Mark Bouris backs NSW Premier Chris Minns’ efforts to cut red tape for businesses

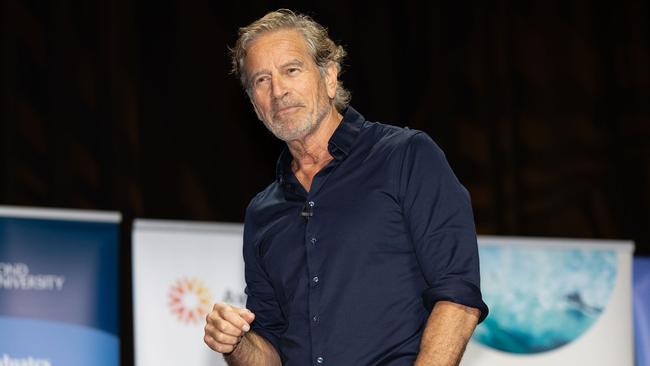

A high-profile Aussie businessman has backed a state premier, saying he is working hard to reduce every business’s worst “nightmare”.

Prolific businessman Mark Bouris has come in to bat for Chris Minns, saying the NSW Premier must be going “mental” trying to cut red tape.

Mr Bouris, who founded Wizard Home Loans and garnered fame on Celebrity Apprentice Australia, says red tape is discouraging people from starting traditional small businesses in Australia.

However, commonly people under 30 were running “side hustles” on top of a day job, he said.

“There’s probably some people in this studio who have another little business that they’re running at night, but they’re all doing online businesses which is a lot less red tape,” he said on 2GB on Tuesday.

Things like trying to put chairs outside your own coffee shop was a “nightmare” because of council approvals, he said.

“So they’re the problems we’re facing, we’ve become overgoverned,” Mr Bouris said.

“We’ve got too many levels of government in this country, at every level.

“I’m sitting here in the same chair, Chris Minns, this is the Premier’s chair I’m sitting in – feels a bit weird.

“But the amount of frustration he must be putting up with trying to reduce red tape would be driving him mental.”

Last month, the Premier announced an outdated Liquor Act provision would be scrapped.

“Adults should be trusted to decide whether they want to stand or sit while enjoying a drink,” Mr Minns tweeted.

“So we’re removing the outdated conditions that force patrons to be seated while drinking outside licensed premises.”

“It’s useless red tape that hinders our night-life and vibrancy across the state.”

The change will create a new Liquor Act pathway to get around the blanket condition that stipulates patrons must be sitting down to consume alcohol in outdoor areas.

Mr Bouris founded Wizard Home Loans in the mid-1990s, sold it for $500m in 2004 and started another mortgage business, Yellow Brick Road.

Yellow Brick Road lost an aggregate of $58m over the course of 10 years to September 2023, during which time Mr Bouris was paid $16m by his company.

He previously said the “misunderstood nature” of the mortgage broking business was to blame for Yellow Brick Road’s tumbling share price. Shareholders voted to delist the company from the ASX last year.

Originally published as Mark Bouris backs NSW Premier Chris Minns’ efforts to cut red tape for businesses