Australia’s top 50 ASX-listed agribusinesses

Australia’s top 50 ASX-listed agribusinesses are a mix of the old, the new and the emerging. In this investor special, AgJournal ranks them by market capitalisation.

TWO decades ago, investors could probably count only a dozen agriculture-related companies listed on the Australian Securities Exchange. Now, there are more than 50, with the number rising each year.

AgJournal has ranked 50 ASX-listed agribusiness companies by their market capitalisation. Companies directly involved in agriculture, producing agricultural commodities or providing services to farmers have been included in the rankings. Macquarie Group is not included, as while the investor has significant agricultural holdings, they are a miniscule proportion of its total global assets and the company’s market capitalisation would distort the rankings.

The rankings show that New Zealand infant formula and fresh milk processor, The a2 Milk Company, is the largest agribusiness listed on the ASX. The company, which specialises in dairy products containing the A2 milk protein, is valued at about $11 billion, streets ahead of its nearest rival, Treasury Wine Estates, maker of Penfolds Grange wines, at about $7.8 billion.

The collective net worth of the top 50 ASX-listed agricultural companies is $39.8 billion. Early last month, prior to the coronavirus-inspired market plunge, it was $43 billion. Some of those listed are quiet achievers. Clover Corporation Limited, based in the Melbourne suburb of Altona North, has built up a company valued at $450 million that supplies healthy omega 3 fatty acid additives for fortifying infant formulas and beverages. It exports to Europe, China, the US and southeast Asia.

Others have inexplicably burst on to the scene. One of the ASX’s newest listings, goat milk infant formula manufacturer Nuchev, is ranked at No. 23, well above its financial credentials. It has no significant income and its average loss over the past three years is about $10 million a year. It ranks well above its weight due to an extremely high initial public offer price of $2.60, bumped up by sharemarket hype to $3.80 a share in the days after listing in December.

By comparison, most infant formula manufacturers – The a2 Milk Company, Bubs Australia, Australian Dairy Nutritionals Group and Wattle Health Australia – began trading at 8c-50c a share when they listed.

Shareholdings in the top listed companies are dominated by institutional investors such as HSBC, J.P. Morgan, Citicorp Nominees, National Nominees and BNP Paribas.

Agribusiness Australia president Mark Allison says investors are increasingly backing companies that address sustainability issues, so agricultural companies should be “swimming with the tide” on societal expectations. Allison says it is no coincidence the world’s biggest investment fund, BlackRock, announced a month ago it would not invest in companies with a poor sustainability agenda.

Not all the big Australian agricultural operations are ASX-listed. These include the West Australian co-operative grain bulk handler and marketer CBH Group, Gina Rinehart’s privately held Hancock Prospecting and the portfolios managed by gofarm Australia and AAM Investment Group.

Whether large or small, the overwhelming motivation by agribusinesses for listing on the ASX is access to capital to expand operations. Six agribusinesses listed on the ASX last year. They include sulphate of potash miner Trigg Mining, industrial hemp grower Ecofibre and soil biotech company Terragen.

Yet ASX listing can leave a company vulnerable to take over, particularly by hungry foreign conglomerates. AWB Limited listed on the ASX in 2001 but was taken over by Canadian fertiliser company Agrium nine years later. Similarly, ABB Grain Ltd listed in 2002 but was bought out by Canadian grain company Viterra in 2009. Canadian fertiliser giant Nutrien recently bought out Ruralco, resulting in its delisting. And last month one of Australia’s oldest companies, pastoral house Webster Limited, whose origins date to 1831, delisted after being taken over by Canadian pension fund PSP Investments.

Chinese companies are increasingly active in the takeover space, with Mengniu Dairy Company last year taking over infant formula manufacturer Bellamy’s Organic.

Other ASX-listed infant formula manufacturers are expected to be swallowed up by Chinese dairy companies, given the Chinese Government is stalling on granting permits to Australian companies wanting to sell their products through bricks-and-mortar outlets in China.

Ironically, a number of Chinese companies that listed on the ASX have now been suspended. These include Bojun Agricultural Holdings, Dongfang Modern Agriculture Holding Group, Jiajiafu Modern Agriculture and Tianmei Beverage Group. The ASX is known to be concerned about governance standards in some Chinese companies.

Mark Allison, who is also Elders’ managing director, says the historical wisdom was that ASX listings did not work best for agricultural companies.

“That’s because of the short performance timelines expected in listed capitals and the expectation in listed companies that they will have consistent growth,” Allison says.

Historically, he says, agricultural companies were close to the farm gate. But now, the bigger ones are “consumer-facing agricultural companies” such as The a2 Milk Company and Treasury Wine Estates.

“The closer you are to the farm gate, the more variable is the profitability and the less conducive to public listing because that is not what the market wants,” Allison says. “In order to offset that, there are two extreme options.

“One is where you have a single-product focus, such as wine or milk. You become a specialist aiming to be the best in class globally.”

At the other end of the scale are companies such as Elders.

Allison says Elders adopted a cost and structure base where it makes “good money in bad years and great money in good years”. “If a company is close to the farm gate, the way to achieve consistent return on capital and profit growth is to be significantly diversified through multi vectors and have the appropriate cost and capital base.”

AUSTRALIA’S TOP 50 ASX-LISTED AGRIBUSINESSES

* Dollar figures in millions

1. THE A2 MILK COMPANY

Dairy processing

ASX CODE: A2M

MARKET CAPITALISATION: $11,093.40

NET REVENUE IN 2019: $1,256.74

NET PROFIT (LOSS) IN 2019: $277.02

THE a2 Milk Company is the darling of the ag investment world.

Just 20 years old, a2 Milk is now the biggest dairy company – and agribusiness – in Australia and New Zealand by a long shot, based on market capitalisation.

With a value of $11 billion, the New Zealand company is almost twice the size of its rival Fonterra, thanks largely to a burgeoning share price. Putting that further into perspective, a2 Milk has 12 times the market capitalisation of Australia’s largest listed dairy company, Bega Cheese. That is despite Bega Cheese’s sales revenue in 2018-19 of $1.43 billion exceeding that of a2 Milk’s $1.26 billion.

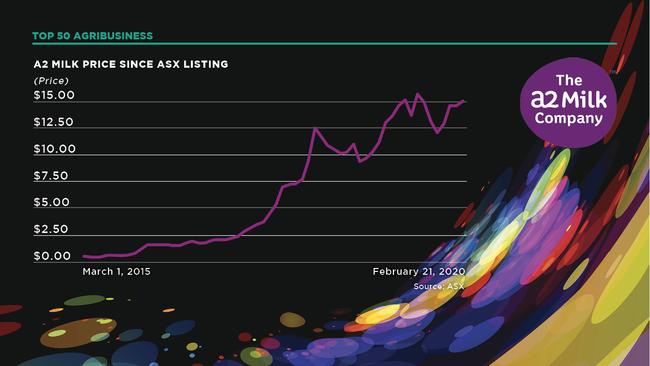

When a2 Milk listed on the Australian Securities Exchange in 2015, the shares were trading at about 50c each. In 2019 they topped $17.30 apiece – about 30 times their initial value.

Investment analysts believe the sky is the limit for a2 Milk, with the share price yet to reach its full potential. It has even held up during the coronavirus scare.

The company’s success centres on specific proteins in milk. Conventional milk contains both the A1 and A2 beta-casein proteins. But the A1 protein can cause gastrointestinal problems for some people, while the A2 version does not upset stomachs. Over time, the A1 overshadowed the A2 gene, but by selecting cows with A2-A2 genetics, milk with the A1 protein can be eliminated.

The company has built its business by supplying fresh milk, powdered milk and infant formula solely with A2 protein to global markets. China has become an important export market, with the company launching its a2 Platinum infant formula there in 2013.

In more recent years, a2 Milk has launched liquid milk products in the US. Australia and New Zealand continue to be the company’s biggest markets, accounting for about two thirds of sales.

From 2012 to 2015, a2 Milk’s revenue rose from $60 million to $150 million, but it was barely making a profit. From about the time it listed on the ASX, revenue jumped from $NZ352.8 million in 2015-16, to $NZ1304.5 million last financial year.

Concurrently, net profit after tax jumped from $NZ30.4 million in 2015-16, to $NZ287.7 million. The company is expected to continue strong growth in China and other Asian markets, as well as the US.

2. TREASURY WINE ESTATES

Wine production

ASX CODE: TWE

MARKET CAPITALISATION: $7,807.81

NET REVENUE IN 2019: $2,883.00

NET PROFIT (LOSS) in 2019: $419.50

WITH a wine portfolio that includes the legendary Penfolds Grange, you would expect Treasury Wine Estates to be enjoying the good life.

The winemaker recorded revenue of $2.88 billion in 2018-19 and net profit after tax of $419.5 million.

Treasury Wine Estates is one of the world’s largest listed wine companies.

It would have topped AgJournal’s list of top agribusinesses in terms of market capitalisation but for a huge plunge in its share price during the Australia Day week.

Over two days alone, its share price took a 30 per cent dive, wiping $3.85 billion off its market capitalisation.

It came after TWE downgraded its profit forecast for 2019-20 following concerns about cheap wines flooding one of its key markets, the US, plus fears the coronavirus would hit high-end sales of wine into China. Shareholder class action over the share-price plunge has been mooted.

The winemaker boasts eight wineries in Australia, seven in the US and one each in New Zealand and Italy, with 13,000 hectares of grapevines planted globally.

As well as Penfolds, its brands include Seppelt, Wolf Blass, Lindeman’s, Jamiesons Run and Beringer, the latter from the oldest continuously operating winery in California’s Napa Valley, in the US.

TWE sells into more than 100 countries.

The company’s two biggest shareholders, HSBC Custody Nominees (Australia) and J.P. Morgan Nominees Australia, collectively hold about 64 per cent of shares for their investors.

3. INCITEC PIVOT LIMITED

Fertiliser production

ASX CODE: IPL

MARKET CAPITALISATION: $4,678.98

NET REVENUE IN 2019: $3,918.20

NET PROFIT (LOSS) IN 2019: $152.10

INCITEC Pivot has developed from being a fertiliser manufacturer to an explosives manufacturer over the course of a century.

It began more than 100 years ago as the Phosphate Co-operative Company, which many farmers held shares in to take advantage of its rebate system for fertiliser purchases. The fertiliser manufacturer later became known as Pivot.

In 2003, it merged with Incitec Fertilisers, an offshoot of chemical manufacturer Orica. That same year, it listed on the ASX. Five years later, IPL bought explosives producer Dyno Nobel, which had links to Alfred Nobel, inventor of dynamite and creator of the Nobel Prize. Explosives manufacturing has since become a mainstay of the business.

IPL’s fertiliser fortunes fluctuate with Australian climatic conditions. Drought resulted in an $80 million loss for the fertiliser division in 2018-19.

IPL is currently conducting a review of the fertiliser business, looking at whether it should be sold off, hived off into a separate company or retained with further investment to boost its performance.

IPL’s biggest shareholders are institutional conglomerates HSBC Custody Nominees (Australia) and J.P. Morgan Nominees Australia, which combined hold 63 per cent of the company’s shares on behalf of their investors.

4. NUFARM

Agricultural chemical production

ASX CODE: NUF

MARKET CAPITALISATION: $2,031.37

NET REVENUE IN 2019: $3,757.59

NET PROFIT (LOSS) IN 2019: $38.31

NUFARM has been a very successful player in the global farm chemical market over many years.

In recent years, it has built its revenue and global spread by buying discarded chemical portfolios forced on to the market by regulators worldwide as the top crop protection players amalgamate.

Nufarm is now ranked the No. 7 crop protection company in the world by turnover.

It is a long way from its humble beginnings as the Fernz Corporation in New Zealand in 1995. In 2000, the company relocated to Australia – where most of its sales were – and changed its name to Nufarm. At the time, Australia accounted for 80 per cent of its sales.

But subsequent expansion into North America, Latin America and Europe, mostly under the longstanding stewardship of former managing director Doug Rathbone, has resulted in those regions accounting for more than three quarters of Nufarm’s gross profit and Australia-New Zealand less than 10 per cent by last year.

Last September, the company announced it would sell its poor-performing Latin American operations to Japanese trading giant Sumitomo.

The deal, yet to be concluded, would allow Nufarm to concentrate on higher-margin regions such as Europe and North America.

Those regions generate a significant proportion of the group’s profit – 72 per cent – but the more compelling arguments are the elimination of foreign exchange volatility with Latin America and a substantial reduction in the company’s financing costs.

Sumitomo holds a 15.88 per cent stake in the company.

5. GRAINCORP

Grain bulk handling and malt production

ASX CODE: GNC

MARKET CAPITALISATION: $1,872.04

NET REVENUE IN 2019: $4,780.00

NET PROFIT (LOSS) IN 2019: ($113.00)

GRAINCORP began life as the state-owned NSW grain bulk handler, Government Grain Elevator, in 1917.

With a name change to GrainCorp, it was listed on the ASX in 1998. After a merger with Victorian bulk handler Vicgrain and takeover of Queensland bulk handler Grainco, it became the predominant east coast grain handling operation.

The fortunes of grain bulk handlers such as GrainCorp are tied heavily to droughts. An expansion into grain trading helped GrainCorp overcome this dilemma, but it was the move to buy global malting operations in 2009 that was the key to reducing its risk.

That was followed in 2012 with development of a vegetable oils business through the purchase of the Gardner Smith Group and Goodman Fielder’s edible oils operations.

GrainCorp has become the fourth largest maltster in the world, with malting plants in Canada, the US and the UK, as well as Australia. The malting division has consistently accounted for about a third of the company’s earnings for much of the past decade.

In 2018, amid an unsolicited – and unsuccessful – takeover bid, the company reviewed its operations.

Its diversification strategy of a decade ago was turned on its head. The company integrated its oils operation into the grains division, sold off its Bulk Liquid Terminals division and a proposal to demerge its malting business into a separate company goes before shareholders this month. It’s back to the future for GrainCorp.

6. ELDERS

Real estate, farm merchandise, livestock, grain, finance services

ASX CODE: ELD

MARKET CAPITALISATION: $1,265.62

NET REVENUE IN 2019: $1,667.35

NET PROFIT (LOSS) IN 2019: $70.70

ELDERS has worked its way back to being a pure-play agricultural services provider after the wheels fell off about 10 years ago.

Like many agricultural companies reliant on the fortunes of farmers, its profitability is a function of climate – drought in particular.

In 2018-19, Elders recorded a net profit after tax of $70.7 million.

In the 1980s and ’90s, Elders morphed from its historical base as a rural services provider to brewing and other industries. It ended up being bought by Futuris Corporation in 1995. Futuris’ businesses included forestry and automotive, plus a 43 per cent stake in Australian Agricultural Company. The company changed its name back to Elders in 2009 but, crumbling under a $1.4 billion debt, its share price plummeted.

Mark Allison joined the board as a director in 2009 and became chairman in 2013. When managing director Malcolm Jackman resigned later that year, Allison oversaw the search for a replacement. But the board soon realised Allison was the best person for the job and appointed him chief executive officer and managing director in 2014.

The company has not looked back since. From a low of about 62c in 2013, the share price has risen above $8 as Allison introduced an eight-point plan to bring the company back into profitability.

HSBC Custody Nominees (Australia) is the largest shareholder, with 32.1 per cent of the scrip. J.P. Morgan Nominees Australia is its second biggest shareholder, with 13.2 per cent, followed by Citicorp Nominees with 9.8 per cent. Elders celebrated 180 years of servicing the agricultural community in 2019.

7. FREEDOM FOODS GROUP

Dairy, cereal, snack food manufacturing

ASX CODE: FNP

MARKET CAPITALISATION: $1,233.24

NET REVENUE IN 2019: $479.36

NET PROFIT (LOSS) IN 2019: $11.58

FREEDOM Foods has built a healthy business manufacturing dairy, cereal and snack foods, along with plant-based beverages, specialty seafood and nutritional consumer foods.

It sells its food products in Australia, China, Southeast Asia, the US and the Middle East.

Its brands include Freedom Foods, Freedom Nutritionals, MilkLab, Messy Monkeys snack foods for kids, Heritage Mill, Vital Strength and Australia’s Own.

Freedom Foods has a 10 per cent stake in Australian Fresh Milk Holdings, which completed the purchase of Gerry Harvey’s failed Coomboona dairy farm in Victoria early last year. AFMH also has another large dairy operation at Torrumbarry on the Murray River.

Freedom Foods sources 400 million litres of milk from AFMH and other dairy farmers.

The company has factories at Shepparton in Victoria and Ingleburn in NSW.

It expanded its UHT milk plant at Shepparton in the past year to produce milk proteins, lactoferrin, micellar casein and whey protein isolate for sale to sports nutrition companies and inclusion in its own sports products.

Freedom Foods is controlled by the Perich family, of Bringelly, on the western outskirts of Sydney, through their company Arrovest Pty Ltd, which holds a 52.45 per cent stake in the food manufacturer. Brothers Anthony and Ron Perich are two of the four non-executive directors on the board. The Perich family is a joint partner in AFMH with the Moxey family. Freedom Foods’ total revenue was $479.4 million last year. Sales have grown exponentially during the past four years.

8. INGHAMS GROUP

Chicken grower and processing

ASX CODE: ING

MARKET CAPITALISATION: $1,225.52

NET REVENUE IN 2019: $2,539.70

NET PROFIT (LOSS) IN 2019: $126.20

CHICKEN producer Inghams Group is another of Australia’s top listed agricultural companies whose origins go back more than 100 years.

Walter Ingham began the family operation as a young kid in 1918 with a rooster and six hens.

He built up the company organically, but it was his sons, Bob and Jack, who rapidly expanded the business after Walter died in 1953.

They built Ingham Enterprises Pty Limited into the largest chicken and turkey producer and processor in Australia and New Zealand. The company later expanded into feed mills to provide feed mostly for their poultry operations, but also servicing the pig and dairy industries.

Inghams Group Limited, as the company is now known, is a vertically integrated operation that includes 66 breeder farms, 10 hatcheries, 221 broiler farms, nine feed mills, 14 processing plants and an extensive distribution system. Growth of the poultry business runs at 4.3 per cent a year.

The company’s customers include supermarket chains Coles, Woolworths and Aldi, and fast food outlets KFC, McDonald’s and Domino’s Pizza.

It earned $2.5 billion in revenue in 2018-19 and posted a net profit after tax of $126.2 million. Nearly 90 per cent of the company’s shares are held by 19 financial institutions.

9. COSTA GROUP HOLDINGS

Horticultural production

ASX CODE: CGC

MARKET CAPITALISATION: $1,152.28

NET REVENUE IN 2019: $1,047.87

NET PROFIT (LOSS) IN 2019: ($33.76)

THE vagaries of farming hit Costa Group Holdings, Australia’s largest horticultural company, last year.

Since listing on the ASX in July, 2015, Costa Group’s revenue has risen by about $100 million a year to top $1 billion for the year ended June 30, 2018.

Profits doubled year on year to $117.8 million for 2017-18. The share price rose steadily from about $2 at the time of listing to $8.20 in June, 2018.

But it has been all downhill from there. In the past year, Costa Group has been forced to announce four profit downgrades as unfavourable weather hit its crops. To top off a bad run, the recent bushfires damaged the citrus and berry farm in NSW it leases from Vitalharvest Freehold Trust.

Costa Group has horticultural operations in all Australian states, plus six blueberry farms in Morocco and three berry farms in China. Its Australian operations include berries, mushrooms, citrus, avocados, bananas and glasshouse-grown tomatoes.

10. SYNLAIT MILK

Dairy farming and processing

ASX CODE: SM1

MARKET CAPITALISATION: $1,054.32

NET REVENUE IN 2019: $987.67

NET PROFIT (LOSS) IN 2019: $79.23

SYNLAIT Milk is one of two dairy companies dual listed on the ASX and New Zealand’s Exchange. And it is heavily aligned with the other one: The a2 Milk Company. It does not have factories or a real presence in Australia.

Synlait’s origins date back to 2000 when it began buying dairy farms in New Zealand.

In 2007, it expanded into milk processing, particularly for the manufacture of infant formulas for The a2 Milk Company, destined for the Chinese market.

Synlait has two spray dryers and a fresh milk packing line in its Dunsandel plant in the Canterbury region southwest of Christchurch. It is now building another spray dryer at Pokeno, south of Auckland on the North Island, to strengthen its core infant nutrition business.

China’s Bright Dairy recognised the potential of Synlait Milk early, investing $NZ81 million in the company in 2010. Bright Dairy continues to hold a 39 per cent stake in the New Zealand company.

The a2 Milk Company holds 17.4 per cent of Synlait’s shares. Revenue, gross profit and net profit after tax have all increased year on year since 2015.

Last year, Synlait topped $NZ1 billion in revenue for the first time. More than a third has been wiped off Synlait’s market capitalisation since mid-February after the company announced it would not meet its profit forecasts for 2019-20.

This is a result of slower than expected growth in infant formula sales, but importantly, lower sales of infant base powder in China due to uncertainty in brand registrations by the central government.

11. BEGA CHEESE

Dairy processing

ASX CODE: BGA

MARKET CAPITALISATION: $878.40

NET REVENUE IN 2019: $1,432.71

NET PROFIT (LOSS) IN 2019: $11.82

12. RURAL FUNDS GROUP

Diverse agricultural investments

ASX CODE: RFF

MARKET CAPITALISATION: $673.64

NET REVENUE IN 2019: $68.93

NET PROFIT (LOSS) IN 2019: $33.35

13. AUSTRALIAN AGRICULTURAL COMPANY

Cattle and meat production

ASX CODE: AAC

MARKET CAPITALISATION: $666.06

NET REVENUE IN 2019: $365.90

NET PROFIT (LOSS) IN 2019: ($148.40)

14. SELECT HARVESTS

Almond growing and processing

ASX CODE: SHV

MARKET CAPITALISATION: $636.71

NET REVENUE IN 2019: $309.17

NET PROFIT (LOSS) IN 2019: $53.02

15. CLOVER CORPORATION LIMITED

Omega 3 additives for infant formulas

ASX CODE: CLVMARKET CAPITALISATION: $445.71

NET REVENUE IN 2019: $77.40

NET PROFIT (LOSS) IN 2019: $10.10

16. BUBS AUSTRALIA

Goat milk infant formula

ASX CODE: BUB

MARKET CAPITALISATION: $403.41

NET REVENUE IN 2019: $45.15

NET PROFIT (LOSS) IN 2019: ($35.51)

17. ECOFIBRE LIMITED

Industrial hemp production

ASX CODE: EOF

MARKET CAPITALISATION: $311.14

NET REVENUE IN 2019: $37.47

NET PROFIT (LOSS) IN 2019: $6.00

18. RIDLEY CORPORATION

Stockfeed sales

ASX CODE: RIC

MARKET CAPITALISATION: $284.80

NET REVENUE IN 2019: $1,009.88

NET PROFIT (LOSS) IN 2019: $23.57

19. RICEGROWERS LIMITED

Rice processing

ASX CODE: SGL/SGLLV

MARKET CAPITALISATION: $241.87

NET REVENUE IN 2019: $1,193.06

NET PROFIT (LOSS) IN 2019: $32.77

20. KALIUM LAKES

Sulphate of potash mining

ASX CODE: KLLMARKET CAPITALISATION: $190.08

NET REVENUE IN 2019: $1.71

NET PROFIT (LOSS) IN 2019: ($11.80)

21. DUXTON WATER

Water trading

ASX CODE: D2O

MARKET CAPITALISATION: $161.35

NET REVENUE IN 2018: $28.20

NET PROFIT (LOSS) IN 2018: $7.27

22. AUSTRALIAN PRIMARY HEMP

Industrial hemp production

ASX CODE: APH

MARKET CAPITALISATION: $152.99

NET REVENUE IN 2019: $0.90

NET PROFIT (LOSS) IN 2019: ($1.36)

23. NUCHEV

Goat milk infant formula

ASX CODE: NUC

MARKET CAPITALISATION: $134.10

NET REVENUE IN 2019: $9.50

NET PROFIT (LOSS) IN 2019: ($9.70)

24. VITALHARVEST FREEHOLD TRUST

Citrus and berry production

ASX CODE: VTH

MARKET CAPITALISATION: $133.20

NET REVENUE IN 2019: $18.30

NET PROFIT (LOSS) IN 2019: ($5.50)

25. AUSTRALIAN VINTAGE

Wine production

ASX CODE: AVG

MARKET CAPITALISATION: $131.93

NET REVENUE IN 2019: $270.11

NET PROFIT (LOSS) IN 2019: $8.12

26. LINDSAY AUSTRALIA LIMITED

Transport and logistics for agriculture

ASX CODE: LAU

MARKET CAPITALISATION: $109.05

NET REVENUE IN 2019: $389.82

NET PROFIT (LOSS) in 2019: $8.88

27. WATTLE HEALTH

Dairy processing

ASX CODE: WHA

MARKET CAPITALISATION: $105.26

NET REVENUE IN 2019: $0.89

NET PROFIT (LOSS) IN 2019: ($10.34)

28. AGRIMIN

Sulphate of potash mining

ASX CODE: AMN

MARKET CAPITALISATION: $76.51

NET REVENUE IN 2019: $0.24

NET PROFIT (LOSS) IN 2019: ($1.79)

29. KEYTONE DAIRY CORPORATION

Milk powder production

ASX CODE: KTD

MARKET CAPITALISATION: $69.91

NET REVENUE IN 2019: $2.68

NET PROFIT (LOSS) in 2019: ($3.29)

30. MURRAY RIVER ORGANICS

Horticultural production

ASX CODE: MRG

MARKET CAPITALISATION: $50.42

NET REVENUE IN 2019: $60.07

NET PROFIT (LOSS) IN 2019: ($12.04)

31. APIAM ANIMAL HEALTH

Veterinary services

ASX CODE: AHX

MARKET CAPITALISATION: $50.38

NET REVENUE IN 2019: $111.74

NET PROFIT (LOSS) IN 2019: $3.15

32. DUXTON BROADACRE FARMS

Grain crop and livestock production

ASX CODE: DBF

MARKET CAPITALISATION: $47.68

NET REVENUE IN 2019: $13.62

NET PROFIT (LOSS) IN 2019: ($1.12)

33. NAMOI COTTON

Cotton production

ASX CODE: NAM

MARKET CAPITALISATION: $46.30

NET REVENUE IN 2019: $5.95

NET PROFIT (LOSS) IN 2019: ($0.56)

34. JATENERGY LIMITED

Milk powder production

ASX CODE: JAT

MARKET CAPITALISATION: $45.79

NET REVENUE IN 2019: $66.44

NET PROFIT (LOSS) IN 2019: ($20.49)

35. BESTON GLOBAL

Dairy, meat and seafood exporting

ASX CODE: BFC

MARKET CAPITALISATION: $36.27

NET REVENUE IN 2019: $86.03

NET PROFIT (LOSS) IN 2019: ($27.32)

36. WELLARD

Cattle exports

ASX CODE: WLD

MARKET CAPITALISATION: $34.53

NET REVENUE IN 2019: $235.09

NET PROFIT (LOSS) IN 2019: ($48.44)

37. AUSTRALIAN POTASH LIMITED

Potash mining

ASX CODE: APC

MARKET CAPITALISATION: $33.28

NET REVENUE IN 2019: $2.31

NET PROFIT (LOSS) IN 2019: $0.14

38. AUSTRALIAN DAIRY NUTRITIONALS GROUP

Dairy farming and processing

ASX CODE: AHF

MARKET CAPITALISATION: $32.65

NET REVENUE IN 2019: $21.94

NET PROFIT (LOSS) IN 2019: ($4.03)

39. LONG TABLE

Dairy production and retail sales

ASX CODE: LON

MARKET CAPITALISATION: $31.07

NET REVENUE IN 2019: $25.75

NET PROFIT (LOSS) IN 2019: ($24.16)

40. TERRAGEN

Soil and animal health biotech services

ASX CODE: TGH

MARKET CAPITALISATION: $30.83

NET REVENUE IN 2019: $0.98

NET PROFIT (LOSS) in 2019: ($3.21)

41. WINGARA AG

Agricultural product processing

ASX CODE: WNR

MARKET CAPITALISATION: $28.10

NET REVENUE IN 2019: $29.26

NET PROFIT (LOSS) IN 2019: $0.91

42. BIO-GENE TECHNOLOGY

Insecticide development

ASX CODE: BGTMARKET CAPITALISATION: $23.92

NET REVENUE IN 2019: $0.66

NET PROFIT (LOSS) IN 2019: ($2.06)

43. BUDERIM GROUP

Ginger and macadamia production

ASX CODE: BUG

MARKET CAPITALISATION: $20.64

NET REVENUE IN 2019: $76.17

NET PROFIT (LOSS) IN 2019: ($0.24)

44. FARM PRIDE FOODS

Egg production

ASX CODE: FRM

MARKET CAPITALISATION: $16.00

NET REVENUE IN 2019: $86.64

NET PROFIT (LOSS) IN 2019: ($3.86)

45. CENTREX METALS

Phosphate rock mining

ASX CODE: CXM

MARKET CAPITALISATION: $12.94

NET REVENUE IN 2019: $0.28

NET PROFIT (LOSS) IN 2019: ($1.38)

46. CROP LOGIC

Crop data systems sales

ASX CODE: CLI

MARKET CAPITALISATION: $12.91

NET REVENUE IN 2019: $2.10

NET PROFIT (LOSS) IN 2019: ($4.75)

47. WIDE OPEN AGRICULTURE

Vegetable, beef, lamb and hemp production

ASX CODE: WOA

MARKET CAPITALISATION: $8.82

NET REVENUE IN 2019: $0.31

NET PROFIT (LOSS) IN 2019: ($2.08)

48. AVECHO BIOTECHNOLOCY

Human health and animal feed services

ASX CODE: AVE

MARKET CAPITALISATION: $4.73

NET REVENUE IN 2019: $1.39

NET PROFIT (LOSS) IN 2019: ($3.99)

49. ROOTS SUSTAINABLE AGRICULTURAL TECHNOLOGIES

Precision ag technology provider

ASX CODE: ROO

MARKET CAPITALISATION: $4.01

NET REVENUE IN 2019: $0.31

NET PROFIT (LOSS) IN 2019: ($2.99)

50. AUSTRALIAN RURAL CAPITAL

Cotton, grains and beef investor

ASX CODE: ARC

MARKET CAPITALISATION: $3.75

NET REVENUE IN 2019: ($2.03)

NET PROFIT (LOSS) IN 2019: ($2.48)