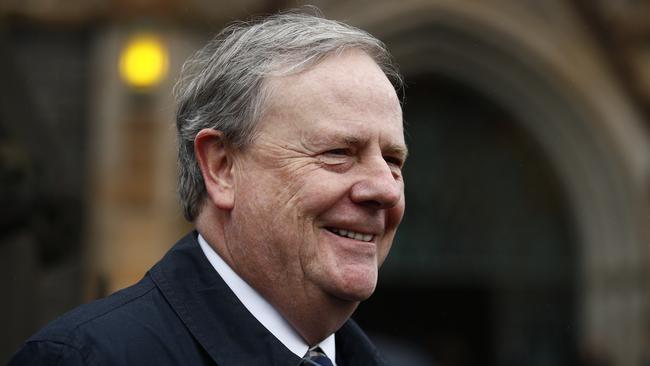

Chalmers’ budget stimulatory ‘on any measure’, Peter Costello says

Former treasurer Peter Costello says Australia is living through the biggest trade boom since the gold rush of the 1850s and budget measures are too inflationary.

Former treasurer Peter Costello has criticised the Albanese government’s latest budget, saying it is stimulatory “on any measure” and will add to the nation’s inflation challenge.

Speaking at a Financial Services Council event in Melbourne on Wednesday, Mr Costello, who was federal treasurer from 1996 to 2007, said fiscal policy should be tighter, and the government focused on paying down debt.

“Will this budget increase pressure or relieve pressure on inflation? Well, it won’t relieve it and to the extent of its stimulus, it will increase it,” Mr Costello said.

“Are payments going up? Yes. Is the bottom line deteriorating? Yes. Is debt increasing? Yes. So on any measure this is a budget that is stimulatory and will add rather than detract from inflation.”

Adopting a tighter fiscal policy would help to ease the inflationary pressures, he added.

“We are now in a term of trade boom. We are living through the greatest trading conditions Australia has had in its history. The only thing that could rival it is the gold rush of the 1850s … The things we trade – iron ore, coal, gas – are at all-time record prices.

“So we are in this boom, and in terms of a boom you should be paying off debt … I think we ought to be out on financial markets retiring debt, both for macroeconomic and financial reasons.”

Mr Costello, who is Australia’s longest-serving treasurer and handed down 12 budgets, 10 in surplus, warned on the impact of higher energy prices on the inflation outlook.

“The tools to (tackle) inflation are principally fiscal policy and, I would say, energy policy. A lot of this inflation has been driven by rising energy prices and the government is introducing a rebate to try and bring that down,” Mr Costello told The Australian.

“But this transition to renewables in itself is inflationary, and it’s got a long way to run. We’ve got to be very, very careful here that we don’t saddle ourselves with long-term higher energy prices because they really will be inflationary,” he said.

Mr Costello cautioned against taxing unrealised gains on large superannuation balances, saying it would have little impact on the tax take but would set a dangerous precedent for similar moves in other parts of the economy.

Putting an additional tax on retirement savings was “enormously complex” and had been looked at “many times” in the past.

“The conclusion always was that the complexity in doing this would outweigh the benefits,” he said.

“The government is proposing to tax unrealised capital gains and then tax again when gains are realised, unless they try to work out some kind of credit system.

“Then you have defined benefit where there are no assets to tax, but they’re going to try to tax these pensions with a notional tax base ... the complexity will be unbelievable.”

The Labor government has proposed taxing earnings from super savings above $3m at a rate of up to 30 per cent, double the current 15 per cent rate. The change is due to come into effect from July 2025.

The response from those affected would be to withdraw their money from the system, Mr Costello said.

“There’s behavioural changes here and if the government says you shouldn’t have more than $3m in super what will you do it? You could put it in the family home, and it would be tax-free. Would that be good for the economy? No, but it’s quite legal.

“It won’t raise taxes because it doesn’t take into account behavioural changes. But, it will establish a bad precedent on the tax of unrealised capital gains. And so when someone comes along and says ‘oh what about other parts of the economy, let’s tax unrealised gains there’ … it would establish a very bad precedent that people down the track would like to use.”

Originally published as Chalmers’ budget stimulatory ‘on any measure’, Peter Costello says