ASX Trader: Platinum has broken the $1000USD barrier - but this data suggests it’s not done yet

Platinum has broken out, jumping over 10 per cent and trading around $1080USD. That key resistance at $1000? Smashed. Here’s what could happen next.

Just one week ago, I wrote about platinum as “the overlooked metal that may be the next major bull market.”

At the time, it was coiling just below the psychologically significant $1000USD level, forming a base while gold stole the spotlight.

Fast forward to today platinum has broken out, jumping over 10 per cent and currently trading around $1080USD. That key resistance at $1000? Smashed.

If you missed last week’s article, read it here.

Why this move is important

1. Technical breakout confirmed

The breakout above $1000USD wasn’t just psychological, it was structural. Platinum had been range-bound below that level for over a year. Now that it’s cleared with strength and volume, this may mark the beginning of a new bullish cycle.

The next key level to watch: $1300USD. A monthly close above that would confirm a long-term breakout, potentially opening the path toward $3000USD-plus over the next few years.

2. Platinum still looks cheap compared to gold

Despite the recent move, platinum remains heavily discounted relative to gold:

• Gold: ~$3250 USD

• Platinum: ~$1080 USD

• Gold-to-platinum ratio: ~3.0

Historically, this ratio has averaged closer to 1.0. Today’s reading makes platinum one of the most undervalued assets in the precious metals space.

3. The fundamentals remain bullish

• Tight supply: South African mines, which produce the majority of global platinum, are struggling with electricity shortages and production delays.

• Growing demand: Platinum is increasingly used in hydrogen fuel cells and clean energy technologies.

• Lack of new supply: Few new projects are entering the pipeline, making any increase in demand likely to push prices higher.

A closer look: Understanding the chart setup

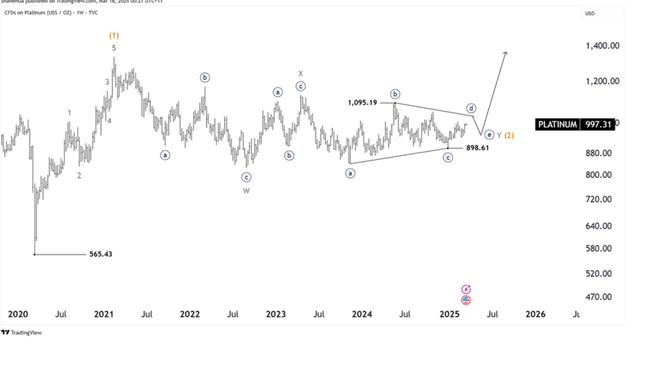

Back on March 18, the team at Mastering the Markets conducted a detailed Elliott Wave analysis, identifying a powerful setup that has since begun to unfold. That forecast is exactly why we’ve kept platinum on our radar for the past two months.

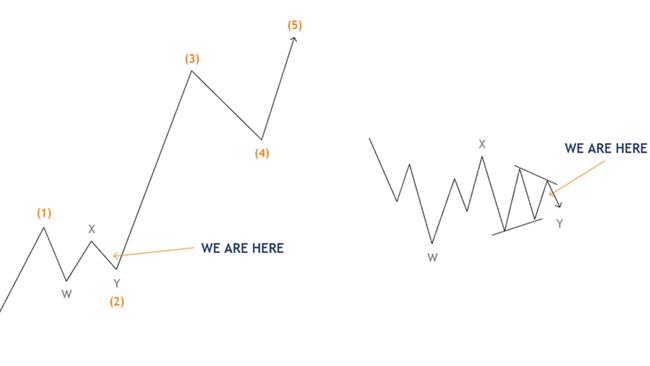

Here’s what the analysis revealed in beginner-friendly terms:

Where are we now?

Platinum has broken out and is currently trading around $1080USD. According to the original chart structure, this is likely the end of a short-term consolidation phase, known as Wave Two.

The next phase, Wave Three, typically brings strong upward momentum.

The pattern in simple terms

• The most recent pattern resembles a triangle, a structure that often appears just before a strong breakout.

• A close above $1300 USD would confirm the next major leg, Wave Three, has begun and that upward momentum is now firmly in control.

This Elliott Wave forecast was issued March 18, 2025, by Mastering the Markets

What’s next for investors?

If you entered the market last week then well done. If not, here’s how you can still get exposure via the Australian Securities Exchange (ASX):

ETPMPT (ASX)

This physically backed ETF has just broken out of a four-year accumulation base. If it holds above that breakout level in the coming days, it may mark the start of a sustained rally. For beginner investors, ETPMPT offers a simple and direct way to gain exposure to platinum prices.

Platinum stocks to watch (YTD performance since last week’s article):

•Zimplats (ZIM) – +20 per cent

•Platinum Group Metals (POD) – +73 per cent

•Chalice Mining (CHN) – -4 per cent

These stocks offer leveraged exposure to the platinum sector. ZIM is a well-established producer, while POD and CHN are more speculative, suited to investors with higher risk tolerance.

Reminder: Always conduct your own due diligence and invest according to your risk profile and time horizon.

From whispers to headlines

Smart money doesn’t wait for media buzz; it moves when things are quiet.

Back in March, platinum was whispering through subtle chart patterns. Now, it’s making headlines.

With a breakout confirmed and momentum building, the question for investors isn’t if platinum will rise, it’s how high. All eyes are now on the next big level: $1300USD. Break that, and this quiet metal could roar into one of the strongest commodity trades of the decade.

Originally published as ASX Trader: Platinum has broken the $1000USD barrier - but this data suggests it’s not done yet