Buyers react to compressed livestock prices

The compression of livestock prices into tight ranges has become the hallmark of the cattle market this season, with a similar trend also happening across mutton sales.

The compression of livestock prices into tight ranges has become the hallmark of the cattle market this season, with a similar trend also happening across mutton sales.

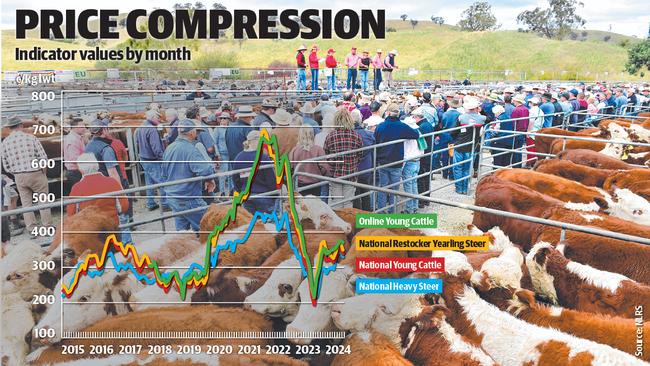

Based on price averages published by the National Livestock Reporting Service, there just was a 20c/kg price spread between the overall average recorded during September for grown steers, feeder steers and yearling steers sold to restockers.

It has tightened further during October, with the latest trend being 330c/kg liveweight for heavy steers, 345c/kg for restockers and 348c/kg for feeders. Also within this range are grown heifers and the best run of heavy cows, making this period one of the most compressed price eras the industry has experienced (see the graphic on this page).

The trend of an extremely tight selling range is also been seen across the mutton market, although in dollar-a-head terms rather than in cents-a-kilogram results.

At the Bendigo prime market on Monday this week 90 per cent of the yarding sold between $50 and $85 regardless of weight.

The tight price pattern across livestock markets is influencing some buying decisions, a case in point being the special Merino store sheep sale at Jerilderie in NSW last week.

At this sale nearly every pen of older Merino ewes, five-years, sold to export meat buyers at a rate of $80 to $110 in a rare result as usually these well-bred proven breeders with another year or two of production in them receive solid support from restockers.

When discussing the result, one agent said how he couldn’t justify paying $100 for old ewes when it was possible to buy lines of younger ewes at $130 to $150 – he averaged a purchase price of $143 at Jerilderie for a client.

His argument was the price different of $40 between a five-year-old ewe to maiden ewes (which admittedly were the third runs) was not great enough to warrant the risk of taking on older sheep that may need to be fed if the season turned dry.

In the case of cattle an opportunity could lie with young heifers, which are at a discounted level to young steers. The price trend line for yearling heifers out of prime markets to restockers is currently at 270c/kg, nearly 75c/kg behind the yearling restocker steer rate of 344c/kg. Noting these prices are for the smaller lots, and often Euro-cross calves, that tend to get sold through weekly prime markets rather than special store sales.

But when you look at outcomes for an average heavy steer and heifer they are currently very similar. For example, at Wagga Wagga last week heavy grown steers averaged 348c/kg compared to grown heifers at 339c/kg.

At Dubbo in Central West NSW late last week heavy grown heifers averaged 340c/kg compared to 350c/kg for steers, according to NLRS data.

It means there is weight gain and cents-a-kilogram gain possible from buying younger heifers at the moment the way the market is.

But the upshot for such compressed prices over the cattle sector for traders is they are in a position to benefit from all weight gain without having to sacrifice some to cover the usually inflated prices of store stock.

To refer back to the graph again, it is unusual to see store steer prices tracking so closely against rates for finished feeder and heavier slaughter animals.

While the patchy season is being pin pointed as the main reason store prices have become so much more aligned to finish stock as producers show extra caution, the interesting feedback from Jerilderie was talk about lack of cash reserves on farm.

Agents said higher input and running costs, against reduced returns for cattle, sheep and lambs (compared to where the market was before the crash last year) had led to financial stress in many operations and was a key reason store stock were not selling at premiums.