Federal budget, states and households all damaged by debt

We didn’t realise how spoiled we were before the pandemic struck, Paul Starick writes, and now the nation has debt bombs ticking fast everywhere.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

A stark prediction from the turbulent early days of the coronavirus pandemic is hitting home hard as families and governments struggle with extraordinary debt burdens.

The same forecast was delivered in two conversations – with prominent business and political leaders – as thousands of people lost their jobs and many of those fortunate enough to keep theirs were sent to work from home.

When the real economic shock hits, they said, we’ll look back and realise just how spoiled we’ve been for many years.

Going out for coffee or a meal was considered a treat in the early 2000s, they said, whereas these days people enjoy multiple coffees per day, plus regularly eat out or grab takeaway.

Years of low interest rates had underpinned this, they argued, as Australian living standards were raised to some of the world’s best.

But the hammer would fall, they predicted, arguing interest rates would rise, household and government budgets would be stretched and, eventually, jobs would be lost.

Clearly, these political and business leaders enjoy healthier household budgets than most Australians.

But many of their prescient predictions are unfolding, with devastating consequences.

Federal Treasurer Jim Chalmers delivers his Budget on Tuesday, promising cost-of-living relief including tax cuts.

But this won’t help much at all for middle-class Australian families whose mortgage and household costs have skyrocketed – like teacher and draftsman Tarni and Alex Witts, and their three young children. Their typical case was documented in Friday’s Advertiser.

In the past year, their mortgage repayments have soared from $1980 per month to $4000, since they dropped off a 1.99 per cent fixed rate. Their grocery budget has surged from $250 per week to $400.

Mr Chalmers is struggling with debt and interest payments in his own Budget, as he said in a Canberra press conference on Thursday.

“Debt interest is still one of the big five pressures on the Budget (he also listed defence, health, NDIS and aged care). … They intensify rather than ease over time, and that’s why this responsible approach that we’re taking to get that debt interest down, to get that gross debt down, is so important.”

State Treasurer Stephen Mullighan, who hands down his third Budget on June 6, has long warned spending needs to significantly tighten after the necessary completion of twin “mega-projects” – the $15.4bn South Rd tunnels by 2031 and the $3.2bn Women’s and Children’s Hospital by 2030-31.

“There’s no bottomless pit or money tree to continue coughing up more capacity,” Mr Mullighan told The Advertiser in 2022, ahead of his first Budget.

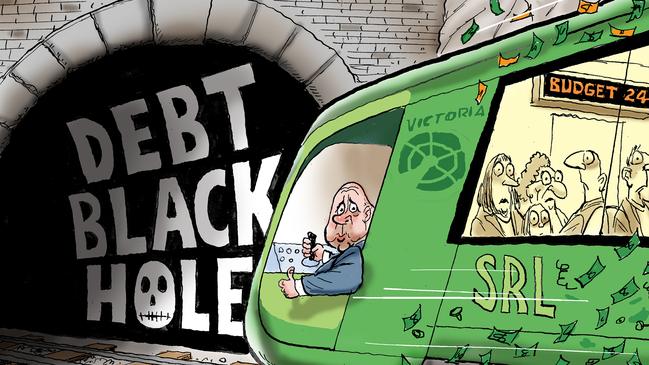

SA’s finances are in vastly better shape than the basket case over the border in Victoria, where a state budget delivered on Tuesday contained record debt soaring to an unprecedented $187.8bn – or $67,000 for every household.

Almost $47m had been added to the debt pile every day since last May’s figures.

This was despite broken promises and stalled projects that included grounding Melbourne’s Airport Rail Link and ditching the state’s first homebuyers scheme.

In Victoria, a financially incompetent government is punishing its citizens and becoming a burden to the entire country.

S & P Global Ratings analyst Martin Foo told The Advertiser Victoria’s gross debt was the highest of the states, at 189 per cent of operating revenues, compared to SA’s mid-range figure of 149 per cent.

“South Australia’s credit rating of AA+ denotes a very strong capacity to meet financial commitments, in our view,” he said.

But Mr Foo said SA’s self-imposed fiscal targets, published in Budget papers, included a commitment to achieve a level of net debt that was “sustainable over the forward estimates”. “We view this target as somewhat vague, and not a major constraint on growth in debt,” he said, pointing out that Australian state governments’ debt was already high on a global scale.

Maybe we didn’t realise how spoiled we were before debt and inflation soared. But there’s no going back to 2019.

There is a considerable challenge ahead of state and federal governments to get their debt under control and be honest with the public about what they can really do to help those struggling with their own finances.

More Coverage

Originally published as Federal budget, states and households all damaged by debt