‘Due for a downturn’: 9% drop in Hobart home values forecast

The worst scenario for property owners would see about $70,000 come off Hobart’s median house price if this forecast comes to fruition.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

BUDDING Hobart homebuyers could be back on the hunter for cheaper prices next year.

In its new Boom & Bust report, released Monday night, SQM Research has forecast a downturn for housing prices in Hobart.

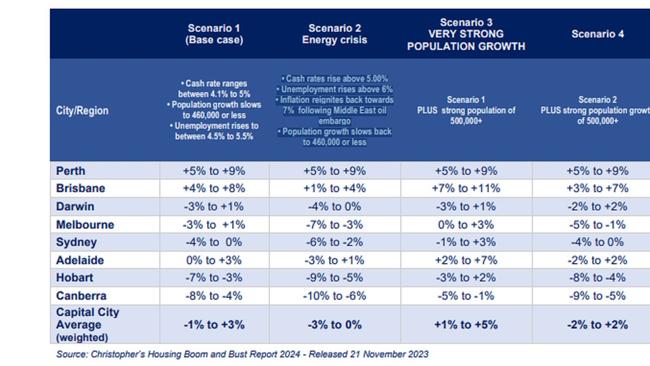

The report offers four scenarios, and the median price will shrink in each one by 3 per cent to 9 per cent.

Hobart’s current median house price, per PropTrack, is $719,000; a 9 per cent decrease would be about $71,109.

While Hobart was among the cities forecast to have the largest percentage of pricing falls, SQM managing director Louis Christopher said he was not forecasting a housing price crash.

“If Hobart is down by 7-9 per cent next year, that would be one of the bigger corrections, but it is not a double-digit downturn and it would come following many years of growth,” he said.

Hobart’s increasing rental vacancy rate was a factor in the forecast, having grown from a dire 0.6 per cent at the end of 2022 to as high as 1.9 per cent in June.

“There has been a supply-side response over the last 12 months, in particular,” Mr Christopher said.

“We have also recorded asking rents being down by 1.4 per cent — some relief for tenants but not great news for property investors.”

MORE: Tasmania’s premier fly fishing retreat has global appeal

Ooh la la elegance by the riverside in Rosetta

While home sales prices have returned to growth in other cities this year, Mr Christopher said the recovery had not reached Hobart.

“With the latest interest rate rise, we are expecting to see more sellers in the marketplace,” he said. “And more caution by would-be homebuyers.”

ABS data shows Tasmania has not had the equivalent surge in population that has been experienced interstate.

Mr Christopher said Tasmania’s population growth rate has “reduced significantly”.

“Slower population growth, an increase in supply, a small fall in rental prices, Hobart being interest rate sensitive, and the most recent rate rise are some of the factors we took into account in our forecast,” he said.

“We are expecting a slower economy in 2024, which is generally not conducive to strong price growth.

“It is fair to note, Hobart prices have boomed between 2016 to 2022; with medians rising from $395,000 to $750,000. It is due for a downturn.

“While at relatively low levels, we have also seen an uptick in distressed selling in Tasmania.”

MORE: Slice of heaven: Church’s first time for sale in 141 years

Baby boomer hero’s smashed avo warning rings true

Last month, KPMG forecast a surge in housing prices next year and in 2025, led by Hobart with 6 per cent growth by June 2024, followed by a further 14.2 per cent by June 2025.

PropTrack has forecast a 1-4 per cent decline in Hobart home prices by the end of next year.

4one4 Property Co. agent John McGregor said the value of market forecasts for the typical property buyer can vary.

“It depends on their personal circumstances,” he said.

“These reports can be interesting for investors, but perhaps not as much for someone who needs to buy a place to live in and is less focused on future growth or declining market cycles.”

The SQM Research Boom & Bust Report 2024 is available to purchase at its website.