Report reveals Aussie coal exporters’ staggering $45B gain amid Russian invasion of Ukraine

The profits Australian coal exporters have made over the past year have been revealed as the Ukrainian war continues.

Coal companies have recorded windfall profits amid the Russian invasion of Ukraine, with new research revealing the billions of dollars exporters made.

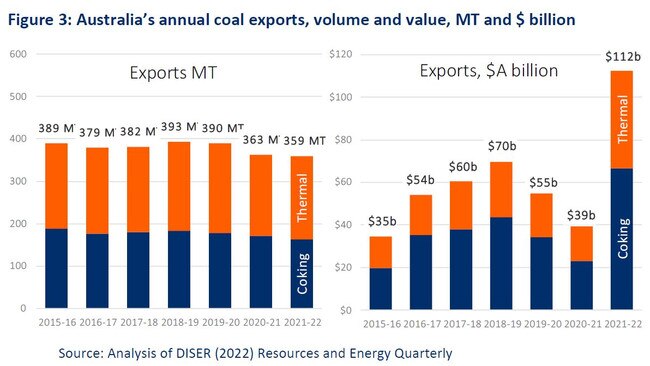

The value of coal exports skyrocketed to $112B over 2021-22 despite Australians being crippled by climbing energy prices as a direct result of Russia’s invasion.

It marks a 186 per cent increase from the $39B previously recorded over 2020-21.

“It’s not just gas exporters who have been reaping the benefit of Russia’s invasion of Ukraine,” Dr Richard Denniss, executive director at leading public policy think tank The Australia Institute, says.

“This research shows that while Australian consumers have been hit with surging prices for energy, coal companies have been making windfall profits from exporting Australian coal.

“Combined, the gas and coal export industries have banked up to $85B in windfall profits in 2021-22.”

The Australia Institute‘s new research reveals coal exporters have pocketed staggering amounts since the fighting across war-ravaged Ukraine commenced.

The report – titled “From Russia with love: Coal profits from war in Ukraine” – estimates windfall gains to coal companies over 2021-22 were between $38B and $45B alone.

Between $13 to $23B of this is “directly attributable” to turmoil in energy markets following Russia’s invasion of Ukraine in February last year, report authors Rod Campbell and Matt Saunders found.

They estimate a $73B increase on coal export revenue occurred last year due to the conflict in Ukraine.

“Russia is the world’s third largest coal exporter, behind Indonesia and Australia, meaning that turmoil in Russia causes disruptions in international coal markets,” the report states.

Dr Denniss said coal companies had been recording huge profits while Australian households and businesses were “slugged with surging prices for energy”.

He argued a windfall profits tax could collect “almost 100 per cent” of this money for the public to assist low and middle-income families with cost of living relief.

The report noted there was little change in volume of coal exported between 2020-21 and 2021-22.

But with prices over the previous year being “well below” recent average prices, it said the $73B windfall in export earnings should be considered an “upper bound” estimate.

“Had prices in 2020-21 been equal to 5-year pre-Covid averages, then the exports earnings in 2020-21 would be $9 billion higher,” the report states.

“Subsequently the windfall for 2021-22 would be $9 billion lower, at $64 billion.”

The estimated $63-73B windfall is split between profits for multinational coal companies, royalties and company tax.

Of this, company tax applied at 30 per cent of the windfall while royalty rates were applied at different methods in Queensland and NSW.

The report states a sudden rise in coal prices from late 2021 were not solely caused by energy turmoil following Russia invading Ukraine.

It further states Australia’s self-imposed restrictions on Indonesian experts and extreme weather in some of the country’s coal producing regions also contributed to the increased export prices.

“If it is assumed that the invasion did not happen and instead coal prices in the March and June quarters of 2022 remained at their December 2021 levels, then the gain attributable to the Russian invasion alone is estimated to be $20.8B,” the report states.

“The $12.7B increase in profits represents a $70M a day increase in profits over a six-month period.”

The paper suggests the windfall could be repeated over the next financial year depending on prices at international coal markets, noting the Queensland government had already made small changes to its royalty rates.

Similar research conducted in October found Australian natural gas exporters recorded almost $40B in profits over the same period.

In April, Australia banned the import, purchase and transport of Russian gas, oil and refined petroleum products in response to the invasion of Ukraine.

Last month, the country joined other G7 nations voting on a price cap of $60/b for seaborne crude oil from Russia.

A Department of Foreign Affairs and Trade (DFAT) spokesman said was this was done to “maintain a reliable supply of oil to the global market”.

In response, Russian president Vladimir Putin announced a sweeping ban on the sale of oil and petroleum to foreign nations – including Australia.

The Kremlin order, which comes into effect from July 1, said the imposition was because of “unfriendly actions taken by the United States, other foreign states and international organisations that sided with them”.

The federal government’s latest quarterly resources and energy report, published in December, found high energy commodity prices and strength in the US dollar were driving a surge in earnings.

“After a record $422B billion in 2021–22, resource and energy export earnings are forecast to lift to $459 billion in 2022–23, before falling back to $391B in 2023–24,” the report states.

Lithium exports are forecast to return to $16B over the next year – becoming Australia’s sixth largest resource and energy export.

Originally published as Report reveals Aussie coal exporters’ staggering $45B gain amid Russian invasion of Ukraine