Kelly Country: grinding beef prices are something to watch

Australia having the highest value and quality meat globally needs to be celebrated, but it also brings with it its own complications and pressures when trading at the coalface.

AS farmers watch their livestock prices race upwards, processors are watching their margins erode.

It is not a break-out-the-tissues moment, as the meat industry has enjoyed some pretty good times this drought due to the influx of animals into abattoirs.

However, the difference between what is happening with prices at the farm gate level compared to the price trajectory for red meat into some key export markets is something producers should be aware of.

The issue stems from the differing conversations and mood observed at markets in recent weeks.

While the rapid price jumps for store cattle, and record rates for prime lambs this month excited the farming community, the reaction among buyers has been much more subdued.

There has been conversations around dropping kill days, potential abattoir closures, the position of Australian meat prices on the world stage, and how margins are being squeezed when the drought hasn’t even broken and the toughest supply months of autumn and winter still lie ahead.

Again, to clarify this isn’t an argument about livestock prices being too high.

Rather, this is just to go a step beyond the headlines of rapidly rising livestock prices and look at some of the other data coming through.

Manufacturing meat is one of the strongest indicators of demand for beef, as it is a base commodity that is traded in big volumes around the world.

The 90 chemical lean cow beef price into the US is what many market analysts track. 90CL means a blend of 90 per cent red meat and 10 per cent fat that is used to make hamburgers.

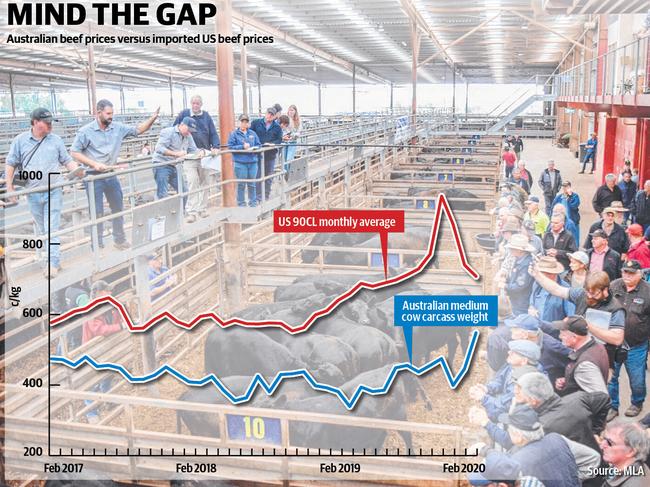

As the graph shows, after reaching record highs in spring last year — driven by demand for grinding beef into what was then a heated Chinese market — prices have fallen away.

To put some figures around it, in November last year the average export price for 90CL cow beef into the US was 935c/kg shipped, according to the Steiner Consulting Group.

The latest figure for February is 708c/kg, marking a correction of 227c/kg in the space of three months.

At the same time, cow prices have ramped up this year following bursts of rain, bringing the two trend lines of raw product to export price much closer together.

In historical terms, the difference between saleyard cows and export returns has been tighter, and if you study the graph it shows how processors were enjoying exaggerated margins most of last year.

The take-home message is that grinding beef prices are something to watch, particularly if the coronavirus spreads to become a pandemic.

There have been claims in the media in the past week of massive hits to China’s fast-food industry, with sales down by up to 50 per cent.

Interestingly, the national price indicator for cows sold at auction last week eased 15c/kg back to an average of 262c/kg liveweight on Monday.

This correction was recorded despite much lower slaughter levels of female cattle in Queensland and NSW the previous week — maybe a reminder of how markets are a component of demand and supply, not just supply.

The other data to emerge this week was a ranking of the top beef exporting nations based on volume and value.

Australia sold about 1.2 million tonnes of beef on the world stage last year worth $US7.5 billion ($A10.8 billion), to claim the No. 1 ranking for export country by value.

Before this data was released, a conversation with an exporter last week touched on this subject.

When The Weekly Times suggested the company needed to go out and ask for a bit more money now livestock prices had spiked, the reply was short: “(Australia) already has the highest meat prices in the world, you go out and get more for it — it is not that easy.’’

On one hand Australia having the highest value and quality meat globally needs to be celebrated; on the other hand it brings with it its own complications and pressures when trading at the coalface.

The latest figures for export lamb show the industry is travelling strongly, but not at the highs experienced last year.

Steiner Consulting issued an update on the US lamb market, and listed the following indicator prices for Australian product being shipped in.

Prices listed as current on February 10 included:

Australian fresh/chilled shortloins: $US4.87l billion, down 5.3 per cent on a year ago.

Australian shoulder square cut: $US3l billion, 1.3 per cent lower.

Australian racks: $US11.66l billion, down 5.3 per cent.

Amid the rumblings around saleyard lamb prices trending above 900c/kg carcass weight in February, The Weekly Times queried buyers about what level was viable.

Most quoted 800c/kg to 850c/kg, suggesting rates above this were difficult to return a margin from. But there is no hard data to support this argument either way.

The other big livestock events in the past week centred around the store market.

At Ballarat last week prices lifted to another level for a feature yarding of weaner, yearling and grown steers.

The quote was 420c/kg to 470c/kg liveweight across the bulk of the 5200 sold, at an average of $1500.

Using 450c/kg as the average, it shows prices for store steers are again making big premiums, beating returns for bullocks which are currently at a national average of 345c/kg.

It is the norm for store stock to be dearer than the finished article, but with the buzz around herd rebuilding this price difference is something for cattle traders to monitor.

A record offering of about 14,000 cattle on AuctionsPlus defied the logic that once it rained, fewer cattle would be available.

A couple of observations from this; first, prices jumped so high so quickly there is some fear it can’t be sustained and people don’t want to miss out; and a lot of areas remain in dire drought.

As livestock prices rise, the complete picture of what is happening locally, overseas and with the weather needs to be considered.