See the Hobart suburbs where it’s cheaper to purchase property than rent

Dream of owning your own slice of Hobart but can’t break out of the rent cycle? Renters could save hundreds every month by making the switch to a home loan – but only in these suburbs. SEE THE LIST >>

Real estate

Don't miss out on the headlines from Real estate. Followed categories will be added to My News.

HOBART home buyers can save hundreds of dollars by breaking out of the rental cycle and getting their foot in the ownership door.

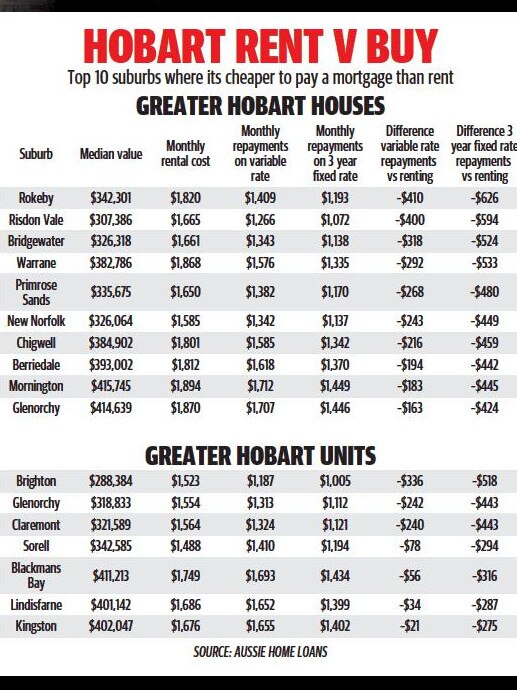

In Aussie Home Loans Buy vs. Rent report, released today, Eastern Shore suburb Rokeby was named the No. 1 area where house buyers stand to save the most money by making the switch.

The difference between paying a typical rent and the repayments on a variable rate home loan was $410 per month, the report said.

Select a three-year fixed rate repayment and a home purchaser could save $626 monthly.

The data revealed similarly large savings in Risdon Vale ($400 variable, $594 fixed), Bridgewater ($318, $524), Warrane ($292, $533) and Primrose Sands ($268, $480) housing markets.

New Norfolk, Chigwell, Berriedale, Mornington and Glenorchy rounded out greater Hobart’s top 10 with savings ranging from $163-$243 variable and $424-$449 fixed.

In the past five years, the proportion of Hobart suburbs where a house mortgage repayment was less than rents has hardly shifted.

In September 2015, 51 per cent of Hobart suburbs had lower mortgage payments than rents compared to 50 per cent in 2020.

In that period the unit market grew from 35 per cent with cheaper mortgages to 44 per cent this year.

In regional areas, the report’s fixed rate scenario found that almost 98 per cent of Tassie suburbs were more expensive to rent than pay down a mortgage.

Outside of chart-topping Bicheno, where asking rents are often impacted by holiday home rentals, West Coast towns Zeehan and Queenstown showed savings pushing into the $700 and $800 per month range.

Aussie chief executive James Symond said for young Tassie buyers or the average mum and day, the take away from the report was a case of “if not now, then when?”

“We see it as a great time for people to buy in Hobart and regional Tasmania,” Mr Symond said.

“Price are continually getting stronger,” he said.

“And if there is anything we know, it is that real estate prices ultimately go up and you have got to get on the bandwagon as soon as possible.

“People want to live in “lifestyle areas”, in safe and friendly areas and Tassie is known as that.”

PRD Hobart director Tony Collidge said an interesting takeaway from the Aussie data was that most of the areas that are cheaper to buy than to rent are located in the mid to lower buying tiers.

“While rents are higher compared to paying a mortgage, many renters in these areas are in the lower income demographic and may find it hard to save and find extra funds for a deposit,” he said.

“These same people generally have difficulties meeting increasingly stringent bank lending criteria and therefore remain in the rental sector.

“The fact that there is a dire shortage of Hobart property for rent and sale has seen significant increases in prices and rent over recent years.

“Such demand is now spreading across our major population and regional areas.”

Daniel Wass and Katelin Jones said they were excited to move into their newly-purchased home in Mornington this month after the sale settled this week.

Mr Wass said the couple had been renting but earlier this year moved back in with parents in order to save.

He said they had not rented in Mornington before but in their previous rental had paid about the same in rental payments than what they would now pay in mortgage repayments.

“It’s always a good option to get into the market if your circumstances allow you to,’’ he said.

“I would say if you have the opportunity to be able to save up, do it.”