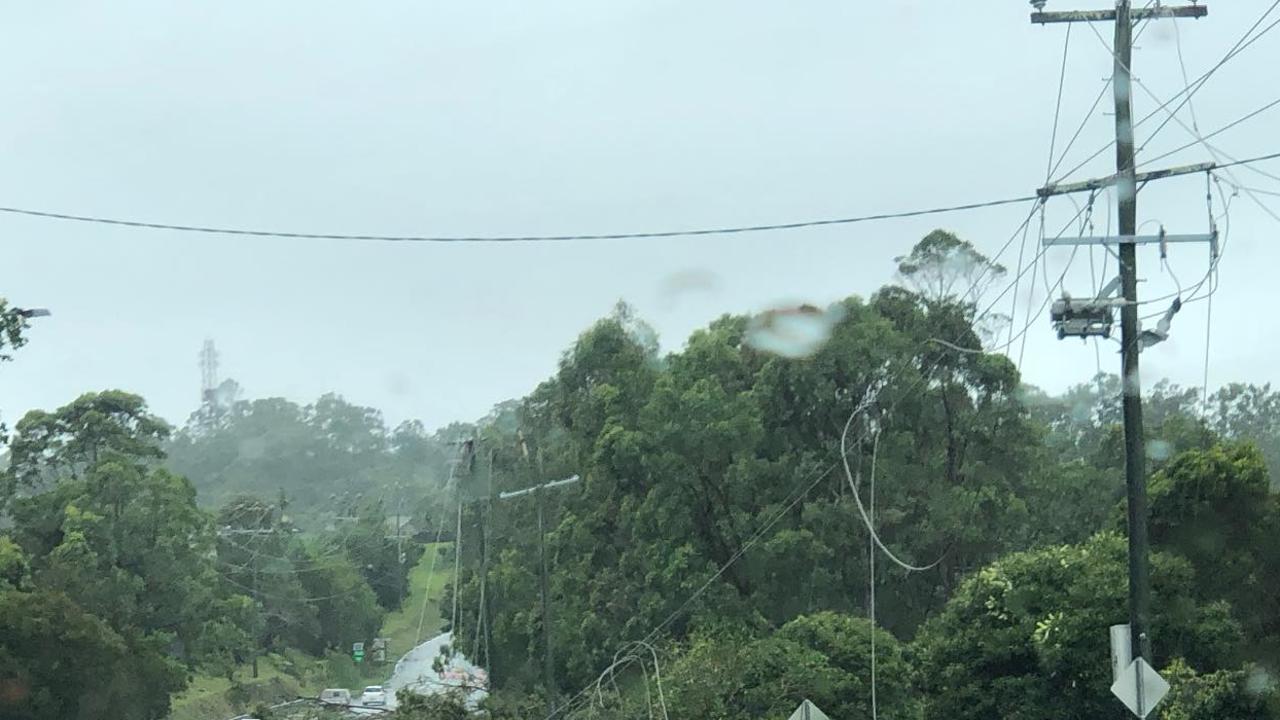

Cyclone Alfred: Victims warned of ripoffs by ‘disaster chasers’

Queenslanders impacted by Cyclone Alfred have been warned of unscrupulous operators hiring themselves out for the clean-up.

QLD News

Don't miss out on the headlines from QLD News. Followed categories will be added to My News.

The boss of Australia’s largest insurance company has warned policy premiums will likely keep increasing at rates higher than inflation unless more money is invested in mitigating disaster damage.

IAG chief executive Nick Hawkins said it was still too early to determine the full impact of Tropical Cyclone Alfred, which had resulted in 4000 claims so far being made to the company’s insurers which include NRMA and CGU.

But he said the increasing number of major weather events meant that without significant investment in disaster mitigation, costs would be borne by households in premiums that would likely go up at rates higher than CPI.

“If nothing else changes over the next 10 to 20 years … that’s what you would expect,” he said.

Mr Hawkins said Australia needed intergenerational mitigation investment.

“We know that we have built, over the last 100 or so years around Australia, or longer, towns and communities in areas that are subject to harm’s way.

“We also know we’ve had pretty significant building cost inflation over the last 10 to 20 years, particularly in the last five, and so unfortunately … if we don’t do anything about it, most likely that’s just going to end up as an increased cost.”

NRMA Insurance CEO Julie Batch said a majority of the 4000 claims so far, including 1350 on the Gold Coast, had been for food spoilage, fallen trees and water ingress.

KPMG assurance and risk partner Scott Guse said much of the disaster would be covered by the federal government’s $10b cyclone reinsurance pool, set up three years ago to make it cheaper for insurers to reinsure against tropical super storms and keep a lid on consumer premiums.

The cyclone pool covered claims for related damage, including flooding, during the declared cyclone period – from February 28 until last Monday morning – and for 48 hours after.

“The impact of this event shouldn’t have any significant impact on their premiums for two reasons,” Mr Guse said.

“One is the (existence of the) pool and secondly, insurers have expectations of cyclonic events and to date we haven’t had any major events, so this (Alfred) is well within their allowances. It’s something they can take in their stride.”

Mr Guse said the only unknown was that a cyclone had not hit the South East for 50 years so Alfred would not have been factored into insurance pricing models.

But he said New Zealand had been hit with its first cyclone in 2023 and if “unusual” cyclones became more common, premiums could jump.

“The unfortunate thing is we’re starting to see these unusual, unforecast, unplanned events arising,” he said.

“They do need to be put into the (premium) pricing models and they can obviously produce additional risk for insurers. To date we’ve only had two of them and insurers do expect unusual events to arise but if they happen more frequently, we’re going to be hit by premium increases.”

Mr Guse said insurers probably settled more than 90 per cent of claims.

Meanwhile, the Insurance Council of Australia has warned about “disaster chasers” operating in impacted communities, as total claim numbers in Queensland and NSW reach more than

34,000.

These chasers may be offering to undertake work such as tree and debris removal, requesting payment upfront in cash but often leaving work poorly done or incomplete.

They can also offer to undertake home inspections or repairs for cash payment.

ICA chief executive Andrew Hall said insurers had already paid out almost $2.4m in 6000 small emergency cash payments to help impacted customers get through the immediate aftermath of this event, for items such as food and temporary accommodation.

Originally published as Cyclone Alfred: Victims warned of ripoffs by ‘disaster chasers’