ASX Trader: Hidden bear market: Are your real estate gains just a mirage?

That tripling of your home value? Rather than genuine wealth creation, it may be the silent influence of a hidden bear market eroding your money’s purchasing power, writes ASX Trader.

Many homeowners believe their property has made them wealthier because its value has increased over time.

But the reality may be more complicated than it seems.

The rise in real estate prices, especially since the GFC is often driven by inflation, rather than a true increase in property value.

The illusion of rising home prices

Since the 2008 Global Financial Crisis (GFC), governments around the world have printed trillions of dollars to stimulate their economies.

This massive influx of money has led to more dollars chasing the same number of assets, like real estate, which makes it appear as though home prices have soared.

However, when adjusted for inflation, many properties haven’t really increased in real terms.

While home prices seem to be rising, the true story is that the value of the dollar has been steadily declining.

This means the “wealth” from your home might not be as significant as it seems.

Everyday goods and the real impact of inflation

I make a shake every morning for our family, and one of the key ingredients is a bag of frozen berries.

In 2020, I was paying $3 per bag.

Today, in 2025, that same bag costs $6.50 - more than double the price in just five years.

At the same time, a Cadbury Dairy Milk chocolate bar that cost $1.25 in 2020 now sells for $2.50.

These aren’t luxury goods, they’re everyday grocery items.

While the price of my house has risen by 70 per cent during this period, the purchasing power of my dollar hasn’t kept up.

My home may be worth more on paper, but the money I earn buys less of the things we use every day.

This is a clear example of how inflation, especially in food and essentials, erodes real-world affordability, even when asset values are rising.

It’s not just about higher prices; it’s about how inflation quietly reshapes daily life, budgets, and consumption habits.

A century of perspective: Buying a car in 1925 vs 2025

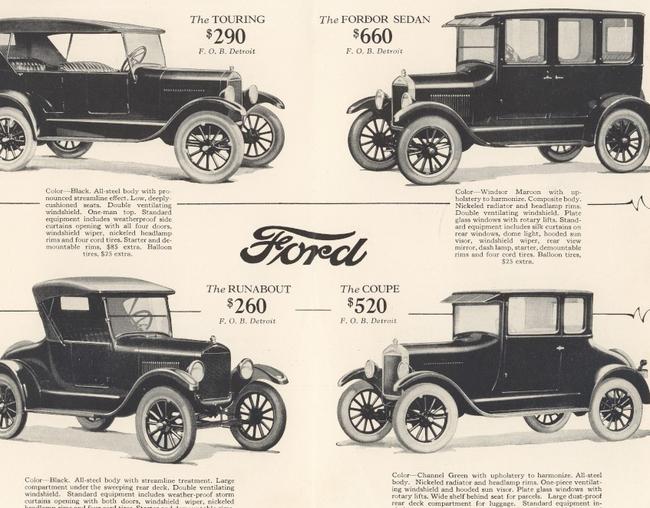

Let’s explore how the relationship between gold and the price of a car has changed or rather, stayed surprisingly consistent over the past 100 years.

Average car price in 1925

In 1925, the average price of a new car was around $260.

At the time, gold was fixed at $20.67 per ounce under the gold standard.

This means that with $260, you could purchase approximately:

260 / 20.67 ≈ 12.58 ounces of gold

What that gold is worth in 2025

Fast forward to 2025, and the price of gold is around $3,300 per ounce.

If you had kept those 12.58 ounces of gold from 1925, they would now be worth:

12.58 × 3300 = $41,514

That’s enough to buy a brand-new mid-to-high-end car today, showing the staying power of gold.

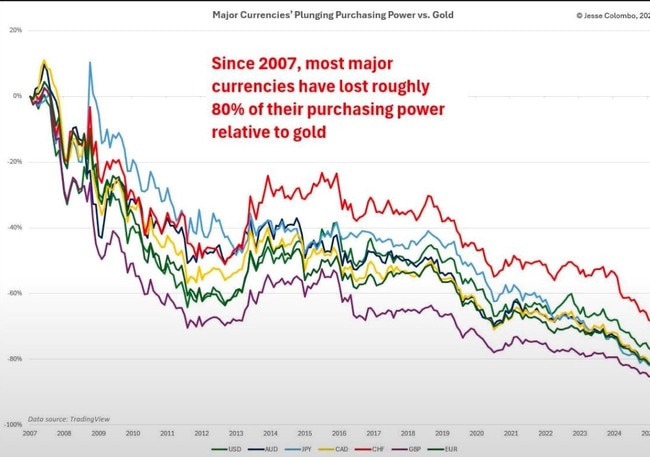

Gold vs. the Dollar

While $260 in 1925 could buy you a car, that same amount today won’t even buy a car tire. But if you had exchanged that money for gold, your purchasing power would be almost 160 times higher today.

Key takeaway

A car cost 12.58 ounces of gold in 1925, and that same amount of gold can still buy a car in 2025.

Over a century, the dollar lost value, but gold did not - proving its role as a long-term store of wealth.

This comparison illustrates that gold has held its value much better than the dollar over time. The price of a car in terms of gold has remained relatively stable, while the dollar has weakened.

This highlights how inflation impacts purchasing power over the long term.

Gold: A long-standing store of wealth

Gold has been a store of wealth for thousands of years.

Its value has remained relatively stable throughout history, making it one of the most reliable measures of real wealth.

Unlike fiat currencies (like the dollar), which can lose value due to inflation or poor management, gold has maintained its purchasing power for centuries.

Civilizations have used gold to preserve wealth and to back their currencies.

From the ancient Egyptians to the Romans, and even up to the modern era, gold has consistently been viewed as a safe haven in times of economic uncertainty.

It’s not just a commodity; it has cultural and historical significance as a symbol of stability and value.

While the value of money, whether in the form of a dollar, a pound, or any other currency can fluctuate, gold tends to hold its purchasing power over time.

This makes it an excellent way to protect wealth from inflation, unlike assets tied to the currency, like real estate, which can seem to increase in value simply because the currency is weakening.

Gold-to-Real-Estate ratio in Australia (2007–2024)

The gold-to-real-estate ratio compares the amount of gold (in grams or kilograms) required to purchase a median-priced home.

This ratio fluctuates annually based on changes in gold prices and real estate values.

Below is an overview of this ratio over the past two decades:

Observations

Declining Ratio: Over the past two decades, the gold-to-real-estate ratio has decreased, indicating that fewer grams of gold are needed to purchase a median-priced home.

This trend suggests that gold has outpaced the growth in real estate prices.

Price Increases: Both gold and real estate prices have risen over the years, but gold’s appreciation has been more pronounced, leading to a lower ratio.

Investment Implications: Investors may interpret this trend as an indication that gold has been a more lucrative investment compared to real estate during this period.

When you price homes in gold, not dollars, the picture changes dramatically.

Over the past 15 years, many real estate markets appear to be flat or even down.

That “tripling” of property value in your neighbourhood? It might just be the result of inflation’s silent influence, rather than genuine wealth creation.

This is the hidden bear market, a bear market not in stocks, but in the purchasing power of your money.

It’s not about the assets going down, it’s about the dollars losing value, and with them, the illusion of rising prices.

In essence, real estate “gains” are often little more than a mirage, masking the erosion of your money’s purchasing power.

True wealth isn’t measured by inflated asset prices; it’s about maintaining the value of your money over time.

If the value of your home triples, but the cost of living and the price of tangible assets like gold triples too, did you actually get richer?

The answer might not be as clear-cut as you think.

Many people are beginning to notice this disconnect.

They feel stuck, unsure if their supposed real estate wealth is genuine or just a byproduct of inflation.

If you’re feeling like your net worth isn’t growing despite your home’s rising value, you’re not crazy.

You’re simply seeing what many people miss: the hidden bear market that nobody talks about.

It’s time to look beyond the headlines and examine the true picture.

Real wealth is not about paper profits or inflated numbers.

It’s about your ability to hold onto purchasing power in an ever-devaluing economy.

And that, unfortunately, is a reality that most people are only just beginning to understand.

Originally published as ASX Trader: Hidden bear market: Are your real estate gains just a mirage?