The ambitious plan to help first homebuyers save thousands while boosting housing supply

A proposal to get more young Australians into their own home sooner would save them $13,000 a year and slash the time it takes to scrape together a deposit.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

A major property group will lobby Labor and the Coalition to adopt its ambitious proposal to save homebuyers up to $13,000 a year while boosting housing supply at the same time.

The Property Council of Australia launches its federal election platform on Monday, including its plan to limit deposits for first-time buyers of brand-new houses or apartments to just five per cent.

Its bold idea, dubbed the First Home Buyer Accelerator Loan Scheme, would also cap the interest rate charges by banks.

Buyers would save money – and time

Property Council chief executive Mike Zorbas said the capped interest rate would be either whatever the Reserve Bank’s official cash rate is at the time – now sitting at 4.35 per cent – or a flat five per cent, whichever is greater.

The average variable mortgage interest rate at the moment is 6.51 per cent, so those buying a new home would save big under the proposal.

“Our proposal will help first-home buyers save up to $1087 every month and $13,044 annually,” Mr Zorbas said.

To support banks to offer home loans with a five per cent deposit, the government would guarantee the remaining 15 per cent, he added.

By drastically reducing the amount first home buyers would need to save for a deposit, potentially by several years, more people would be able to purchase sooner.

“This policy requires zero upfront government spending and would be subject to appropriate credit checks and serviceability assessments, meaning future exposure will be minimal,” he said.

“With cost-of-living pressures and housing affordability consistently the two issues of most concern for Australians, the government can and should use its balance sheet to support first-home buyers and the delivery of new homes.”

The Property Council’s idea would go some way to supporting home-building by making it cheaper and easier for first-timers to enter the market, he added.

“The scheme should be targeted, regularly reviewed and applied where it is driving new supply,” Mr Zorbas said.

“Done right, it will help thousands of Australians onto the property ladder.”

Meeting supply targets a big challenge

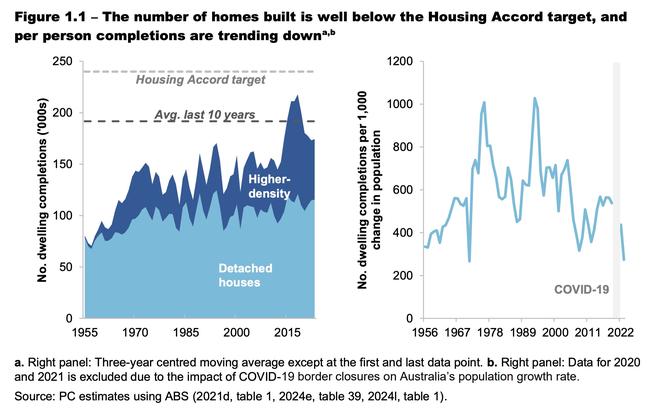

Prime Minister Anthony Albanese has a target of building 1.2 million new homes across the country in just five years, with eight months already having passed since the starting gun was fired.

But experts and pundits have already declared the goal dead in the water, with cost constraints, lending restrictions and continuing upheaval in the construction sector hampering activity.

A new report by the Productivity Commission exploring issues in the residential construction sector warned the country is incapable of building the new homes it needs to house a growing population without urgent intervention.

Over the past 30 years, physical productivity has collapsed by 53 per cent and labour productivity has declined 12 per cent, it found.

“Governments have focused on alleviating constraints to new supply via changes to planning regimes … but the speed and cost of new building is also a constraint on new housing supply,” the report read.

The key challenges faced by the sector are complex and slow approvals, a lack of scale, a lack of innovation, and workforce shortages.

Also impacting supply shortages is the fact construction costs have soared by 40 per cent in the past five years alone.

Home-building completion times have skyrocketed by 80 per cent in 15 years.

Master Builders Australia boss Denita Wawn said the housing crisis won’t be solved while “we drag our heels on tackling the challenges faced in the industry”.

“Just like the housing crisis, there is no silver bullet to solving woeful productivity in the industry, and it requires a co-ordinated and comprehensive approach by all levels of government,” Ms Wawn said.

She said the Productivity Commission’s report highlighted the impact of “slow and poorly co-ordinated regulatory processes, inconsistency across jurisdictions, and policies that have chilled innovation”.

More support urgently needed

Master Builders today launched a resource with start-to-finish advice on how anyone, no matter their age of gender, can begin a career in the industry.

Ms Wawn said the Construct Your Career Guide explains what new entrants can expect, how much they stand to make in a particular trade, and the career opportunities that await them.

“Master Builders has made it a priority to do our part in addressing skills shortages and we urge all students, parents, schools and those looking for a career change to check out the guide,” she said.

Meanwhile, the Property Council’s election policy wish list includes a range of pro-investment initiatives to boost supply and improve planning controls.

It includes a proposed Housing Sub-Committee of Cabinet, which would be charged by the housing minister and include the treasurer and ministers for industry, environment, infrastructure and cities, and industrial relations.

It has also called for a doubling of the $3 billion performance-based New Home Bonus and the $500 million Housing Support Program on offer to states and territories that beat supply targets set by the National Housing Accord.

Labor nicks Coalition’s popular policy

Last week, the Federal Government announced a ban on foreigners purchasing established homes, to commence from April 1 and run for at least two years.

Treasurer Jim Chalmers said a review would then determine whether the ban should be extended.

It would free up the proportion of existing dwellings on offer to homebuyers, although modelling shows it would be a fairly modest number.

The Coalition announced the exact same policy last year, which the government at the time claimed would make little difference to housing prices and availability.

But its proposal garnered broad public support, polling showed, which likely explains why Labor has now chosen to copy it.

Originally published as The ambitious plan to help first homebuyers save thousands while boosting housing supply