GST shake-up to deliver $112 million boost for Tasmania, says Federal Treasurer

UPDATED: THE Federal Government’s new GST distribution formula is “worth considering”, Tasmanian Premier Will Hodgman says. READ THE EDITORIAL, WATCH THE PREMIER’S PRESS CONFERENCE

Tasmania

Don't miss out on the headlines from Tasmania. Followed categories will be added to My News.

UPDATED: THE Federal Government’s new GST distribution formula is “worth considering”, Tasmanian Premier Will Hodgman says.

Mr Hodgman says detailed modelling by Treasury will determine whether his government accepts the proposed changes to the horizontal fiscal equalisation model that allocates the goods and services tax revenue to states.

But he says the Turnbull Government’s proposed $6.7 billion of top-ups should benefit the state.

EDITORIAL: DON’T RUSH TO SIGN GST DEAL

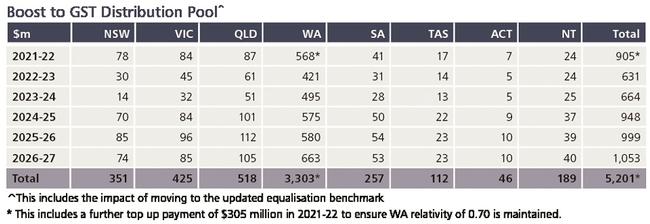

“On the face of it, what has been proposed by the Commonwealth will advantage our state to the tune of $112m,” Mr Hodgman said.

“On the face of it, this is a proposal that is worth considering.

“It is also a proposal that meets the Commonwealth’s commitment to ensure that Tasmania is not a dollar worse off.”

Prime Minister Malcolm Turnbull had previously given the dollar guarantee, leading some analysts to predict Tasmania’s relative share could still fall.

Mr Hodgman said state and federal treasury officials would model the new system over coming months.

“We will go over this with a fine-tooth comb,” he said.

“I will assure Tasmanians we will do nothing that disadvantages our state at all.”

Federal Treasurer Scott Morrison has proposed an intergovernmental agreement by the end of the year to enshrine the new model.

Tasmania’s ability to opt out appears limited, with Mr Morrison making it clear he has the power to introduce the new deal, which would begin in 2021-22.

State Treasurer Peter Gutwein said Tasmania’s $112m top-up over the years to 2026-27 would then continue under the new system.

“This isn’t a transition to 2026-27,’ Mr Gutwein said.

“What’s being proposed by the Commonwealth is an ongoing boost to the GST pool in perpetuity.”

In North-West Tasmania ahead to the Braddon by-election, Opposition Leader Bill Shorten said he had not yet read the Productivity Commission’s report but would study it and find the “devil in the detail”.

Mr Shorten said the states needed funding certainty and should not have to go cap in hand to the Federal Government.

“This government might not be around to take the consequences of its GST distribution decision,” he said.

“I will read the report, talk to the states and territories.

“I want to know where the money is coming from. Is it a case of robbing Peter to pay Paul?

If something seems too good to be true, it often is.”

Tasmanian economist Saul Eslake said the top-up meant is was likely no state would be worse off under the new carve-up.

“Provided that the current Federal Government, or a future Federal Government, doesn’t seek to claw back some or all of this $6.7 billion by cutting specific purpose payments — for instance for hospitals, schools, housing or roads — to the states, then it is likely that no state will be worse off,” Mr Eslake said.

“If I were a state or territory treasurer, I would be seeking some explicit guarantees to that effect before signing up.”

The new system puts a floor in the carve-up where no state could fall below a 70 cents per capita distribution in the future.

The carve-up formula will equalise to the better of NSW and Victoria.

Tasmania receives about $2.48 billion, or 40 per cent of revenue, from GST payments.

OVERNIGHT: TASMANIA will receive a $112 million boost over eight years to ensure it is no worse off, under changes to the GST distribution system proposed by the Federal Government.

The Turnbull Government will today outline a new formula for distributing goods and services tax revenue to the states from 2021-22, declaring it will preserve the “fair go” of the current system.

Known as horizontal fiscal equalisation, it ties each state’s ability to provide services to the level of the best performing state. The key recommendation of a Productivity Commission review into the GST was that distribution be based on a new equalisation benchmark of all states’ averages.

The Government has rejected the formula, which would have cost Tasmania an estimated $814 million over eight years.

Instead, it has opted for a benchmark that will ensure all states and territories are at least the equal of NSW or Victoria — whichever is higher.

“Benchmarking all states and territories to the economies of the two largest states will remove the effects of extreme circumstances, like the mining boom, from Australia’s GST distribution system,” Treasurer Scott Morrison told the Mercury.

The Federal Government would inject an additional $600 million into the GST pie in the first year of the new system’s operation, including $17 million for Tasmania, indexing the amount over following years by the increase in GST revenue.

Another $250 million would be allocated in 2024-25, the booster payments increasing GST distribution nationally by $7.2 billion.

“The Turnbull Government’s changes will reinforce and protect the fair go system used to distribute the GST that supports the services all Australians rely on, especially in smaller states, while removing the volatility in how these funds are distributed,” Mr Morrison said.

In addition, a “floor” of 70 cents per person per dollar of GST will be introduced, rising to 75 cents from 2024-25.

The more stable benchmark would make it unlikely states’ “relativities” would fall below the new floors, Mr Morrison said.

The outcome will come as a relief to the Hodgman Liberal Government, which has been fending off claims the state could be $600 million worse off under a new formula.

MORE: TASSIE WEIGHS UP THREAT OF GST GRAB

MORE: TURNBULL’S PLEDGE ON STATE’S SLICE OF GST

Sticking to the current system would leave Tasmania more than $250 million worse off than under the proposed formula, Turnbull Government insiders said.

A joint statement from Premier Will Hodgman and State Treasurer Peter Gutwein said the new deal appeared to deliver on the commitment that Tasmania would not be worse off in dollar terms.

“The Tasmanian Government won’t accept the proposal if it’s not in Tasmania’s best interests,” they said.

But reacting to Mr Turnbull’s announcement of a shake-up in federal-state financial relations yesterday, Tasmanian Labor leader Rebecca White said Premier Hodgman still faced a stark choice.

“Maintaining the current GST formula locks in Tasmania’s future prosperity — anything less than that is second best,” Ms White said.

“Tasmanian political parties have had a unity ticket on GST for decades. If the Premier walks away now he is selling out future generations. That will be his legacy.”

Mr Morrison and Prime Minister Malcolm Turnbull believe the fallout from the mining boom, which left Western Australia with as little as 30 cents in the dollar per person of GST — compared with 95c in NSW — didn’t pass the “pub test”.

They will accept the Productivity Commission’s recommendations around simplifying the distribution formula, but considered the “state average” model went too far.

“The Government considers that implementing the PC’s preferred model would move too far from the fair go principle of horizontal fiscal equalisation, and risk leaving smaller states behind,” Mr Morrison said.

“We also consider that the PC’s preferred option would create a level of unnecessary disruption and transition costs that most states, and the Commonwealth, would not be able to reasonably accept or absorb.”

Commission’s plan firmly panned on all sides

NICK CLARK

PRIME Minister Malcolm Turnbull has ruled out adoption of the Productivity Commission’s GST plan which could have reduced Tasmania’s payments by up to $1.1 billion over four years.

Released yesterday, the Commission’s option was for the GST carve-up formula to be equalised to the average of all states rather than equalised to the fiscally strongest state.

It was soundly panned by Tasmanian leaders with Federal Treasurer Scott Morrison announcing that Tasmania’s share will be equalised to whichever state is the fiscally strongest, Victoria or New South Wales.

Mr Morrison said the Government would be adopting its own GST carve-up model which tops up Tasmania’s GST share by $112 million for the five years from its introduction in 2021-22.

“We have rejected that [Productivity Commission model] and the Treasurer will have more to say about this,” Mr Turnbull said.”

Tasmanian Treasurer Peter Gutwein welcomed the Prime Minister’s statement.

“We welcome the Prime Minister’s statement that all states will be better off than they are now under the Federal Government’s proposal,” he said.

He rejected the Commission’s preferred option.

“Today I was briefed by the Productivity Commission on the findings of its report and I expressed my disappointment to the Productivity Commission directly and that I do not accept their findings because of the significant impact it would have on Tasmania,” he said.

The Government has been under enormous pressure from the West Australian Government and WA’s Federal Liberal politicians to increase the state’s share. The decision comes in the run-up to five critical by elections, including Braddon, on July 28.

Mr Morrison told the Mercury that he would convene a special Treasurers meeting in Canberra in September when he hoped to get agreement from all states and territories. He said, however, that he had the power to act unilaterally.

Labor leader Rebecca White said Premier Will Hodgman would have been shown to have failed to stand up for Tasmania unless there was a Federal Government guarantee to retain the current GST formula.

Economist Saul Eslake, commenting on the Productivity Commission’s preferred option, said it would have clearly been a step away from the principle that had governed the distribution of general purpose grants to states and territories since 1981.

“It would have implied a redistribution of income away from Australia’s poorest states, Tasmania and South Australia, to Australia’s richest states, NSW and WA,” he said.

Denison MP Andrew Wilkie, also commenting on the Commission’s leaked preferred option, said any additional top-up payments would not fix the situation because they would be at the whim of the government of the day and could just as easily run out or be taken away.