DeepSeek the new frontline in digital cold war against China

China outmanoeuvred the US with the launch of DeepSeek. But the US’s biggest tech companies are fighting back to maintain dominance in the AI race.

China began the week with a bang when it launched its homegrown chatbot DeepSeek, but America’s big technology companies were determined not to let the week end with a whimper.

Elon Musk is leading the charge after DeepSeek’s launch caught Wall Street and the world off guard, declaring Tesla will become the world’s most valuable company – worth more than the world’s top five companies – as it ramps up investment in self-driving cars and humanoid robots.

Facebook founder and Meta chief executive Mark Zuckerberg is building a data centre “so large it would cover a significant part of Manhattan” to blast DeepSeek out of the water.

The so-called Magnificent Seven US tech companies are now scrambling to maintain their dominance in the artificial intelligence race in a new cold war.

China has built an AI model that has matched the US’s best, including ChatGPT. Not only that, it achieved the feat for just $US5.6m ($9m) and without access to the world’s most advanced chips.

The fact China could do it so cheaply embarrassed Silicon Valley’s best and brightest, wiping almost $1 trillion off Nvidia’s market value on Monday.

Microsoft, Meta, Amazon and other big US tech companies have spent billions of dollars developing and training AI models and believed they were miles ahead in the AI race.

China changed the game with DeepSeek.

Australian data centres were also caught in the market carnage, with NextDC shares falling as much as 7.8 per cent on Tuesday.

As David Somers – chief product officer of $US70bn HR software titan Workday – said: “Some things we thought were a given are not a given”. JJ Fiasson – who founded Australia’s AI foundational model Leonardo. Ai – says it shows how innovation can be achieved via constraint and without the deep pockets of US companies.

But as the week progressed Silicon Valley began changing the message, from impending doom to what it does best – creating opportunity.

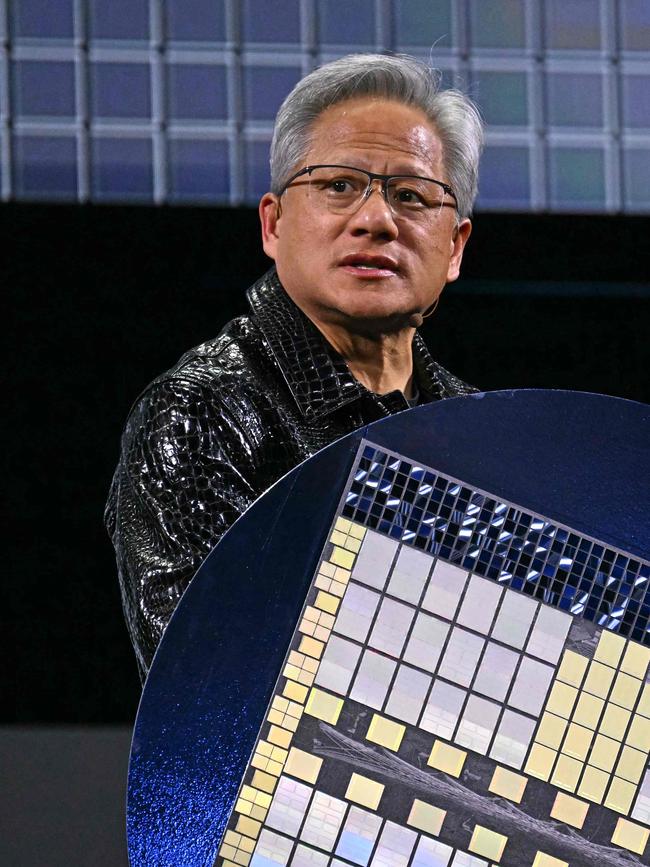

Nvidia chief executive Jensen Huang said DeepSeek was an “excellent AI advancement” that proved demand for its chips would continue to soar, despite Nvidia’s share price diving more than 15 per cent this week.

Here’s why.

Mr Somers from Workday said DeepSeek “actually starts to lower the floor”. AI applications that have previously been deemed too expensive will become more affordable and therefore AI will become accessible to more people. “We start to see the cost of that go down, which, I’ve got to say, brings a smile to my face as a product person,” Mr Somers said.

“We can start to look at some of those … roles or use cases that before (we thought) the cost to deliver that may outweigh the actual return. Well, that could actually be gone if this plays out.”

The more people use AI, the more demand for computing power and chips like Nvidia’s. Mr Somers’ enthusiasm soon spread. Microsoft, Meta, Tesla and Apple reported their quarterly earnings on Thursday and Friday. Their chief executives provided a glimpse into how they would react to the new Chinese threat.

Facebook founder and Meta chief executive Mark Zuckerberg said it was irrelevant DeepSeek had come from China.

“There are a number of things that they have, advances, that we will hope to implement in our systems,” he said.

“Whether it’s a Chinese competitor or not, I kind of expect that every new company that has an advance event, that has a launch, is going to have some new advances that the rest of the field learns from and that’s sort of how the technology industry goes.”

How was DeepSeek able to develop and train a model which could rival ChatGPT so cheaply?

The work required for AI to deliver answers to prompts – a process called inference – typically involves high-performance Nvidia chips. To date, the best AI models have been trained on copious amounts of data. With ChatGPT, it is like asking a librarian who has read all the books in the library for an answer. DeepSeek, in contrast, was able to cut the processing power by asking the librarian to instead find the right book.

Nvidia and Mr Zuckerberg say while this is an innovative solution, it could curtail investment or demand for chips.

Indeed, DeepSeek said it used more than 2000 of Nvidia’s tailor-made Chinese chips to train one of its AI models.

Meta is now building a data centre “so large it would cover a significant part of Manhattan” as part of a $US65bn AI spending spree. Mr Zuckerberg said this was vital to maintaining a competitive advantage in the AI race.

“There’s already sort of a debate around how much of the compute infrastructure that we’re using is going to go towards pre-training, versus … putting more compute into inference. That was already something that I think a lot of the other labs and ourselves were starting to think more about,” he said.

“That doesn’t mean that you need less compute, because one of the new properties that’s emerged is the ability to apply more compute at inference time in order to generate a higher level of intelligence and a higher quality of service, which means that as a company that has a strong business model to support this, I think that’s generally an advantage.” Satya Nadella – chief executive of Microsoft, which has reportedly invested $US13bn in ChatGPT maker OpenAI – agrees. He said the biggest beneficiaries would be consumers.

“People can consume more and there’ll be more apps written. This is all good news, as far as I’m concerned,” he said.

Mr Nadella said even before DeepSeek’s launch, Microsoft had achieved “significant efficiency gains in both training and inference for years now” and it would spend about $US80bn in the next six months to accelerate AI development.

“On inference, we have typically seen more than two times price performance gain for every hardware generation, and more than 10 times for every model generation due to software optimisation,” Mr Nadella said.

“As AI becomes more efficient and accessible, we will see exponentially more demand.”

This bodes well for data centre operators like NextDC and AirTrunk, which US private equity titan Blackstone acquired for $24bn last year.

While DeepSeek doesn’t use as much processing power, demand for AI tools is continuing to soar and thus increase the load on data centres, which form the backbone of the AI boom.

“Lower AI cost and more efficient AI development will increase AI adoption, which means the requirement for processing power housed in data centres increases,” one Australian data centre insider said.

“We therefore see this as a potential opportunity for our customers and for the data centre industry.”

If DeepSeek still needed high-performing chips, how did it get them when China had no access to Nvidia’s most advanced technology?

The Biden administration forced Nvidia and other US chip companies to throttle chip function in 2022. Nvidia developed a new product tailored for the Chinese market which, while being export-compliant, was able to maintain high performance in other ways. Some analysts said at the time the chip could match Nvidia’s best at the time.

US officials were far from impressed Nvidia had broken the spirit of the new laws and tightened rules again 12 months later – creating a one-year gap for China to get their hands on the powerful chips.

JJ Fiasson said DeepSeek would have needed access to significant processing power during its experimentation stages.

“Having a small number of GPUs (graphic processing units) used for the final training run does not necessarily mean that that’s all they would have needed to get to that point in the first place and to get to that point in a timely manner,” Mr Fiasson said.

“There would have been a lot of experiments.”

Mr Nadella said the AI race needed constant investment.

“You don’t want to buy too much of anything at one time. Because of Moore’s Law, every year is going to give you two times. Your optimisation is going to give you 10 times. So you want to continuously upgrade the fleet, modernise the fleet,” Mr Nadella said.

“So I feel very good about the investment we are making – and it’s fungible. It just allows us to scale more long-term business.”

Elon Musk has a bolder vision, saying Tesla’s investments in “physical AI” to develop self-driving cars and humanoid robots will propel its to become the world’s most valuable company, worth $US25 trillion. It’s currently worth about $US1.2 trillion.

“We made many critical investments in 2024 in manufacturing, AI and robotics that will bear immense fruit in the future, immense, in fact, to such a scale that it is difficult to comprehend,” Mr Musk said.

“We’re building the manufacturing lines … setting up for what I think will be an epic 2026 and a ridiculous 27 and 28 – ridiculously good.

“I see a path to Tesla being the most valuable company in the world by far. I think it’s an incredibly difficult path but it’s an achievable path.”

Originally published as DeepSeek the new frontline in digital cold war against China