Heavy lamb and restocker lamb price difference

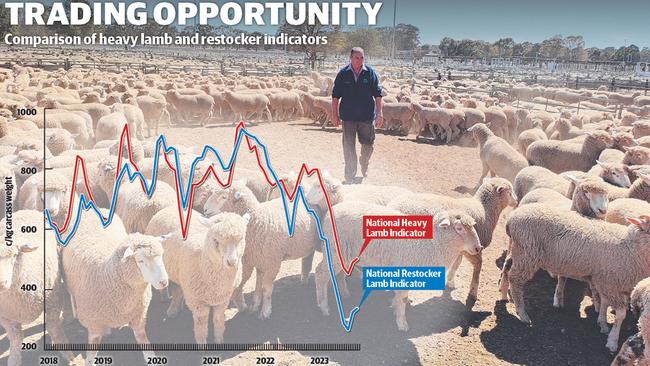

Store lamb prices and the heavy lamb indicator is at its widest discrepancy for at least a decade, so is there opportunity in trading lambs?

Have store lamb prices fallen low enough to carve out a trading margin against strong grain and feed costs and a market offering little forward contract pricing?

Some claim it has and argue trading opportunities are being overlooked by people too focused on today’s lower lamb prices and the negatives from the previous autumn and winter lamb selling period.

It comes down to this. The average store lamb price is sitting at 332c/kg carcass weight to be at a 150c/kg discount to the current ruling rate of 485c/kg for heavy slaughter lambs, according to the latest saleyard results from the National Livestock Reporting Service.

It is the widest price discrepancy seen between the store lamb and heavy lamb indicator for at least a decade (see graphic).

To put it in context, last year the price difference between the two was around 80c/kg in the spring at 710c/kg carcass weight for stores and 790c/kg for heavy prime lambs. In the spring of 2021 during the peak of the flock rebuild frenzy store lambs were costing 50c/kg above slaughter rates at a record 915c/kg.

And while we all lament today’s lower price point for lambs compared to the heady days of $7/kg to $10/kg for lamb, the advantage from a buying perspective is the much lower dollar-a- head investment needed for store lambs which helps reduce trading risk.

In November 2021, a 16-17kg carcass weight store lamb was costing about $150 at a rate of 915c/kg. Last year it was about $120. Using the current national saleyard indicator that same 16-17kg store lamb is worth about $55.

Store lamb values have more than halved, however there doesn’t seem to be the same focus on this downturn compared to other categories of stock.

For example, the industry has just came off the big first-cross ewe trading week in the south with feature sales at Naracoorte in South Australia and Bendigo.

These were the averages rattled off to The Weekly Times for 1½-year-old first-cross ewes sold at Naracoorte in the past three years:

IN 2021 ewes sold to a record $538 and averaged $379;

IN 2022 ewes sold to $426 and averaged $350;

LAST week ewes sold to $228 and averaged $163.

There is some shock value in these figures as the initial reaction is wow, first-cross values have come off in a big way. And interestingly, agents were commenting about how much value there is in young ewes at present.

On paper, at least, store lambs have followed a similar falling price pattern. Obviously, there are different considerations for a breeding ewe with a five or six-year production span compared to a prime lamb which is a six- to nine-month prospective before it cuts its teeth.

But it highlights the point that maybe store lambs deserve a bit more thought around trading opportunities.

Elders Rainbow agent Graeme Summerhayes bought 1100 crossbred store lambs at Bendigo on Monday this week for clients in the Mallee.

He paid an average of $62.70 for the lead run which are destined to firstly be put onto recently cut oaten hay paddocks, then onto grain stubbles, before being topped up in an on-farm feedlot scenario to reach export weights in the winter.

It is an annual program for his clients, and Mr Summerhayes said while they had come off a tough trading year he was much more comfortable with the figures and outlook going forward.

“Last year was our worst year ever but I think we have had the bad one now and we’ve copped it on the chin and moved on and the figures are different now,” he said.

“But I think too many people are still burying their heads in the sand over last year and not looking at the market now, and that was evident by the lack of store buyers at Bendigo.”

An ‘old school’ agent, Mr Summerhayes keeps detailed records. He said last year they paid an average of $121.97 for store lambs, and while they re-sold at a peak of $199, the sliding winter market meant some lambs went out at just $130. The average was $165.13 for a gross of about $44 a lamb.

The game changer this year he said was a 50 per cent cut in the store lamb price down to $62. Working on a very conservative average of $130 resale price as heavy lambs, this would give them a profit, even with $40 to $50 in costs. And he noted his clients were able to keep feed costs low by using home grown feed such as grain screenings and hay not up to export specifications.

“The store lamb price is low enough to create a margin in my opinion,” he said.

When it comes to store lamb trading, there are numerous ways to do the figures. If you use industry calculators that take into account machinery wear and tear and farmer wages per hour, etc, it would suggest a rate of 600c/kg to 800c/kg carcass weight would be needed to grain finish lambs.

At present, while there was talk of impending forward contracts for lamb, no major exporter has publicly issued a rate for the summer and beyond.

The Weekly Times understands there has been some private deals done with volume lamb feeder/suppliers for around 540c/kg to 580c/kg carcass weight for lambs delivered in January.

There is still the suggestion the season and more light MK lambs being processed could create tighter supplies of quality prime lambs next year.

Like always it is a gamble, but maybe the improved odds for store lambs at least need to be considered.