Vertical farming: Sprout Stack, Eden Towers, Stacked Farm grab slice of $6b global sector

These Australian farms are expanding their agricultural output by growing up, not out. See how profitable the vertical trend has become.

It’s a vision of the future that has captured the imagination of farmers, food companies and agricultural scientists for the past decade.

As arable land becomes scarcer, the climate-change risk of destroying forests to make more cropping country becomes ever-more apparent, and food insecurity intensifies as a global threat to world peace, many minds have started to turn to greater urban food production as a potential solution.

But a few trendy beehives and raised vegetable beds on the roofs of city apartments is unlikely to ever solve world hunger.

However, vertical agriculture – the farming and growing of food in stacks of shipping containers and elevated racks, even water tanks, inside industrial warehouses, silos and high-rise buildings – could just hold the key.

Farming inside buildings removes the risk and inherent financial instability that has at times plagues every agricultural enterprise.

With vertical farming, the climatic and weather events – whether long droughts, apocalyptic floods or devastating hailstorms – are no longer a threat, but can instead be controlled. So too can inputs with little variability and, best of all, production outcomes guaranteed regardless of seasons.

It also has the major advantages in consumers’ eyes of reduced carbon footprints, low food miles and no pesticide use. Water use is just 5-10 per cent of that in conventional cropping to produce the same amount of food.

Food is also able to be grown closer than usual to, or even within, the cities where most consumers live. It offers consumers fresher, more recently harvested food from a clearly identifiable “farm” source; vegetables and greens that last longer and so also reduce food waste.

Vertical farming is different from the large-scale glasshouses and greenhouses that make up the boom in controlled cropping in that its land footprint is small, but its “farming area” just as great.

It is also an entirely new way of farming – whether it is growing lettuces, insects, prawns or cattle feed – using the latest animal and plant technology, artificial intelligence, robot systems and controlled environment knowledge.

“The vertical farms of today will not be that different to those on Mars tomorrow,” says John Diener, chief executive of Vertical Oceans, which has just begun harvesting its first king prawns (shrimp) grown in large tanks stacked vertically in a tall round “aqua-tower” in Singapore.

“Our product tastes like fresh shrimp from the ocean, which is really hard to achieve in a recirculating aquaculture system and is grown without chemicals or antibiotics.

“Because our product is sold fresh, immediately after harvest, we can sell (at a price) on par with fresh wild caught versus farmed frozen shrimp. This higher price more than offsets the costs of going vertical and urban.”

One of the earliest companies to pioneer large-scale indoor vertical agriculture was US-based start-up AeroFarms, which has just won a global GreenTech Impact award for its groundbreaking work.

In 2016, it converted an old steel mill in Newark, New Jersey, into a vertical farm growing leafy greens in 25m-high towers of trays spread over a 6500sq m ground footprint.

More than 900,000kg of kale, mizuna, arugula (rocket), and watercress are grown annually in multiple harvests; growing not in soil or even in a hydroponic system, but planted on a reusable cloth sheet made from recycled plastic, with water and nutrients mist sprayed on to the layers of seedlings.

With an autonomous computer system controlling light, water and nutrients to the crops, AeroFarms has shown that its vertical indoor farming is 75 times more productive than growing a standard agricultural crop in a paddock, using the same land footprint. Robot forklifts load the seedlings on to trays and harvest-ready racks using artificial intelligence.

“Growing crops outdoors is more challenged than ever before, especially when you layer in the increasing volatility of weather and climate change and issues of food safety and pesticides,” said AeroFarms co-founder Marc Oshima at the opening of the breakthrough facility.

“We need a new paradigm; vertical farming gives us control over a lot of these variables.”

Since that time six years ago, interest and investment in vertical agricultural “farms” and the technology behind them, has exploded worldwide.

Other countries such as Japan, Singapore, Italy and Brazil have also moved into vertical farming.

By the end of this year, the value of the vertical farming industry globally is predicted to be close to $US6 billion.

The global Covid-19 pandemic has also fuelled the boom, as the food insecurity of highly urbanised nations such as Singapore, Japan and the United Arab Emirates was laid bare and such countries moved to boost their own local food production and reduce reliance on food imports

As a small island nation, Singapore imports more than 90 per cent of its food from 170 countries. It recently launched an ambitious “30 by 30” initiative to produce 30 per cent of its nutritional needs by 2030.

To achieve this enhanced food security, Singapore’s Minister for Environment and Water Resources Masagos Zulkifli says its agrifood industry must adopt new paradigms and new solutions to raise productivity.

He promised major government funding of new climate-controlled indoor farms optimising plant growth with reduced water use, farms on urban rooftops and initiatives such as Vertical Oceans’ innovative prawn production in tall towers.

In Australia, the growth and adoption of vertical farming is only just taking off, mainly because neither arable farmland or food is yet in short supply, and fresh food prices remain relatively low. (Except in times of widespread floods or fires, as seen recently when a lettuce in Brisbane cost $12).

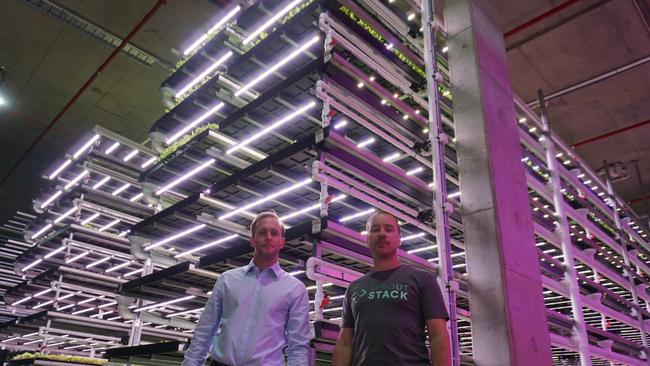

The vertical farming concept has been pioneered here by early innovator Sprout Stack, part-owned by Markus Kahlbetzer, son of former cotton, sheep and water baron John Kahlbetzer of Twynam fame, and his BridgeLane investment group.

More recently, two relative newcomers have entered the fray; nascent Perth-based Eden Towers, which is starting to build its first vertical farm with four large towers just south of Perth at Nambeelup, and ambitious Stacked Farm, which is just about to open its first vertical farm on the Gold Coast entirely fuelled by green biogas, after its final $56 million capital raising in June.

Sprout Stack partner and general manager Francisco Caffarena says while his business started out six years ago with a small-scale mindset of growing high-quality vegetables in containers in underused carparks to supply local restaurants, it has now diversified to become a volume grower.

“There’s almost two ways of looking at vertical farming; one is that boutique idea of every top-end restaurant having a container or garden on its rooftop so its chef can pick his own vegetables and herbs every day fresh from the restaurants own garden, and being able to tell customers with full knowledge how and where they were grown,” Caffarena says.

“But we quickly realised if we are serious about growing a big volume of food with scale efficiently, that means not one or two shipping containers scattered around Sydney, but a full warehouse, which gives you the space and height to achieve as much automation using the latest technology as we can”

Three years ago Sprout Stack leased its first warehouse in Brookvale on Sydney’s fringe where it now grows more than 600kg of radish, kale, leafy greens, broccoli lettuces, watercress and microgreens for salad mixes every week from seed to harvest, from just 800sq m of land footprint.

The plants are grown hydroponically in shallow 10m-long trays filled with coconut fibre, stacked up to five metres high, and all handled by automated forklifts and harvesters. Human contact is minimal, with just 10-15 workers required for every 2500sq m of “farm.”

Sprout Stack already sells its products into Sydney restaurants in boxes, and as packed salad mixes under its own brand into major retailers such as Harris Farms, IGA, premium greengrocers and via the Milkrun delivery app. A 120g of salad mix sells for $5.99 and a 1kg restaurant box of mixed greens for about $30/kg.

“Chefs love knowing that they can get clean, green, fresh produce at a set price and consistent high quality and with known provenance all year round; we can have it on the IGA shelves or at the restaurant door just 16 hours after it has been harvested,” Caffarena says.

Caffarena says the Sprout Stack business is growing at 30 per cent a year and just starting to break even now scale is being achieved and the model proven. Installing a fully automated farm module in a leased warehouse requires about $40,000 for every 90sq m of investment, he says.

Spout Stack now has more vertical farms under way in warehouses based in industrial estates about one hour from central Melbourne and Sydney city markets – the sweet spot in terms of distance and lease prices – with the ideal 1000sq m vertical farm requiring $500,000 to build and open. Mushrooms and even chicken farming may be added to its repertoire.

“We’ve really validated the concept now and, while there is plenty of room (for vertical farming) to grow in Australia, we will take it offshore too,” Caffarena says.

“In Australia, I think it will remain a small part of the market except perhaps in times like the recent floods. There is a great fresh, sustainable and convenient component to the way we grow and present our products but at $6 a salad bowl it’s expensive other than to high-income earners; we don’t expect this will ever replace the $2 heads of lettuce in Coles and Woolworths.”

In New York, MyForest Foods is growing “slabs” of mushroom mycelium to turn into alternative bacon. In Israel, Hargo FoodTech is producing alternative protein powder from grasshoppers grown from eggs in vertical stacks of nurseries. In Utah, Grov Technologies is using vertical farming to produce fodder for cows; growing wheatgrass stacked in automated towers in a model it hopes can be adopted by dairy farmers worldwide. Grov Technologies president Steve Lindsley argues vertical farming can help the beef and dairy sectors be on the front foot environmentally.

“The industry can utilise this technology as a counterpunch to some of the lab-based protein ‘meat’ or the competitive efforts that are trying to pull consumers away from beef and dairy products,” Lindsley says.