Covid crisis won’t stop the profit party: $25bn in buybacks and dividends unveiled

You could almost forget the country is in a health crisis with the first two weeks of the reporting season highlighting $25bn in capital returns.

In the span of a fortnight from late July to the end of this week, Australia’s biggest listed companies representing the mining, financial services and telecommunications sectors promised to shower shareholders with more than $25 billion in dividends, special dividends and share buybacks.

To put that 14-day cash splash into some context, it is equivalent to almost three years of planned infrastructure investment pledged by the federal government in the recent budget, easily beats the $18bn announced to overhaul the nation’s scandal-ridden aged-care system and is around half the initial $56bn in JobKeeper payments that saved millions of jobs last year.

Australia’s corporate balance sheets have never been stronger, bulging with cash, they are scooping up cash with buckets and tipping them over investors.

A pandemic crisis, what crisis? The biggest listed companies on the Australian Securities Exchange so far this reporting season have shown that while the outlook is unclear, while the vaccine roll out is under a cloud and while half the population are locked in their homes under lockdowns, they are raking in the cash.

Rio Tinto led the pack in late July when it posted a jaw-dropping whopper of a total dividend payout of $US9.1 billion ($12.37bn) driven by record high iron-ore prices and was followed over the next two weeks by a $6bn share buyback from Commonwealth Bank (as well as $3bn in dividends), a $250m buyback from Suncorp and this week a $1.35bn buyback from Telstra that was complemented by more than $1.5bn dollars in declared dividends.

Then there were a trail of small and mid-cap stocks such as Nick Scali and Baby Bunting that ramped up their final dividends by 11 per cent and 29 per cent respectively. Even troubled department store owner Myer has turned a profit.

It underscores the rapid clip at which corporate Australia emerged from lockdowns last year following the first wave of Covid-19, and to be sure while there are still some sectors in panic especially in tourism and travel, but for much of the nation’s public companies the Covid-19 economic impact reflects more a ‘‘phony war’’.

And the reporting season isn’t even in full swing yet with the remainder of August to feature some of the market’s biggest companies such as CSL, Wesfarmers and Woolworths along with other industrials and miners that are tipped to keep the dividends and buyback party going.

The clues to the upbeat start to reporting season driven by robust corporate balance sheets were first evident in the pre-reporting season, also known as ‘‘confession season’’, was heavily skewed to earnings upgrades.

Upgrades were concentrated in the materials and general industrials, namely James Hardie, Sims, and Ansell. There was also upgrades for the REITs such as Charter Hall, Dexus, and Goodman Group.

According to UBS analyst George Tharenou other key themes that pointed to the strength of corporate Australia included low implied volatility suggesting markets expect strong results, but with little risk priced-in for cyclicals, REITs, defensives and banks, and banks to report strong results.

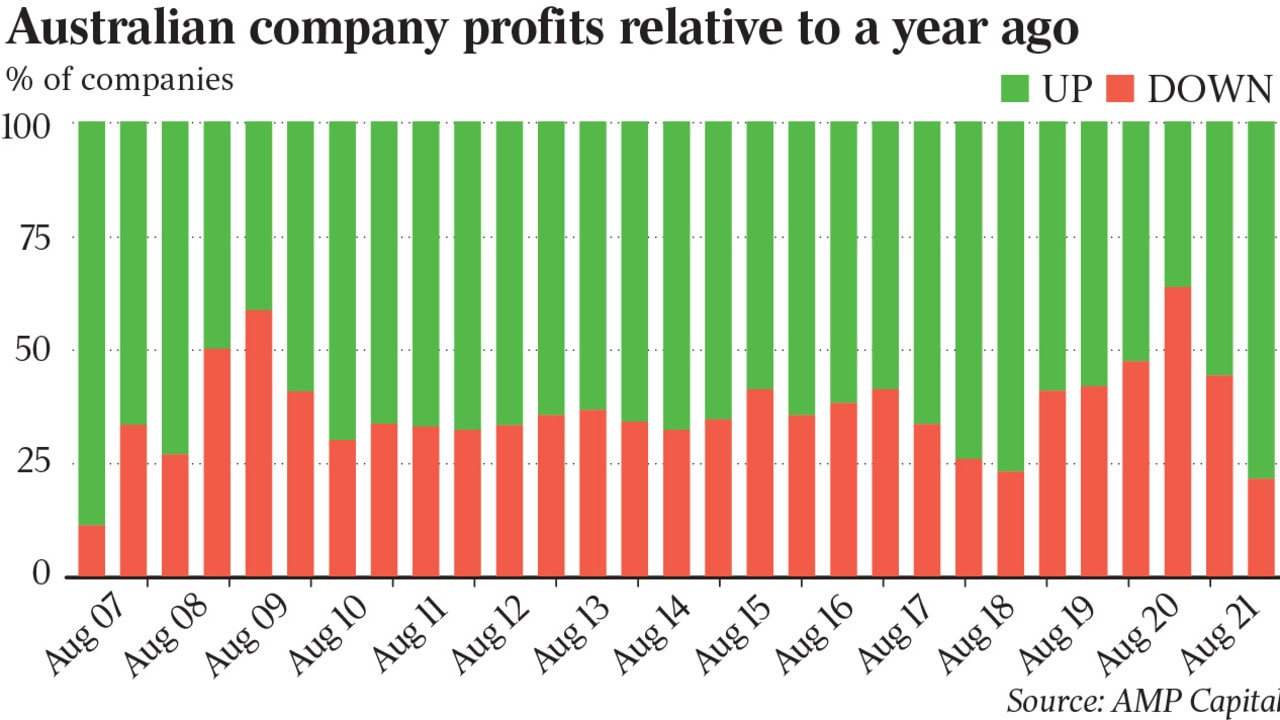

The rebound from the earnings retreat in 2020 has been quick and fast.

“After ASX100 earnings per share collapsed by 35 per cent year on year in fiscal 2020, consensus expects fiscal 2021 rebounded by 49 per cent – surpassing 2019 levels – and will jump by another 9 per cent in fiscal 2022,” Mr Tharenou said in a reporting season preview note to clients of the investment bank.

“This is driven by elevated commodity prices, as well as booming housing, and a fiscal-fuelled rebound in consumption.”

UBS said 2021 earnings per share expectations are led by resources (up 98 per cent) and financials (up 48 per cent), while industrials ex-financials lag (up 2 per cent).

Meanwhile, 2022 dividends per share expectations have lifted over the past month by 4 percentage points to 6 per cent year on year, also well above the prior peak level.

Armytage Private portfolio manager Bradley King said the improving earnings and dividend returns is spread through a number of sectors.

“It is not really singled out to one sector, it is across the board been fairly positive and I think we can be in a bit of a bubble in stockbroking or funds management when you come into work and everything looks quite bullish, everything elsewhere isn’t quite the same,” Mr King told The Weekend Australian.

“But a lot of good companies have had a good look at their operations through Covid-19, their cost structures, most would have got a reasonable win from the government stimulus whether through tax relief or other things and they have really focused on improving productivity, and haven’t had to raise costs that much in terms of wages and the like and perhaps that will continue.”

Dean Fergie, founder and portfolio manager of Cyan Investment Management told The Weekend Australian said many of these company high-flyers that are performing well despite the wider pandemic crisis are sitting on high cash balances and looking to capital management as they ride through the Covid-19 storm.

And they are also armed with inflated share prices that can be used for deals.

“These are profitable, cashflow businesses. They have got money sitting on their balance sheets that aren’t earning anything, share prices are inflated and so the currency is in the equity and not in the cash on the balance sheet.

“So the cash is probably better off just given back to investors and if they want to raise more money for an acquisition they can do it through equity, either by issuing scrip or doing a placement, in the meantime they can just hand it back to shareholders.”

However, not all investors welcome share buybacks with the surplus cash perhaps better directed to acquisitions or reinvesting in the business.

“I’m not a massive fan of share buybacks, I will buy shares when I want to buy shares,” Armytage Private’s Mr King commented.

“I think in terms of dividends, yes absolutely you might as well use them while you have the franking credits – you might as well send them back to shareholders.

“In terms of cash on the balance sheet, you would like them to invest or acquire something but the price to earnings multiples are quite expensive at the moment, so you can understand why they are buying their shares back but it isn’t our favourite capital return.”

Mr Fergie said for the remainder of reporting season, stretching for the rest of the month, he would be looking for further capital management from companies with the economy flooded with cash either from company dividends or people taking their money out of savings banks – that earn little if no interest – and pour it into the sharemarket.

Lead portfolio manager at WAM Capital, Oscar Oberg, said with lockdowns kicking off at the end of June, most of the companies his funds were investing in had strong balance sheets and had racked up good performances through fiscal 2021.

“I think generally, typically for the small-cap industrial companies we follow, we think outlook statements will be pretty tempered, you might not even see any, retailers have had a hard eight week period obviously.

“It will be messy from that respect, but I think corporate Australia generally are positioned where balance sheets are a lot better that we probably all would have envisaged so we do see the potential for M&A and the role of private equity.”

Mr Oberg said companies he would be watching closely in reporting season would be billionaire packaging businessman Raphael Geminder’s Pact Group, building materials business Adbri (formerly known as Adelaide Brighton), petrol stations owner Viva Energy, general insurance broker Steadfast and plumbing supplies company Reliance Worldwide.

“Obviously on the ASX travel stocks have been decimated, but share prices of a lot of companies we have in our portfolios they have held up pretty well, and I think generally since Covid-19 started around 18 months ago the thing I have been the most surprised with is firstly how well the consumer balance sheet or savings have been at very strong levels.

“Secondly I underestimated how much money Australians spend on travel, and that has gone through a huge amount of other sectors such as auto, retail, housing and all that money that was spent overseas has gone somewhat back into the economy.”

And so the economy continues to party and investors can gather up dividends and share buybacks as if a health crisis didn’t exist. Just don’t look outside your homes.

More Coverage

Originally published as Covid crisis won’t stop the profit party: $25bn in buybacks and dividends unveiled