Winners and losers in Australian agriculture

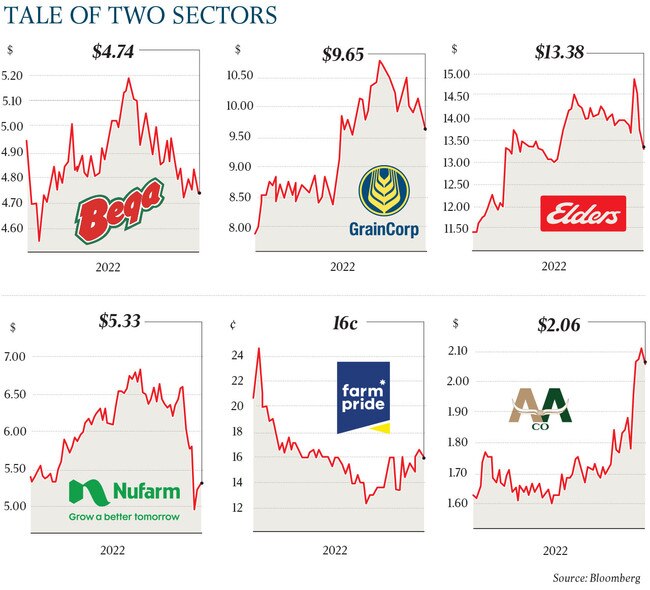

A new gulf has emerged between price makers and takers in Australia’s agribusiness boom.

The best growing conditions in years combined with tightening supply of key farm commodities following Russia’s invasion of Ukraine have delivered a boon for companies such as Elders, GrainCorp and Incitec Pivot.

But businesses that have limited capacity to pass on soaring fertiliser, feed and other input costs – such as poultry giant Inghams and Bega Cheese – are seeing more difficult conditions.

The Reserve Bank recently joined other central banks in raising interest rates for the first time in more than a decade to tame inflation, with consumer prices rising 5.1 per cent – the highest in 20 years. Coles and Woolworths – which typically keep a tight lid on price hikes – are increasingly seeing the need for price increases. And this is sending positive signals to producers, including Inghams, which in a recent trading update said it was “actively seeking increases across the market to offset cost pressures”.

“Costs remain elevated across the business, mainly driven by feed, supply chain and transport costs,” said Inghams, whose share price has dived more than 23 per cent in six months.

Bega Cheese – which has experienced a 15.4 per cent share price slump since the start of the year – said in its most recent trading update that while global dairy demand and commodity process remained strong, the Ukraine war had raised input costs.

Combined with pandemic-related costs, it expects more than $40m to be wiped off full year earnings, forecast to be $175m to $190m on a normalised basis.

It comes as Bega announced a record average opening farm gate price of $8.40 a kilogram of milk solids for the 2022/23 season as competition to source milk from farmers intensified.

Meanwhile, rival Fonterra may delay its ownership review, including a potential float of its Australian business, given the uncertainty. “There’s been a lot of effort that’s gone into it and my primary interest for the last few months has been to make sure I’ve got a healthy business that’s performing and that healthy businesses (is) still attractive to future owners,” Fonterra Australia managing director Rene Dedoncker said in March.

The conflict in Ukraine, which has already sent the global food price index to a record high, has been exacerbated by dry weather in the US, Canada and Brazil.

Russia and Ukraine supply about a third of the world’s wheat, feeding billions of people via bread, pasta, noodles and processed foods. But damage to ports and other essential infrastructure of Ukraine’s Black Sea coast has sparked fears of global food shortages and prompted a shift to alternative grain markets, with Australia a big beneficiary.

The BetaShares Global Agriculture ETF is now closing in on $130m after continued investor interest. It has had an 83 per cent lift in funds under management since the start of the Ukraine conflict.

Meanwhile, GrainCorp shares have almost doubled in the past year. Its net profit surged from $50.5m to $246m in the six months to March 31, prompting the group to lift its interim dividend by 4c and pay shareholders a special fully franked 12c dividend.

GrainCorp is investing in its terminals ahead of the next harvest to “efficiently manage” high volumes from growers.

Elders, which hiked its interim dividend 40 per cent to 28c a share after delivering 80 per cent earnings growth thanks to strong livestock pricing and a buoyant real estate market, said the “outlook is bright”. In the past year, its shares have advanced 21 per cent.

But Rabobank is expecting farm commodity prices to ease soon. In its latest monthly report, it said “a lasting Ukraine conflict is now priced in, La Nina models are trending more neutral, and demand for a number of commodities is in check”.

“Our stance on commodity prices is not as bullish as in previous reports,” the bank’s analysts wrote. “While Russian sanctions remain in place and Ukrainian ports cannot operate, international trade will be a concern, particularly for countries that rely on imports. The situation attracts significant geopolitical attention, with the topic of safe passage for Ukrainian grain cargoes being discussed at the World Economic Forum. For the time being, these issues are largely priced in, and we adopt a neutral price outlook.”

Morgans equity analyst Belinda Moore said it had been generally positive, “but those obviously with rain as a key input get squeezed in this type of environment potentially”.

But she said when seasonal conditions began to turn, companies that had battled share price falls became more appealing.

“Yes, they’ve all sort of got short-term earnings risks, but at the same time under more normalised operating conditions, they’re worth materially more than the current share price.”

But exact forecasts remain difficult, particularly for companies like Inghams.

“We have made further downgrades to our (2022 financial year) forecasts (for Inghams). We have also downgraded our FY23/24 forecasts for inflationary cost pressures and rising feed costs. The question is to what degree price rises and its continuous improvement program can offset these headwinds,” Ms Moore said

More Coverage

Originally published as Winners and losers in Australian agriculture