Australian beef prices undervalued against global competitors

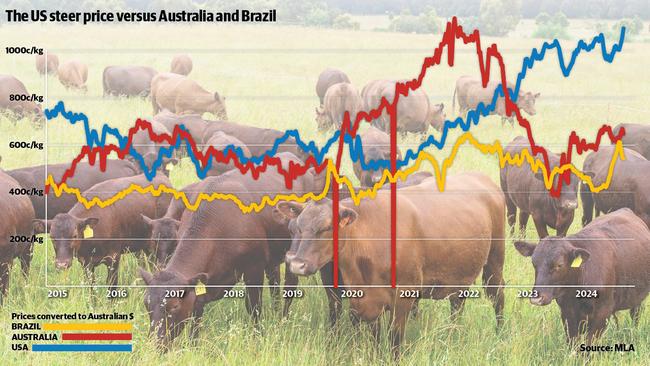

Against its main export competitors Australian beef prices do appear undervalued. See how steer prices compare between the nations.

Against its main export competitors Australian beef prices do appear undervalued.

Heading into 2025 the indicator value, in Australian dollar terms, for heavy steers in Australia was listed at a ballpark average of 650c/kg carcass weight compared to similar grade steers in the US at 1095c/kg and steers in Brazil at 543c/kg.

The graphic on this page shows the price variation between these three countries over time. And while there has always been fluctuations due to the many factors which can influence an individual market, the interesting points at the moment are the rapid rise of Brazilian cattle prices in recent months and the record run of US beef.

Overall, the graphic adds further evidence to the argument that Australian cattle prices should be able to perform about the rates of last year, particularly if the dollar continues to devalue against the US greenback which would make Aussie beef even more competitive on the world stage.

Saleyard selling has opened with a bang, with quotes of 20-50c/kg dearer for a lot of steers and heifers sold at the Wagga Wagga, NSW, prime market on Monday this week, according to the National Livestock Reporting Service. The result for the main run of yearling feeder steers weighing over 400kg was 396c/kg liveweight for a substantial lift of 40c/kg on pre-Christmas levels. For an average 450kg steer it adds up to an extra $180 a head.

It is a timely confidence boost for the weaner steers which kicked-off in earnest this week at Wodonga, Wangaratta and Yea, before moving onto the Western District next week.

In December quality lines of young Angus store steers were averaging just over 400c/kg. Expect these figures to be beaten this January, and it could be a substantial lift if northern producers gain confidence on further rain.

To look at the situation of the world’s biggest exporter, which is Brazil.

The latest data suggests Brazil will have exported around 2.56 million tonnes of beef in 2024 when final figures are tallied – a rise of 28 per cent on year ago levels. It is a key competitor against Australia, which ranks second on the export list with anticipated beef sales of around 1.33 million tonnes in 2024.

Brazilian steer prices surged by nearly 50 per cent between June and November last year, according to the country’s Boi Gordo processor steer indicator. Converted to Australian dollar terms the Brazilian steer price went from just over 400c/kg carcass weight in June 2024 to peak at 610c/kg in late November. This came within a whisker of Australian steer prices, making it one of the rare times in recent years when the Brazilian and Aussie markets have converged or come close to crossing over.

Global supply analyst for Meat and Livestock Australia Tim Jackson said there were signs Brazil’s cattle supply was starting to retract after years of drought and high kills. Evidence of this was seen in October when Brazil’s cattle kill declined 5 per cent on a year earlier, marking the first monthly fall since 2021.

Mr Jackson said the tightening supply of slaughter ready cattle in Brazil coincided with higher export demand, particularly from the US last year. These factors of less supply and higher demand was the driving force behind the rapid rise on Brazilian prices.

The same supply factor has been behind US cattle prices pushing to record levels. When you look at the steer price figures on the graphic on this page, the reason Australian prices haven’t rallied along with its competitors is mainly linked to big weekly cattle kills keeping a cap on the market.

Figures tell the tale.

In the last six months of 2024 the beef cow kill in the US averaged 53,000 cattle per week which was a significant slow down of 22 per cent on the same period in 2023, according to Steiner Consulting.

In comparison Australia’s cattle slaughter has been trending higher than historical levels, the latest data for 2024 suggesting it has been tracking 16 per cent above the five year production average, MLA noted.

If Australia’s cattle supply to processors would settle in 2025 it would help prices improve to better reflect what is happening in other major beef producing countries like the US and Brazil.