Why survival of lead and zinc smelters matters so much

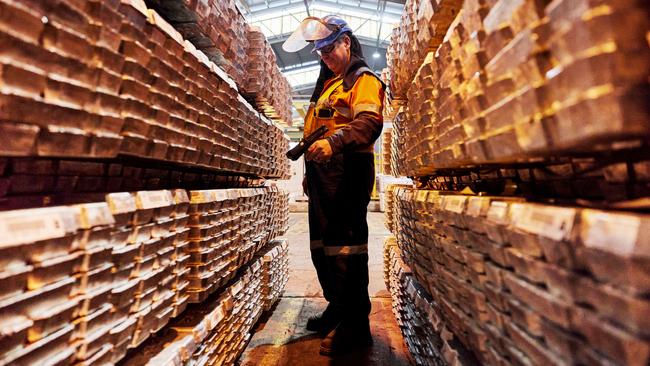

Commodities giant Trafigura has its sights on a critical minerals future in Australia through a taxpayer-backed refit of its lead and zinc smelters, which employ 1500 workers.

Global commodities company Trafigura says Australia’s hopes of becoming a leading exporter of critical minerals are at risk as its zinc and lead smelters fight for survival.

Nyrstar Australia, wholly owned by Trafigura, operates smelters that directly employ about 1500 people and could be retrofitted to produce five critical minerals, including two already subject to Chinese export bans that have alarmed Western nations.

However, Nyrstar’s lead and multi-metal smelter at Port Pirie in South Australia and zinc refinery in Hobart are teetering as the Albanese government pursues its flagship Made in Australian policy and works on plans for a critical minerals strategic reserve. Nyrstar has contributed to shaping the evolving strategic reserve policy and is pushing hard for taxpayer support for major works at Port Pirie to produce a suite of critical minerals.

Nyrstar chief executive Matt Howell said he would not pre-empt the findings of a strategic review announced by Trafigura earlier this year, but warned the future of the smelters was touch-and-go despite their strategic importance and potential to deliver on the government’s critical minerals ambitions.

“The matter is serious and it is urgent and it is not going to self-correct,” Mr Howell said. “What we’re seeing is the concentration of market power in the supply chain has permanently distorted the market.”

Mr Howell said the situation warranted “direct and decisive” government intervention in line with the findings of a new report from economic consultancy firm Mandala.

The Mandala report found safeguarding domestic lead and zinc processing was in the nation’s best interests economically and strategically.

The report warned that if zinc and lead processing was lost, Australia’s ability to rebuild smelting infrastructure and workforce pipelines would be near impossible due to cost, time and skills loss.

The report highlighted the importance of lead and zinc processing in delivering key industrial metals for the world, and as an essential precursor to producing critical minerals.

Nyrstar could leverage existing lead and zinc processing capability to produce five of the Australia’s registered critical minerals: antimony, bismuth, tellurium, germanium and indium. These critical minerals are considered vital in defence, clean energy, hi-tech applications.

China has banned antimony and geranium supply to the US on top of bans on rare earths and high-performance permanent magnets.

Resources Minister Madeleine King referenced China’s export bans and manipulation of pricing last week in shedding light on how the government’s strategic reserve might work. Mr Howell, who ran the Rio Tinto-backed Tomago aluminium smelter from 2013 to 2022, said Nyrstar had been in talks with the government about the strategic reserve and assistance for the Port Pirie and Hobart smelters.

“We are engaged with state and federal governments as we speak. They recognise this is real, this is serious. They are part of the solution,” he said. “We’re actually coming with solutions. We’re saying ‘look, if you want to make critical metals, and the priority one is antimony because of its use in defence and flame retardants, you actually need a lead refinery’.

“There is only one lead refinery in the country. That’s at Port Pirie. So, it’s about modernising it and upgrading it and adding value to it. We need assistance from government because of the concentration and market power that’s distorting the raw materials supply chain.”

Mr Howell declined to speculate on how much it would cost to retrofit the Port Pirie smelter that has been in continuous operation for 134 years, or the 110-year-old Hobart zinc smelter, but acknowledged the costs would be substantial.

Mandala wrote the report that eventually led to the government introducing a 10 per cent production tax credit for critical minerals processing.

The Albanese government and former Coalition government have handed a combined $1.65bn in support to Iluka Resources as it builds Australia’s first integrated rare earth refinery at Eneabba in WA.

Mr Howell said Nyrstar contributed strongly to shaping and framing the strategic reserve policy. “It’s fair to say more detail is required, but we applaud the government for recognising the value that these nationally strategic assets, lead and zinc smelters, can play in making a sovereign manufacturing footprint a reality,” he said.

“Nobody’s going to build a lead smelter from scratch. Nobody’s going to build an antimony smelter from scratch. And you don’t need to because most of the kit already exists at Port Pirie.”

The Mandala analysis concludes that without policy support and modern infrastructure, Australia risks falling further behind China in industrial and critical minerals processing, and losing its existing refining capability in lead and zinc.

The report found China dominates between 52 per cent and 82 per cent of global production of the critical minerals that lead and zinc processing can give rise to, leaving Australia and other countries vulnerable to supply chain disruptions and geopolitical risks.

Mandala managing director Amit Singh said Australia would not achieve its critical minerals potential without building on the upstream processes that made their extraction possible.

“Lead and zinc refining isn’t just about producing base metals, it’s the gateway to producing the critical minerals that power our clean energy and protect our nation,” Mr Singh said.

“If Australia were to lose its lead and zinc refining capability, it would be almost impossible to rebuild.”

It is estimated the Port Pirie and Hobart smelters generated $1.7bn in economic value last year and supported more than 6600 jobs.

The report points to examples of direct government intervention to help Glencore, Alcoa and the Whyalla Steelworks in making the case for the lead and zinc smelters.

Trafigura chief executive Richard Holtum said in March that there were “no sacred cows” as the Singapore-based multinational assessed the future of the struggling smelters.

Mr Holtum, who took the reins at Trafigura in January, said there was a case of some form of government ownership of the two smelters.

“In today’s fractured, multipolar world, I would argue that uncompetitive assets … such as Nyrstar Australia, shouldn’t be in fully private hands,” he said at the time.

“Critical infrastructure and smelting capacity is a national security issue and therefore needs to probably have some sort of government ownership or significant government support for it, because it is not competitive on an international basis comparing it to the Chinese smelters.”

Nyrstar has written down the value of the two smelters by more than $US500m over the past two years. Mr Holtum said the smelters were uneconomical, as were others in Western nations, in the face of competition from China.

Originally published as Why survival of lead and zinc smelters matters so much