks, which explains why the surprise granting of an extra 10 new Chinese export licences to Australian sheep and lamb processors was widely celebrated by industry last week.

China is a complimentary market destination to other high value destinations, taking a wide range of cuts and quality including a lot of the so-called secondary items from a carcass like flaps.

A head-to-head breakdown of lamb and mutton export data from Australia to its two biggest trading partners of the United States and China illustrates how the markets differ and help processors break down carcasses for the best potential value.

In 2024 the US was Australia’s largest lamb market taking 83,133 tonnes, followed by China in the number two spot at 53,478 tonnes, according to data published by the Department of Agriculture, Fisheries and Forestry.

For mutton China was the top ranked market taking 95,622 tonnes, while the US had third spot at 19,077 tonnes.

The illustration on this page shows the main breakdown of mutton and lamb sales last year by major category, or cut. The figures were provided by Meat and Livestock Australia global supply analyst Tim Jackson.

The US is a high value market, taking some of the most expensive lamb items in big volumes. The trade in lamb legs to the US was 23,610 tonnes last year, compared to China which only purchased 610 tonnes of this item.

The biggest market segment of lamb to China was breast and flap which accounted for 31,324 tonnes, a product the US took none of. In contrast the US purchased 9706 tonnes of high value lamb racks and 8451 tonnes of shortloins, items that the more price sensitive and less developed Chinese market didn’t require.

It highlights how the two markets mix and match and interact with each other to give exporters the opportunity to maximise market value.

For mutton, carcass, breasts and flaps were the biggest items sold into China, while the US has less of a footprint in demand for lower value sheep meat protein.

The latest export figures for April were just released and show lamb and mutton sales to China improving on year ago levels, but due to the new Chinese export licenses just being approved and the amount of short trading weeks due to Easter and Anzac Day the true picture of demand won’t be known for another month or two.

Lamb exports to China during April totalled 5677 tonnes to be up 8 per cent on year ago levels, according to data released by DAFF. This matches the trendline this year of a 9 per cent overall move in sales since January.

Mutton exports were at 6052 tonnes during April, a bigger increase of 25 per cent compared to a year ago and above the trendline of a 16 per cent rise in volumes recorded this calendar year.

The mutton market is likely to be the main beneficiary of improved access to China, although in the short-term it is going to be weather patterns and sheep supply that determines price outcomes at saleyards rather than export demand.

The rollercoaster price pattern for sheep continued this week, with prices back $30 to $50 a head again for heavy sheep and other grades back $10 to $30, based on National Livestock Reporting Service data.

With little rain predicted for May on top of already extreme dry conditions, producers have begun another sell-off of stock. And while it is more noticeable in the cattle market, sheep numbers have also remained elevated.

The national saleyard indicator for mutton was still tracking above 600c/kg carcass weight early this week, but is likely to undergo a quick retreat with only limited heavy sheep selling above this mark on Monday.

It is also interesting to note the price discrepancy between light and heavy sheep at present, with a difference of more than 100c/kg often evident for ewes with little fat cover compared to lines still with weight and condition.