ASX fails to articulate plan to lift IPO market, as volumes slump to 12 year lows

The ASX doesn’t appear to have a concrete plan to bolster the dwindling pipeline for initial public offerings in Australia, as listings sink to their lowest level since 2012.

The ASX doesn’t appear to have a concrete plan to bolster the dwindling pipeline for initial public offerings in Australia, as listings slump to their lowest year-to-date level since 2012.

Outgoing ASX chairman Damian Roche and chief executive Helen Lofthouse were peppered with several questions on the topic at an annual general meeting on Monday. They were asked about the lack of listings on the Australian bourse given robust levels of mergers and acquisitions continue to see large companies disappear from public markets.

Over the past five years names including Boral, Sydney Airport and Blackmores have been acquired while in 2024 companies in the crosshairs of deal activity include Platinum Asset Management and Pacific Smiles.

While the weak listing environment is closely correlated to a tougher macroeconomic environment and the growth in private capital, the ASX needs a longer-term plan to address this issue and ensure Australia is an attractive IPO destination.

Better engagement with industry and a streamlining of IPO processes may help, but Roche and Lofthouse didn’t nail their answers on Monday.

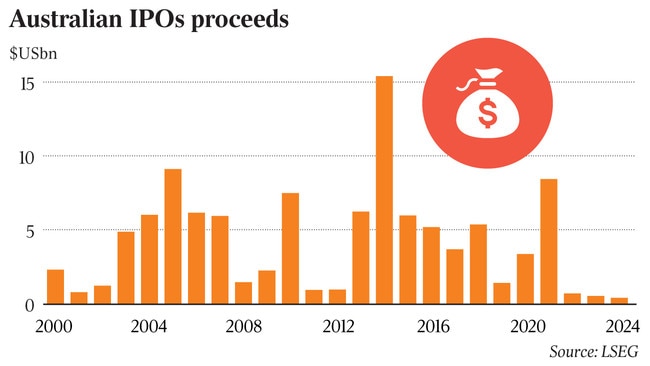

So far in 2024 IPOs on the ASX have totalled just $US383.4m ($581m), a 15 per cent decline versus the same time last year and the lowest year-to-date volume since 2012 when markets were still recovering from the global financial crisis. London Stock Exchange Group data shows just 14 Australian IPOs in 2024, down from 21 at the same time last year.

The numbers don’t, however, include the upcoming ASX listing of payments group Cuscal which analysts at Bank of America estimate is worth between $527m and $656m. After shelving an IPO attempt last year, Cuscal has this time round locked in cornerstone investors and priced its transaction at a $479.1m market value, with shares to be sold at $2.50 apiece and the company raising $336.8m.

Mexican food chain Guzman y Gomez’s sharemarket float injected some confidence into the IPO market in June, following a strong debut, but deal volumes remain soft leading into the year’s end. In response to a question on the state of the IPO market, Roche told ASX investors: “We believe that the current IPO (market) we’re in (is at) a cyclical low. But what I really want to discuss is the really important role the public markets play. They provide liquidity, they provide transparency.”

Lofthouse told the company’s AGM while local IPO activity “remained muted” the bourse was seeing some green shoots.

“More normalised macroeconomic conditions appear to be supportive of an increase in listings activity, although ongoing geopolitical instability could further impact sentiment,” she said.

“It’s important to note that there is a lag between these more favourable conditions and IPOs taking place, while issuers work through the process to fulfil their listing obligations.”

But one industry participant, who declined to be named, said he didn’t believe there were “any real tangible developments” from the ASX on reviving the IPO market or making the listing process easier. “Certainly … the ASX are trying to engage more with industry in a marketing sense,” he said.

“Interestingly we’re seeing a lot more inquires about reverse takeovers which I assume, in part, is about positivity around Chemist Warehouse/Sigma and a perception that a reverse takeover is easier than an IPO.”

Barrenjoey co-executive chair Guy Fowler has urged a simpler process for listing on the ASX and earlier this year suggested the corporate regulator could look to offer companies a “honeymoon period” as they became publicly traded, particularly around prospectus forecasts. Law firm Ashurst has called for the listing process to be shortened, where possible.

Asked by investment columnist and shareholder Stephen Mayne how the ASX was dealing with 20-straight monthly declines in the number of listed entities, Roche didn’t really provide a relevant answer.

“Much like the IPO market, the M&A (mergers and acquisitions) market is also cyclical. But you know, what I really want to focus on is the critical role of public markets, the roles they play in liquidity, transparency and price discovery, and I believe that will continue to be the case,” he said.

Lofthouse said the ASX had conducted some analysis to evaluate the low listing levels of the ASX, but linked some of the softness to an uncertain interest rate environment.

Total equity capital market volumes in 2024 have been buoyed by secondary raisings as companies shore up their balance sheets or fund acquisitions. Total equity capital raised in Australia stands at $US14.1bn this year, up from $US13.03bn at the same time in 2023.

More Coverage

Originally published as ASX fails to articulate plan to lift IPO market, as volumes slump to 12 year lows