Cattle prices: Livestock expert Jenny Kelly analyses Euroa store sale results

Prices compiled by livestock expert Jenny Kelly reveal the average steer price has been consistently high at one of Victoria’s major markets.

As much as farmers welcome high prices, consistent pricing is one of the best attributes of a livestock market and that mantle has shifted from lamb to cattle.

Store cattle, in particular, have weathered coronavirus disruptions and seasonal variations to come through recent months on a more even keel to lamb prices which have bounced around and generally underperformed to farmer expectations.

Thanks to advances in technology, it is now possible to track price averages from some of the biggest store selling centres in the state.

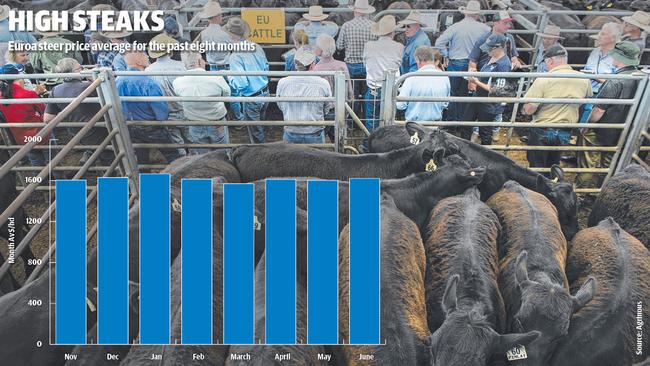

The graph below shows the price average, in dollar-a-head terms, for steers sold at Euroa since November last year.

Remarkably, in six of the past eight months, the average steer price has tracked within a tight $30 range, according to AgriNous — a specialist software company that handles all cattle transfers and sale data at the centre.

In November last year steers averaged $1604 at Euroa, last week they averaged $1621. The highest price average was in January at $1666 when the market was red hot on northern demand for autumn-drop weaners.

The lowest result was in March when steers averaged $1570, but this is still only $30 to $40 shy of the other results, and this period marks a lull in quality as the market transitions from autumn to spring-drop calves.

Overall, the figures are another set of statistics which speak to the extraordinary run of the cattle market. It is a trait being talked about, much like people marvelled about the lamb market when it went to another price level and managed to stay there.

Elders Bendigo agent Pat Esse watched as client’s spring-drop calves sold to $1670 at Euroa last week and said the store market was showing remarkable consistency.

“I’ve been in the game since 1960 and I’ve never seen a price run like it,” he said.

“We sold cattle at those Ballarat store sales in February which were incredible and it just hasn’t stopped since.”

And confidence is growing that the cattle market can keep its momentum as beef prices rise around the world.

The original analysis was that Australia’s beef prices (which readers may recall did rise above competitors like the US, New Zealand and South America to claim the mantle of dearest in the world) would eventually have to undergo a sharp fall to realign with global values.

Instead the industry is now seeing a scenario whereby beef prices in countries like the US and South America are rising up, creating what market commentators are calling a possible ‘softer landing’ for Australian cattle producers as any needed price fall to realign values becomes smaller.

Elders national livestock manager, Peter Homann said the price gap between beef price and live cattle prices being paid by farmers was becoming closer.

“The meat job is probably as strong as it has ever been, it is amazing really,’’ he said at Euroa last week. “The (store) cattle job is probably still that bit stronger, but they are moving closer.’’

As always, the market the beef sector is keenly watching is the US as the performance of its beef heavily influences what happens on the global stage.

The latest data out of the US paints a positive picture, at least in the short-term.

The amount of meat in cold storage in the US is extremely low, according to a US Department of Agriculture survey which keeps track of food supplies held in warehouses across the US. At the end of April it was estimated that 905,000 tonnes of beef, pork, chicken and turkey were in cold storage, 18 per cent lower than 12-months ago and 16 per cent lower than the five-year average.

At the same time, demand for meat has spiked as the US comes out of its severe Covid-19 outbreak and embraces vaccination. This is linked into more eating out as the country returns to a more normal state of work, travel and play.

The National Restaurant Association in the US tracks customer traffic as part of a performance indicator for the sector. At present it has a rating of 109 points. To put it in perspective, the highest level this customer traffic has had before is just over 104 points, so when it is viewed as a graph it shows customer traffic at restaurants going off the chart.

This is putting upward pressure on meat prices, particularly as traders cannot rely on what is in cold storage and US importers are struggling to entice enough beef from supplying nations like Australia who can sell at good money to places like Asia.

The following is a snapshot of what Steiner Consulting, which tracks the US beef market, said is happening in the US beef sector.

During May Australian exporters sold just 11,607 metric tonnes of beef to the US, a 43 per cent drop on a year ago, it said.

“The data supports what we have been hearing from US traders during our weekly calls that Asian markets are paying up and of buying product away from the US,” Steiner reported.

“It is different to a year ago when high prices resulted in a surge of imported beef coming to the US. The reason is that now US buyers have to compete with buyers in other markets.”

It paints a robust picture for Australian cattle markets, at least in the short-term.

So the final word will go to Mr Homann who noted that for farmers buying store cattle at present, they may as well buy the ones they liked rather than trying to find bargains which virtually don’t exist.

Watching the big end of financial year sale at Euroa he said: “You may as well pick the cattle you want to buy and just buy them as they are all virtually the same price, give or take a few dollars”.