Bank launches new offensive on scammers ‘ripping-off’ Aussies of $100M in two months

An Australian bank has shared a really simple hack with their customers to stop a process that has cost more than $100m this year.

Hacking

Don't miss out on the headlines from Hacking. Followed categories will be added to My News.

One of the big four banks has launched a new defence to help prevent customers from getting “ripped off” by scammers.

Australians have already lost almost $100m to scams in the first 59 days of this year, according to ScamWatch.

This is up 36 per cent from the same period last year when the total loss was $71m.

“We’re not going to win this fight,” NAB Group Investigations and Fraud Executive Chris Sheehan said.

“Fraud and scams are like water, as soon as you close off one crack in a pipe, it just hunts for another crack until it finds one.”

It’s clear that existing anti-scam strategies are not moving fast enough to tackle the problem, so NAB’s Investigations and Fraud team has devised a new strategy to stop the scam before it happens.

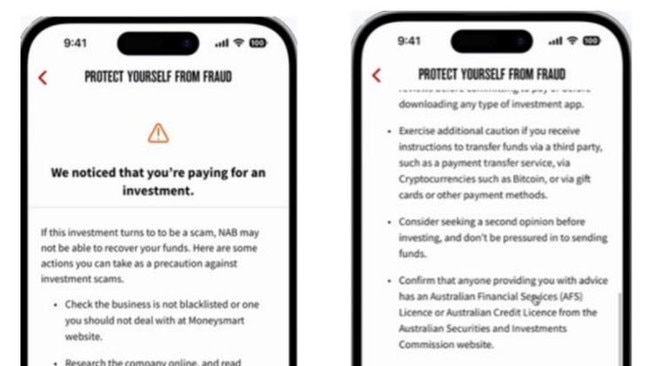

Real-time personalised messages will now pop up on the phones of NAB customers performing out-of-character transactions in the NAB online banking and smartphone app. Such an transaction would be, for example, making an investment in cryptocurrency for the first time.

“Scams often happen when people are rushing, tired or distracted,” Mr Sheehan said.

The prompts feature a checklist designed to get the customer to pause and review the payment.

The bank also employs the help of BioCatch software which can identify the typical behavioural cues of the user and capture when the user's behaviour changes.

It can pick up a change as small as the way a person typically swipes or taps their phone.

“It’s being used to give an indication as to whether the customer is being coerced, or duped, or that someone has taken over or tried to steal the customer's identity into making a payment,” Mr Sheehan said.

Messages will only be sent on a risk-level basis, so customers will only receive the alert when the bank has indicated a level of concern.

“This is a global problem and I’m not exaggerating,” Mr Sheehan said.

“It’s happening right under our noses and these criminal groups are stealing peoples livelihoods multiple times a day.”

The NAB fraud team is currently getting 2580 calls a day from customers reporting scams and fraud. That’s the equivalent of 100 calls an hour.

The new prompts are just one of 64 projects currently under way within the bank to crack down on scammers.

ACMA is working to develop a national SMS registry to make it much more difficult for crooks to impersonate and spoof mobile numbers.

“What we need to do is make it as difficult as possible for the crooks to operate effectively in this country.

‘The only way to do that is to have a national approach, led by government, to target the problem just like we did with drink driving, just like we did for skin cancer from sunburn.

“The numbers don’t lie, people are getting ripped off by these crooks.”

Mr Sheehan encouraged anyone who thought they had been scammed to contact their bank immediately.

Originally published as Bank launches new offensive on scammers ‘ripping-off’ Aussies of $100M in two months