AMP launches mobile-first banking app to ease pressures for small businesses

With an app designed for small business owners and side hustlers, AMP aims to ease financial admin and enhance security for Australia’s overlooked entrepreneurs.

Financial services group AMP will launch its new mobile-first bank on Monday, targeting small and micro business owners – segments it says are overlooked by major banks.

AMP said the new app-only digital bank was designed for small business owners – including micro businesses, ‘solopreneurs’ and side-hustlers.

It will feature Australia’s first numberless debit cards, enhanced fraud protection and accounting capabilities.

AMP Bank group executive Sean O’Malley said the new bank had been built specifically to address the pain points of micro and small business owners, who were often juggling multiple tasks and overwhelmed by administrative tasks. “We don’t think banks in Australia have done a good job of recognising that and doing enough, particularly for that small end of small business, those micro or mini businesses and the side hustler,” he said. “The proposition we’re delivering just makes it easy in lots of different ways. It’s banking on the go, housed within a mobile app and not done at your desk. It’s just one app that can manage a business and personal banking at the same time, without having to juggle between both.”

The new AMP Bank app will include other new security features, such as advanced fraud and scam protection systems and multimodal biometric authentication. Customers will be urged to use face ID and fingerprint ID to enter the app and be prompted to record a video selfie when they sign up, to help prevent identity theft.

AMP said its research showed that close to 90 per cent – or 2.4 million – of Australian businesses are either self-employed or employ up to four people, while the majority of businesses in Australia have turnover of less than $200,000 annually.

Mr O’Malley said that business banking solutions in Australia typically focused on the needs of larger businesses, leaving small business owners with a banking experience that didn’t suit their needs – adding to, rather than easing, their administrative burden.

“As technology advances it allows for greater ability to serve newer markets that have been underserved with ease,” he said.

“When other banks talk about small business, it is really what is a medium-size business on the corporate end. We think this exploits a gap and an opportunity to go after actual small businesses that are underserved, and feedback we have is that many don’t think existing options are enough.” AMP’s new banking product will enable the bank, which has $23bn in loans and $21bn in deposits, to expand its services by targeting business owners with fewer than 20 employees, where the finances of the founder/owners are linked with their personal business.

It will be underpinned by the “software as a service” or SaaS banking platform of London-based neobank Starling, which has been successful in building a digital-only bank in that country.

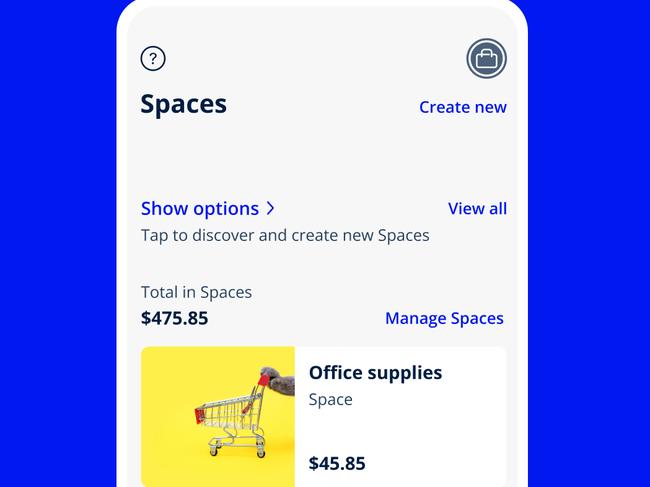

The new mobile app is designed to integrate with small business management software to make accounting, cashflow management and tax time easy.

A range of new partnerships, features, and functionality will be announced over coming months.

Mr O’Malley said there would soon be the ability to accept multiple kinds of payments, along with management software. Almost all offerings will be housed within the app, but some features such as its accounting partnership Xero would also work on the provider’s platform.

“It will purely be an app. We did a lot of work, and we’ve found that people bank on their mobile and not at a computer. There won’t be a web version of the app as small business owners are rarely at a computer.”

Mastercard has rolled out numberless credit and debit cards in other countries in Europe and North America, but AMP will be the first bank in Australia to offer the next generation product locally. Mastercard told The Australian last month that it hoped to phase out numbered cards in Australia by 2030.

Customer support will include both domestic and overseas operations. The call centre will be based in Australia with some support overseas for overnight hours.

While the product is primarily aimed at businesses, it is expected to attract individual customers as well who are after features such as savings buckets.

Originally published as AMP launches mobile-first banking app to ease pressures for small businesses