Westpac dodges bad loan bloat with bank impairments, hardships on the slide

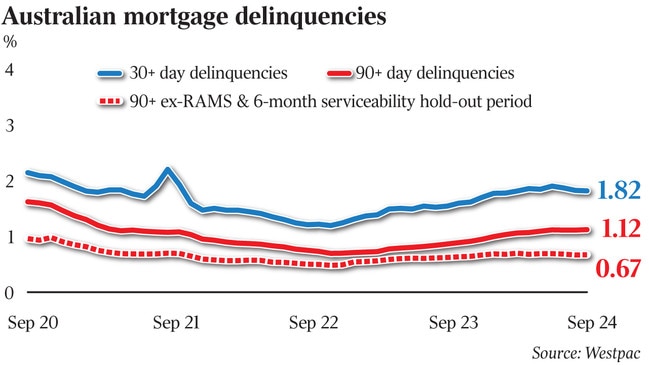

Mortgage delinquency rates may be getting worse, but Westpac says its latest set of results show this time may be different, with bad borrowers gone from the big four bank’s loan books.

Mortgage delinquency rates may be getting worse, but Westpac says its latest set of results show this time may be different, with bad borrowers gone from the big four bank’s loan books.

Ruling off a $7bn full-year profit on Monday, Westpac said its impairment provisions were $39m better than at the half year.

Westpac chief executive Peter King said this time may be different, saying the long-term loan loss rate had “had a step down because of the quality we now write”. He added: “That’s a function of the macroprudential setting, but also the nature of the business we have.”

As noted in a recent Senate inquiry into bank lending, prudential rules introduced in the wake of the Global Financial Crisis have made banks increasingly risk-averse in their lending posture, with borrowers assessed for home loans well in excess of current borrowing rates.

Mr King said Westpac had also dialled down its unsecured lending and riskier borrowing, with the bank selling its vehicle financing business in 2021 to non-bank lender Resimac in a $1bn deal. Mr King, presenting his last set of results before handing the reins to Anthony Miller, said he was hopeful that the Reserve Bank would cut rates in the coming months, providing relief to borrowers. But he said if rate cuts didn’t occur next year, “we’ll actually see slower growth in the economy”.

Impairment charges were seven basis points of loans, down from nine basis points, with Westpac saying its home mortgage book had improved and its business lending was hit by only a few “single name exposures”.

Jarden analyst Jeff Cai said the bad bank loans at Westpac were “better than expectations”. But Mr Cai warned that “more signs of credit stress were evident” in the bank’s results.

Mr King said Westpac’s impairment charges “reflects a combination of prudent lending practices and resilience across household and business customers”.

“That says to me a lot of people have gotten used to these higher levels of interest rates,” he said. “The vast bulk of the book is doing well, but that’s not everyone.”

Despite this, Westpac has locked up $1.5bn in impairment provisions to cover potential loan losses “above the base case”.

Westpac reported 1.14 per cent of its loan book were in hardship, towards its highest level in years.

Of these, 57 per cent were on temporary repayment pauses, while a further 32 per cent were on reduced repayments, and 10 per cent were capitalising their arrears into existing loans. All up, Westpac handed out more than 47,500 hardship packages in the year.

But Mr King said many of those who had taken on the bank’s offer of a repayment pause had resumed paying their mortgages amid strong jobs growth.

“You do have a few people that decide to sell their house,” he said.

Mr King said the key drivers of hardship were unemployment, divorce, or sickness.

Westpac’s data showed homebuyers who borrowed in 2019 and 2018 were the worst performing cohort of recent mortgage customers.

Atlas Funds Management chief investment officer Hugh Dive said Westpac’s arrears and impairment figures showed the bank had been able to shift problematic commercial debts onto other lenders.

“Ten years ago, Westpac would have been tagged with the Rockpool sort of debt,” he said, noting the recent move by Quadrant Private Equity to hand over its restaurant chain, Pacific Hunter, to private lenders Metrics.

“The banks have been more conservative and that debt has gone elsewhere.”

More Coverage

Originally published as Westpac dodges bad loan bloat with bank impairments, hardships on the slide