Danger signs ahead for store cattle

High prices carry high risks and historical trends show that the market has never looked more dangerous, writes Jenny Kelly.

WITH the serious livestock trading and restocking months from August onwards now just weeks away, what can historical trends tell us?

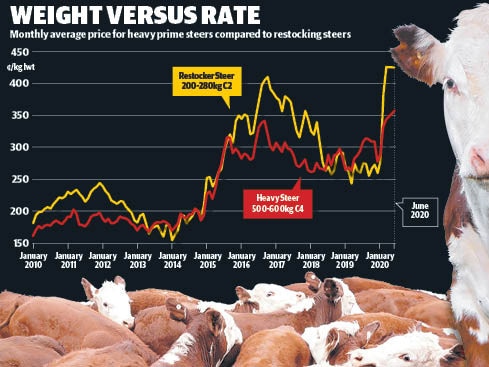

The graph tracks the average heavy steer price recorded at major saleyards against the restocking category of yearling and weaner steers sized from 200kg to 280kg liveweight.

The data goes back 10 years, and it shows the market is tracking at exaggerated price spreads recorded only once before, and that was in the 2016 and 2017 season when the last dry spell broke.

The official figures collected by the National Livestock Reporting Service has the average price for heavy steers (weighing 500-600kg) at 360c/kg live, compared with 425c/kg for restocking steers.

The last time such a margin was evident was in the May 2017 when heavy steers were at 340c/kg against lighter restocking yearlings at 405c/kg live.

And as the graph shows, the market for finished cattle from 2017 onwards was not favourable for farmers who invested in store steers at the top end of the price cycle, with drought the main culprit.

So what is the lesson?

Only that with high prices comes more risk and at current levels in today’s weird world of coronavirus the store market has arguably never looked more dangerous.

Yes, it is possible to add weight to stock to create a margin.

And on paper, if you buy a store steer at 280kg for $1200 and are looking at a resale price of about 350c/kg later on it equates to about 60kg of weight needing to be added for nothing to bring things back into balance ($1200 divided by 350c = 342kg).

Following on from this, if the heavy steer price drops to 300c/kg, an extra 120kg has to be added ($1200 divided by 300c = 400kg.)

As the current lamb market shows, when the market goes pear-shaped due to unexpected events not even weight can be the ultimate saviour.

However, the lamb market is more volatile due to teething issues and a more limited time- span for trading compared with cattle.

At present, heavy lambs, particularly those over 30kg carcass, are being discounted heavily at saleyards, with further price crunches of $10 to $20 a head in the past week.

As auctioneer Nick Byrne, Nutrien Livestock observed at Bendigo on Monday, “it doesn’t take much of a light or secondary lamb to make $160 but it takes a very good lamb now to make $200.’’

Farmers who invested decent money in store lambs and targeted them at the winter market in the expectation of a shortage creating premium prices have been left hurting. Everyone acknowledges it.

At Swan Hill last week an auctioneer implored buyers to support a client who had fed lambs for the first time.

Beautifully shorn and heavy, they sold for $214.

One export buyer who walked past sagely remarked “well it is probably the last time he’ll feed lambs”.

Unexpected events triggered by the COVID-19 pandemic have thrown the meat market into turmoil, and the full fallout from the virus in regard to world economies and trading are yet to be fully realised.

In the past week the Chinese threw another curveball by requesting that meat exporters shipping product into the country provide assurances it is free from COVID-19.

While there are no reported cases of the virus being transmitted through raw food, Chinese authorities are requesting reports into how abattoirs are managing their plants and workforces in relation to the disease.

Sounds benign enough, but there have been real time market repercussions.

US market analysts the Steiner Group said exports from Brazil and Argentina (where COVID-19 is spreading rapidly) are now running scared that Chinese importers could cancel orders while meat is in transit.

As a result, Steiner reported, these countries are now targeting more business towards the perceived safer market of the US, and this has helped soften the price of imported grinding beef.

It is the latest market distortion to be linked to the COVID-19 pandemic.

So on one hand farmers have a boom season and the ability to feed stock this coming spring. But on the other they face a raft of export and global uncertainties.

The road ahead for producers is fraught with more questions than answers this spring.

But as the graph on this page shows, livestock prices are cyclic, and when the industry is at the top of the value wheel the possibility of a downturn is heightened.

MORE