Salmon export market vulnerable to rising trade tensions between China and Australia

Tasmania’s lucrative seafood industry could be next on Beijing’s hit list if the capital decides to “extend its economic blackmail” against Australia, says an author and academic. READ HIS WARNING >>

Tasmania

Don't miss out on the headlines from Tasmania. Followed categories will be added to My News.

THE lucrative salmon export market is vulnerable to rising trade tensions between China and Australia, says a leading economist, author and China watcher.

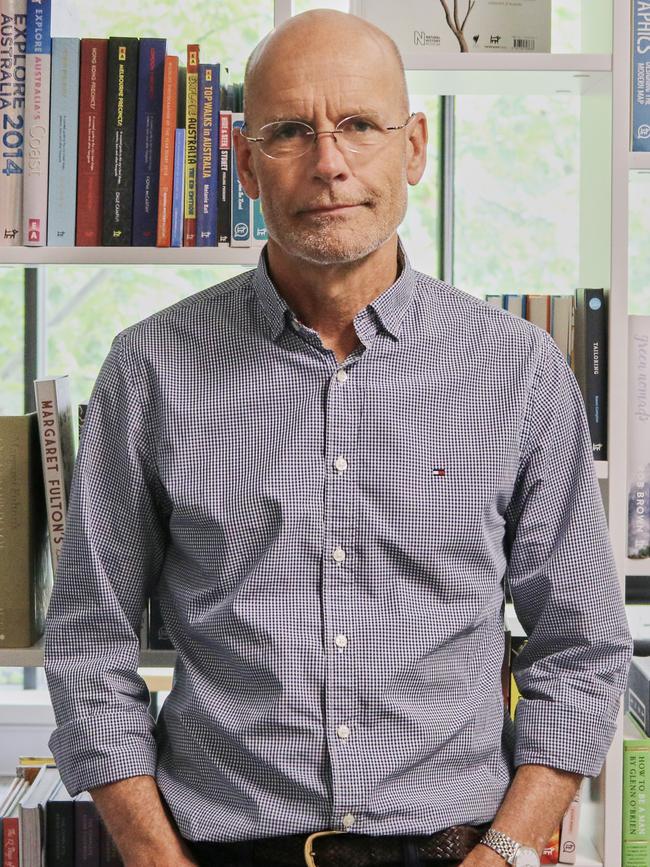

That risk has escalated over recent days, Australia Institute founder Clive Hamilton said on Wednesday, with China’s halting of salmon imports from Norway setting an unnerving precedent.

Though that move was linked to coronavirus outbreak fears in Beijing, Mr Hamilton said Tasmania’s $65 million export market to China could be next in line.

“Norway’s salmon is the scapegoat, but Beijing could easily shift attention to Tasmanian salmon.

“Salmon and cray industries are definitely vulnerable if Beijing decides to extend its economic blackmail against Australia. Those two sectors would be among Beijing’s top 10 on the hit list.”

Mr Hamilton is best known to Tasmanians as the author of the explosive 2018 expose Silent Invasion, a book detailing China’s political interference and strategic assets acquisitions in Australia.

“In Silent Invasion, I warned about Beijing’s propensity for economic blackmail, and I picked out tourism and the higher-education sectors,” Mr Hamilton said.

“Lo and behold, they are now being targeted, along with barley and beef.”

RELATED: TASMANIA’S NEXT BIG TRADE MARKETS

Mr Hamilton was speaking to the Mercury to launch his latest book, Hidden Hand (Hardie Grant, $32.99), in which he alleges rampant Chinese political interference on a global scale.

“Excuses like coronavirus in salmon or some hygiene problem with crays can easily be invented, and it can cause immediate pain,” the author said.

“They are easy targets. China needs Australian iron ore, so it’s not going to target that.

“What happens next depends a bit on Beijing’s judgment about how likely Canberra is to be spooked by potential impacts on cray and salmon industries.”

MORE NEWS:

- Caution as virus checks continue

- UTAS staff agree to no pay rise to save jobs

- Chilling details revealed as siege gunman learns fate

Mr Hamilton said Norwegian salmon had been used as an avenue of economic blackmail before.

“In 2010, China imposed bans on Norwegian salmon after dissident writer Liu Xiaobo was awarded the Nobel Peace Prize.”

Salmon giant Tassal, which has previously identified China as a key growth market, declined to comment. Huon Aquaculture could not be reached for comment.

Tasmanian businessman Adam Gregory Goern, though, echoed Mr Hamilton’s concerns.

“We can only go on probabilities, but it looks like salmon is on the economic chopping block,” Mr Goern said.

It was salmon’s “elasticity” in business export terms with China that made it a target, he said, unlike “inelastic” exports such as infant milk formula or iron ore.

The GFA & Associates chief executive, who is developing a digital strategy to help Tasmanian businesses grow their businesses in Asia, said he was confident that any disruption would be temporary.

China imports salmon mainly from Denmark, Norway, Canada and Australia.

Australian salmon exports to China were worth $74.9 million last year, with $65 million originating from Tasmania.

This accounts for less than 15 per cent of China’s total imports of salmon.

The salmon industry is Tasmania’s largest primary industry sector, and was valued at $838 million in 2017/18.

RELATED: TASMANIAN EXPORTERS WANT TENSIONS TO EASE

The Seafood Trade Advisory Group chair Nathan Maxwell McGinn said Australian seafood exports were not being blocked by China, though COVID-19 testing of Australian seafood was likely.

“The World Health Organisation has stated it is highly unlikely people can contract COVID-19 from food or food packaging,” Mr Maxwell McGinn said.

“And they have not advised that imported food or packaging needs to be tested as a result of these new infections.”