Chemical lean cow beef price into US hits all time high

With the Australian dollar trending lower against the US greenback, chemical lean cow beef export prices have hit an all-time high.

‘Tis the season for crystal ball gazing into 2025.

And cattle market forecasting next year is something of an extreme sport due to the added uncertainty of the likely moves by incoming US president Donald Trump.

Trump’s election win and posturing about imposing trade tariffs has already unsettled the cattle market, and helped create a couple of records including here in Australia.

Since Trump’s election win the US greenback has rallied and pushed down the Australian dollar, which benefits exporters.

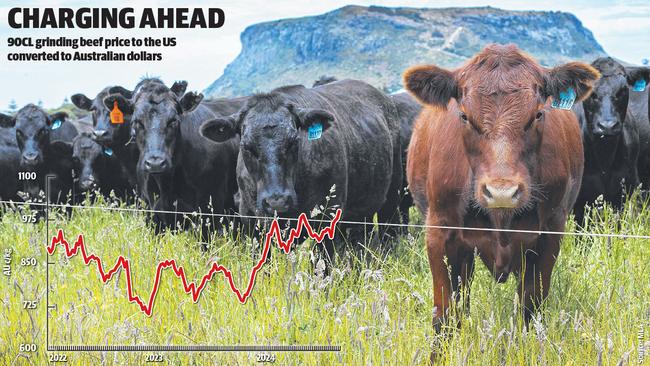

A case in point is the 90 chemical lean cow beef price (90 per cent red meat 10 per cent fat blend grinding beef used as a base for hamburger mixes) into the US, which converted into Australian dollar values has hit an all time high equivalent to $10/kg.

The graphic on this page shows the 90CL cow beef price in Australian dollar terms since 2010, and this key export market indicator has hit the $10/kg level thanks to the influence of the lower Australian dollar.

On Monday the Australian dollar briefly dipped below US64c against the US greenback, the lowest point the exchange rate has been this year, according to data from the Reserve Bank of Australia.

Highlighting the importance of the dollar and how it can benefit or erode export margins is a case study of current values for 90CL cow beef compared to early 2022 which was the last peak in the market.

In February 2022 the US price for 90CL imported grinding beef hit a high of 303c/kg in US pound terms, but as the Australian dollar was tracking above US70c at the time the conversion to Australian money worked out at 920c/kg.

Currently the US pound price for 90CL imported grinding beef is lower than in early 2022 at 292c/kg, but with the Australian dollar trending lower at US64c the value for Australian exporters has been boosted to a record $10/kg.

It is more evidence to suggest the saleyard cow price still has a lot of upside if the female cattle kill slowed and producers weren’t under seasonal or financial pressure to sell down breeders. In 2022 when the 90CL export grinding beef price was nearly 100c/kg lower in Australian dollar terms than it is now, the saleyard average price for cows was at 364c/kg or about 100c/kg higher than this December.

Some financial commentators are now predicting the Australian dollar could be pushed lower next year, which would benefit the cattle market.

Speaking on SkyNews Australia, financial commentator Laura Besarati said banks like the Commonwealth now believed the dollar could go lower.

“The overarching theme here has been Trump’s re-election,” she said.

“We have already seen the US dollar rallying on the back of Trump’s win since early November and that has pushed the Australian dollar lower.”

Trump’s influence and posturing is being seen in the US market, with cattle prices hitting record levels this week around speculation of tariffs and the issue of bans on animals crossing the border from Mexico due to screwworm.

Trump has claimed he will impose a 25 per cent tariff on imports from Mexico and Canada – both important neighbours for the supply of live cattle and beef into the US.

Late last week live cattle futures trading on the Chicago Mercantile Exchange hit a new record high of US$1.922c/pound, according to data from FactSet.

It comes as speculators start putting more money into cattle futures on the possibility of a bullish US cattle market if tariffs are imposed and bans remain on cattle movements due to screwworm.

US market analyst Len Steiner said more futures contracts were being written as “speculative money surges” into the market. According to the Commodity Futures Trading Commission in the US, there is currently more than 128,000 long term futures contracts for fed American cattle (the highest number since 2019), and more than 18,000 long term positions for feeder cattle (near record levels).

Adding fuel to the bullish outlook for US beef was the latest supply and demand data from the US Department of Agriculture. In its latest outlook it suggested more imported beef would need to flow into the US next year. Its ballpark figures were 4.59bn pounds of imported beef would make its way into the US this year, which would have to increase to 4.71bn pounds in 2025 as its own cattle production slowed.

The catch with these figures is if Trump goes ahead and imposes tariffs it will make it even more difficult and expensive for the USA to source this amount of beef from global suppliers.