Iconic Australian retailer Jeanswest’s massive $48m debt revealed

The collapse of iconic Australian fashion brand Jeanswest has left creditors facing huge losses of more than $48m, with hundreds of employees owed millions more.

The collapse of iconic Australian fashion brand Jeanswest has left creditors facing huge losses of more than $48m.

Jeanswest, which collapsed into administration in late March, also owes more than 250 employees over $4m, including for annual leave, long service leave and redundancy entitlements.

The new figures detailing the fallout from the giant’s downfall are contained in a new document lodged with the Australian Securities and Investments Commission.

A report provided to administrators by the director of Harbour Guidance, the company behind the iconic retailer, Wen Kin Wilkin Fon, revealed the business collapsed with a staggering $775,834 in unclaimed gift vouchers.

The Australian Tax Office was also listed as a creditor owed $122,025.

The majority of money owed to creditors was made up by related party debt including to Hong Kong-based company Champion Glory ($19.9m) and Melbourne-based Harbour Guide ($25.3m).

The company declared it had over $13.7m in assets.

This included various cash floats for their stores – the money a business has readily available to cover daily expenses and operations – as well as term deposits, business investment accounts and inventory.

The business had three bank accounts with CommBank and one with NAB containing a total of $114,793 at the time of its administration.

Money owed to the company included $61,755 in rent, and an intercompany loan totalling $1,064,253 from Jeanswest Corporation (New Zealand).

All 87 Jeanswest stores across Australia are expected to shut their doors next month, which could impact up to 600 jobs.

The Aussie fashion giant announced last month that they would run exclusively as an online retailer.

Pitcher Partners administrators Lindsay Bainbridge, Andrew Yeo and David Vasudevan are in the process of selling off remaining stock.

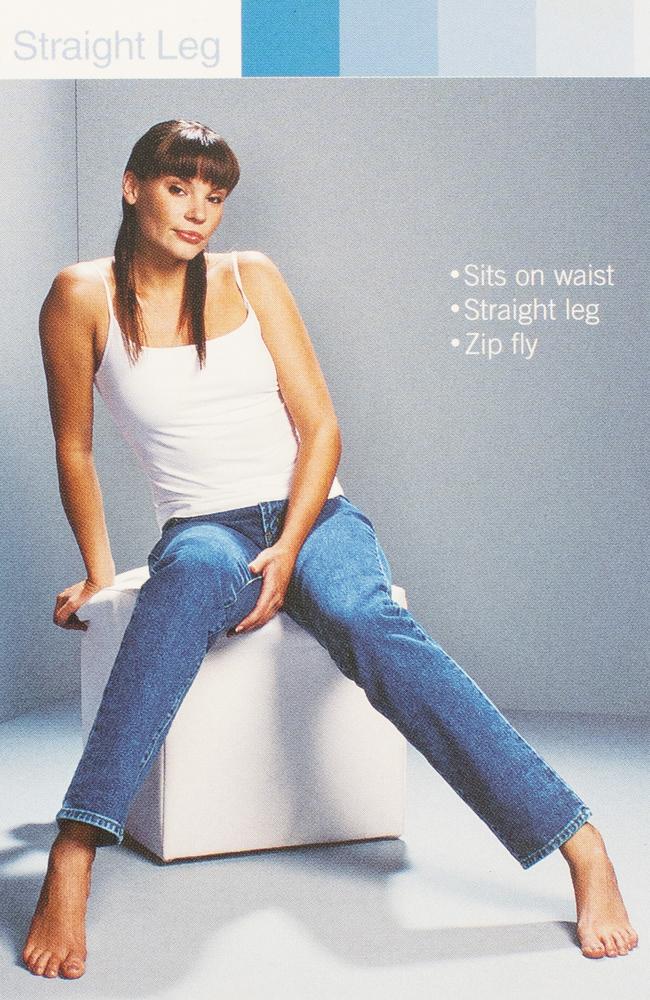

It was reported earlier this month that they had sold more than 53,000 pairs of jeans in the first week of a nationwide discounting campaign, estimated to be worth more than $20m.

Harbour Guidance, a subsidiary of Hong Kong’s Harbour Guide which is controlled by billionaire Chun Fan Yeung, acquired Jeanswest in 2020 out of administration after it previously hit financial strife.

The administrators told News Corp on Wednesday that 40,000 items of new stock had recently arrived in stores.

“With so many items selling well, we are focusing the sale in stores, which remain open until all stock is sold,” they said.

“No decision regarding store closing dates has been made.

“Since the start of its sales, more than 140,000 people have made purchases in the company’s stores and driven sales of over 300,000 items.”

More Coverage

Originally published as Iconic Australian retailer Jeanswest’s massive $48m debt revealed