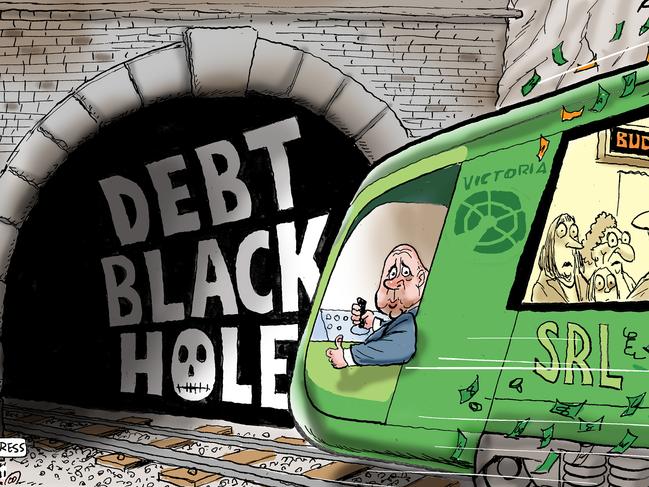

Terry McCrann: Victoria’s worst fiscal days remain ahead

When it finally arrived, Tim Pallas’s 10th budget was nowhere near as horrific as feared — but the disastrous debt spiral will continue.

Victoria

Don't miss out on the headlines from Victoria. Followed categories will be added to My News.

When it finally arrived, Tim Pallas’s 10th budget – he at least doggedly stuck around, when of course his former premier, “Chairman Dan”, had already, well, just dogged it – was nowhere near as horrific as feared.

Indeed, Pallas has even continued the 21st century trend of treasurers handing out “free money” – the $400, not exactly a “cheque in the mail”, but a credit, per child, at your school.

That adds up to $287m of (your) money that the state government does not actually have, and will have to borrow to pay.

Sio it just goes on the state’s credit card – heading for a total of $188bn by June 2028.

That’s the number the budget ‘fesses up to.

The rating agencies like Moody’s and S & P calculate state debt will go past $220bn; and keep rising.

OK. You also need to understand that the “not quite so horror budget” would have been a lot, lot worse but for two things.

One was the extra $4bn that a “friendly” government in Canberra directed to Melbourne, under the GST carve-up.

Now, let me make it clear: Victoria deserved every penny of that money; indeed, it should arguably have got more.

But it certainly helped when you were Pallas preparing a budget full of red ink.

The second was the massive immigration-driven surge in the state’s population.

With all the spending that generates across the state economy, it pours money into the budget upfront.

But the bills – infrastructure, schools, hospitals, police, ambos, services etc – get presented in the not-too distant future.

The biggest bill of all – and a bill which hits a lot of Victorians – is both the availability and the cost of housing.

We are going to build 800,000 new homes in the state? In a word: Fuggedaboutit.

Further, all that future financial pain will come just as we are already trying to pay those bills – unsatisfactorily but also painfully – for the massive population surge of the last ten years.

Indeed, the comparison with the last pre-Covid budget of 2019 is all of just awful, instructive, and ultimately a portend of a building catastrophe that is yet to even really start to play out.

Back in May 2019 Pallas was projecting oceans of never-ending black ink budget surpluses as far as the fiscal eye could see.

We were going to be able to continue our massive multibillion-dollar a year – “The Big Build” – infrastructure spend, and yet net debt would rise to only $55bn by June 2023.

Yes, thanks to the Covid that no one saw coming in May 2019, it turned out to be double that, at $115bn. And heading for, at least, $188bn.

But the debt was also made so much bigger, by Chairman Dan’s closing down of the state like no other in Australia, or indeed the world.

We would also have been able to have poured billions into healthcare, into schools, into police, ambos and the fireys.

Yet the net interest bill would have amounted to only 3 per cent of revenue.

Now, net interest is going to run at nearly three times that – taking 8c of every single dollar of revenue, every week, every year, pretty much forever.

As a base, that is. It will certainly go past 10c in the revenue dollar; and still keep rising.

Back in 2019, we were going to comfortably maintain our Triple-A credit rating; thereby getting the lowest interest rates to be paid on that debt.

Maintain our Triple-A? We will be – almost certainly, unsuccessfully – struggling to hold our Double-A, the lowest rating of any state.

And with a lower rating comes higher interest rates to be paid on the escalating debt; and so bigger future deficits, and so even bigger debt; and on and on the disastrous spiral will continue.

Then add on the bills that will fall due on the massively increased state population.

Pallas really should have taken the opportunity Tuesday to announce the – desperately needed – abandonment of the fiscally and economically crazy, $200bn-plus Suburban Rail Loop. The trainline, from nowhere to nowhere.

But I guess his premier couldn’t cop walking away a second time (remember the Commonwealth Games) from her big baby.

The rail link isn’t only utter fiscal madness that dwarfs even former PM Malcolm Turnbull’s (Snowy) Big Battery.

But, much worse, by soaking up building materials and even more importantly tradies, it is making it hard to build houses and making them far more expensive to boot.

This unsolvable and inevitably getting worse housing crisis is the Andrews-Allan legacy to the state.

Right in the middle of a broader, engulfing, inevitable fiscal crisis.

More Coverage

Originally published as Terry McCrann: Victoria’s worst fiscal days remain ahead