Australian wine exports have rebounded after the end of China tariffs

The removal of Chinese tariffs has helped Australian wine exports rebound to a three-year-high, however the China market has shrunk in size and won’t be the massive buyer of our wine that it once was.

The recent removal of crippling tariffs on Australian wine by the Chinese government has helped drive Australian wine exports to a three-year-high, but a cooling Chinese economy and a cautious consumer means the once thriving billion dollar Chinese market that scooped up Australian wine has shrunk considerably.

It is estimated that the Chinese wine market has slimmed down by more than half which has pinched exports for not just Australia but also other prominent wine producing nations led by France, Spain, Chile and New Zealand.

The absence of Australian wine in China for four years, blocked by punishing tariffs, had also encouraged wholesalers and retailers to now stock up on Australian wine with higher sales to China not necessarily yet finding its way into drinkers glasses.

Elsewhere, challenging trading conditions across other key Australian wine export markets such as Europe, Britain and North America has seen a pullback in wine consumption as cost of living pressures as well as shipping shortages and rising freight costs denting wine sales.

On Tuesday, Wine Australia released its latest export report for fiscal 2024 which showed wine exports increased in value by 17 per cent to $2.2bn, the highest level since the 12 months ended September 2021. Volume remained relatively steady at 619 million litres, according to Wine Australia’s export report.

The growth in value was due to a surge in exports to mainland China in the last three months of the financial year, as Australian wine restocked supply pipelines following the removal of the duties on Australian bottled wine in late March 2024.

“While the figures are very positive, they represent the re – stocking of Australian wine in the pipeline of a major market after a long absence and do not necessarily equate to retail sales. It will take some time before there is a clearer picture of how Chinese consumers are responding to the increased availability of Australian wine in-market,” said Wine Australia manager, market insights, Peter Bailey.

He said that the rise in exports to mainland China is still a small fraction of the historical peaks achieved to the market.

“The surge in exports to mainland China towards the end of the financial year saw volume rise from 1 million litres to 33 million litres and value grow by $392m to $400m compared to last financial year,” he said.

The once $1.3bn Chinese market was unlikely to return to its former full strength in the near term as a slowing Chinese economy and hamstrung consumer generates lower wine sales.

“Consumption of both domestic and imported wines in mainland China is less than a third of what it was six years ago, and thus it is very unlikely that Australian wine exports will return to those previous peaks in the short to medium term.”

“Global trading conditions remain very challenging, with wine consumption continuing to fall in many markets around the world due to moderation trends and cost of living pressures. There are also enduring problems in shipping, with a shortage of ships globally and freight and charter rates on the rise,” Mr Bailey said.

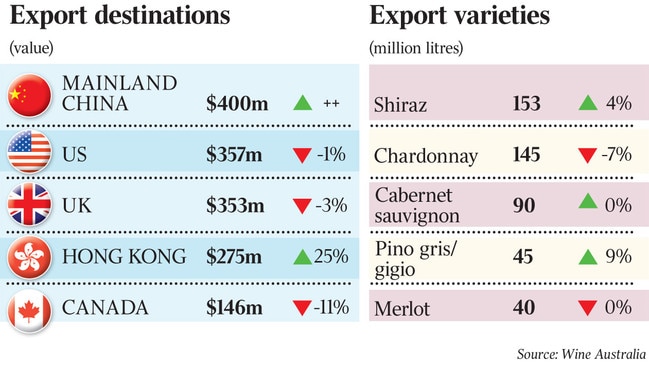

Among varieties exported from Australia, red wine was the main beneficiary of the growth in exports to mainland China, with total volume of red wine up 3 per cent to 330 million litres and value up 27 per cent to $1.5bn compared to fiscal 2023. For white wine, chardonnay remained the number one variety and while volumes declined by 6 per cent to 158 million litres, value was up marginally to $307m.

Among the top export destinations by value in fiscal 2024, sales to mainland China were up $392m to $400m, US sales were down $2m to $357m and UK sales were down $11m to $353m.

More Coverage

Originally published as Australian wine exports have rebounded after the end of China tariffs