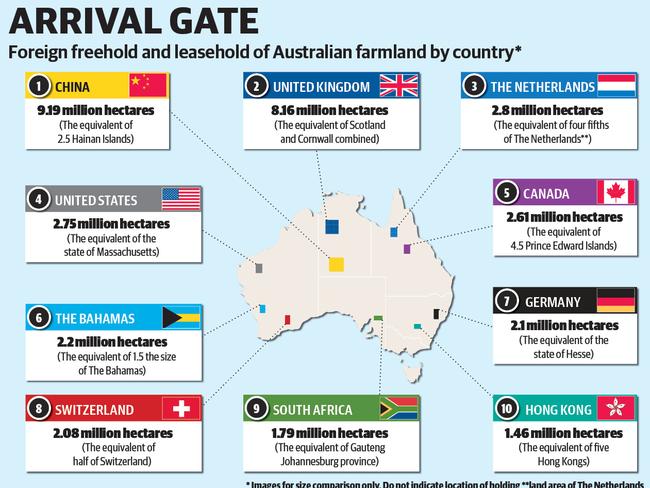

Australian farmland: How countries stack up in the foreign investment stakes

Foreign investors now have combined leaseholds and freeholds in Australia that are geographically larger than their home nations. Can you guess which nations are top of the investment pops?

BAHAMIAN investors operate more Australian farmland than the combined area of its 700 islands in the West Indies.

Hong Kong investors have a stake in freehold and leasehold land Down Under at a scale five times the size of the former British colony.

Meanwhile, Dutch investors control a portion of Australia’s farmland that’s equivalent to four-fifths the size of The Netherlands.

The Foreign Investment Review Board has revealed foreign interests snapped a further 900,000 hectares of land during 2019-20, a 10 per cent step up year-on-year.

The FIRB’s annual farmland ownership report showed the combined foreign freehold and leasehold nationwide was more than 53 million hectares, representing about 13.8 per cent of Australia’s farming area.

China is again the biggest offshore landholder with 9.2 million hectares – 8.4 million hectares of which is lease country.

That figure represents more than 2½ Hainan Islands, a province off China’s southeast coast, or in local terms, a combined freehold and leasehold stake that’s equivalent to nearly 21 Kangaroo Islands.

Great Britain was in second place in the combined freehold/leasehold stakes at 7.3 million hectares — a slab of Australia that’s equivalent in size to Scotland and Cornwall combined.

In third position was The Netherlands at 2.8 million hectares; followed by the United States with 2.75 million hectares, Canada at 2.61 million hectares and The Bahamas at 2.2 million hectares.

In seventh spot was Germany with 2.1 million hectares — a slab of farmland equivalent in size to the state of Hesse, a province that covers Frankfurt and Wiesbaden.

Eighth place was taken by Switzerland with 2.08 million hectares — a freehold/leasehold portfolio equivalent in size to half of the Swiss Confederation.

Rounding off the top 10 were South Africa with 1.79 million hectares and Hong Kong with 1.46 million hectares respectively.

The high-profile Canadian surge in investments in recent years has been spearheaded by the Public Sector Pension Investment Board, which manages the superannuation of Canadian government workers, including the nation’s famed mounted police and armed services.

PSP Investments is now the single-biggest investor in Australian agriculture with land and water assets valued well north of $3 billion.

In February it finalised its $854 million takeover of ASX-listed Webster Limited – Australia’s fourth-oldest company and one of the nation’s biggest landholders with more than 340,000 hectares and 153,000 megalitres of water.

Last year, PSP paid about $850 million in a landmark land and water deal involving 12,000 hectares of almond plantations near Robinvale in northern Victoria, and almost 90,000 megalitres of high-security water.

In another show of strength from North America, Boston-based Hancock Agricultural Investment Group earlier this year paid $120 million for 19,877 hectares of cotton and almond farms at Hillston in NSW from Harvard University’s endowment fund, with US-based TIAA-CREF – which has more than $1.7 billion worth of agriculture investments in Australia – late last year purchased 4000 hectares of dryland cropping country near Moree for a reported $28.4 million.

The Netherlands’ investors include public sector fund Stichting Pensioenfunds ABP, which has a sizeable stake in Macquarie Agriculture’s Paraway Pastoral Company and its 4.46 million hectare land portfolio. With 12 stations spread across 7.5 million hectares, Australia’s biggest landholder by size is S Kidman and Co, which is owned by an Australian-Chinese consortium.

MORE:

CALL OUT FOR AUSTRALIA’S SENIOR FARMERS