Understanding risk is critical to investment success

Learning how to manage financial risks requires understanding, strategy and calculated decisions, says financial adviser Bruce Brammall.

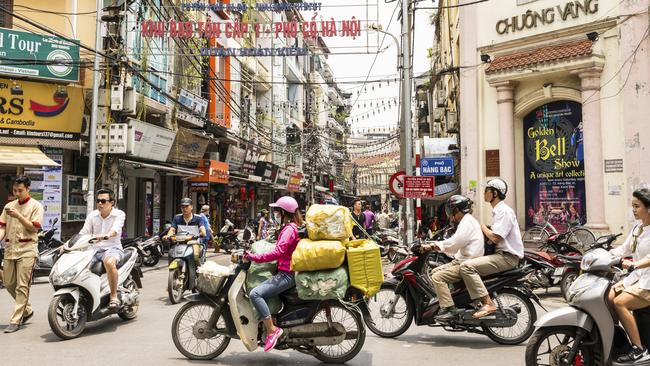

Anyone who has spent time in a big Asian city will understand how utterly crazy-chaotic the traffic can be.

You look at the hundreds of motorbikes and cars passing you each minute and it seems just incomprehensible that people aren’t dying right in front of your eyes.

If you were trying to cross the road, but were standing back waiting for a break in the traffic, the risk you’re assessing feels like: “will I die of old age waiting for a break in the traffic, or be killed trying to cross?”

As I showed my kids in Hanoi years ago … you just go. You just take a step out (obviously not in front of a bus or a car) onto the road, watching the oncoming traffic, and you put one foot in front of the next.

The traffic is chaos. But there are surprisingly few accidents. Drivers, particularly of motorcycles, slow down, go around, brake, or do whatever they need to, to get around you and keep their lives moving on. They drive at a speed to match the conditions – they aren’t doing 60kmh, that’s for sure.

It just works. The risk of personal injury in crossing a road seems off the charts, but it’s really not.

Risky business

Realise it or not, you take risks everyday, just living. While most of what we do each day is fairly routine and mundane, there are still risks involved, inside and outside your home, driving a car, working, eating out.

When it comes to your finances, what risks are you taking?

Have you ever really thought much about it?

Start by writing down what your main assets are. How much cash are you holding, including what’s in your offset/redraw accounts? Do you have other investments? What are they and how much are they worth? How much super have you got and how is it invested?

Taking a test

Do you know how much risk you are prepared to take? Have you ever done a risk profile, or risk tolerance, test?

If you have a financial adviser, most likely you have done a bit of work with them to find out your risk tolerance and to understand the risks of each asset class.

If you haven’t, then getting a good understanding of your ability to handle risk is critical to investing. It should be the starting point.

But it’s not as simple as just doing a quiz that shows you have a high, medium or low tolerance to taking risk. Your investments/super also need to take into account your various time frames for investing, as you can afford to take higher risks with longer time frames (which I’ll come back to).

Each asset class has its own risk characteristics. Let’s keep it simple and say there are four main asset classes – cash, fixed interest, property and shares.

Cash is pretty simple. You give your $100 to the bank and they pay you interest, while they lend it out to people and businesses.

Fixed interest is loans to the likes of governments and major companies. They generally pay regular coupons (income). They are sold in $100 lots, but the value of the $100 can move up and down, usually fairly gently, unlike the stock market. So, there is a “capital movement” component to bonds. You’re taking a higher risk than with cash, so you would generally hope the returns are higher.

Cash and fixed interest are generally considered to be “income” investments. It’s more about the income than making capital gains.

Yes, property pays rent and shares pay dividends, but they are largely about capital growth. Buying a property for $500,000, in the hope that it will be worth $1 million or $1.5 million down the track, or buying BHP shares for $40 in the hope they’ll move on to $80 or $100 eventually.

Blending together

Obviously, with shares and property, the risks are considerably higher than investing in cash and fixed interest.

But it’s not a case of simply banging all of your money into one or other asset class. Almost always, there should be a blend of assets, that helps match with your risk profile and time frame.

For example, a balanced (also known as “moderate” or the “average”) investor, might have about 60-70 per cent of their assets in property and shares, with around 30-40 per cent in cash and fixed interest.

People wanting to take higher risk (aggressive or growth investors) might put 80-100 per cent of their money in shares or property.

(With shares and property, you can then potentially add gearing, or borrowing money to buy these assets, which then dramatically increases the risk further. Topic for another day.)

The level of risk correlates with those asset class returns over medium and long terms. That is, shares should beat property, should beat fixed interest, which should beat cash. Not every year, because asset classes bounce around, but when measured over five or seven years or more.

Those wanting to take lower risk (conservative), might reduce their exposure to shares and property considerably (potentially even down to 0 per cent), with all of their money sitting in cash and fixed interest.

There are people who operate at either ends of the spectrum – all in shares and property, or all in cash and fixed interest – but even aggressive investors generally need to hold some cash and conservative investors, in most cases, should have some exposure to growth assets.

There are risks in all investing, including holding too much cash. The risks with cash include if interest rates are low, inflation is high, or missing out on better medium to long-term returns from other asset classes.

Matching risk and time

You might not have thought much about it, but most of you are going to have more than one investment timeframe.

Some timeframes are going to be longer than others. And each of those timeframes should be matched with its own level of risk.

For example, someone aged 50 can’t touch their super until they turn 65 (or 60 and change jobs). If they wish to turn on a pension at age 65, it is then designed to become an ongoing income stream that pays out over the next 15 to 30 years.

Therefore, A 50-year-old still has a timeframe for their super of, roughly, 30-40 years. They could/should consider taking more risk with that money, to try to take advantage of the higher long-term returns from growth assets.

The same person might also have short-term time frames. For example, having enough money to pay school fees, or a bigger holiday. That money is generally going to need to be in cash (preferably in an offset or redraw account).

But they might also have medium term plans (3-6 years) which might allow them to have some money invested in growth assets, with some in income assets.

Saving a deposit

I see a lot of people in their 20s and 30s, who are looking to buy their first home. They come in and say, for example: “We’ve saved $100,000 for our first home and we believe we’ll have hit our target savings and want to buy in about 18 months. How should we invest the money in the meantime?”

The answer is always: “Keep it in cash and get the best interest rate you can for it.”

Any timeframe under about 2-3 years, should be in cash. Why? We could have another Global Financial Crisis (where shares fell as much as 55 per cent and listed property fell 75 per cent), or Covid Crash, just when you want to buy your home. And suddenly, just when you need your money, your investments have dropped 30, 40 or 50 per cent.

Understand the dangers

Warren Buffett said, “Risk comes from not knowing what you’re doing”.

And it’s hard to argue with that. But most people aren’t going to spend most of their lives diving into investments to understand the risks and to try to minimise them.

Because most people have better things to do, outside of work hours. Play with the kids, play or watch some sport, cook a meal with the family, head out for a movie, or to catch up with friends.

But your investments, both super and non-super, need a plan, overall and individually. And if you know that you’re not going to make the time to do the research, to reduce the risks, then you’ve got to have a plan to get someone, such as a financial adviser, to help you in that process.

Bruce Brammall is both a financial adviser and mortgage broker and author of books including Debt Man Walking. E: bruce@brucebrammallfinancial.com.au.

DISCLAIMER: Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.

More Coverage

Originally published as Understanding risk is critical to investment success