Talking Point: Tax revenue is the lowest outside Northern Territory

Governments must stop caving in to interest groups and take top economist’s advice, writes GREG BARNS

Opinion

Don't miss out on the headlines from Opinion. Followed categories will be added to My News.

It is self-evident that the Gutwein government, and for that matter the opposition parties, have dropped the ball on economic reform. Not since the Field, Groom and Rundle governments of the 1990s has their been any major reform of Tasmania’s micro and macroeconomic settings. And the consequences are plain for all to see now. Tasmania is heading into the deep waters of years of deficits as the state’s Treasury observed last year. Yet when an insightful, sensible tax reform paper from Tasmania’s most prominent economist Saul Eslake was published last week, the Gutwein government dismissed it out of hand. More fool them.

Mr Eslake, the former chief economist for the ANZ Bank, has written a concise, impeccably argued road map for tax reform in Tasmania. The report is published by the Australia Institute and it ought to be read by all politicians, policy makers and media types. That is because the case for tax reform is not only compelling but without it, the Tasmanian economy’s downward slide will not be arrested.

Tasmania’s reliance on inefficient and inequitable taxes like conveyancing duty, stamp duties on property transfers, and taxes on insurance is higher than is the case for any other state or territory jurisdiction with the exception of Victoria. On the other hand when it comes to efficient and equitable taxes like payroll tax and land tax Tasmania is the least reliant, with the exception of Queensland. It is not a sustainable position for a number of reasons.

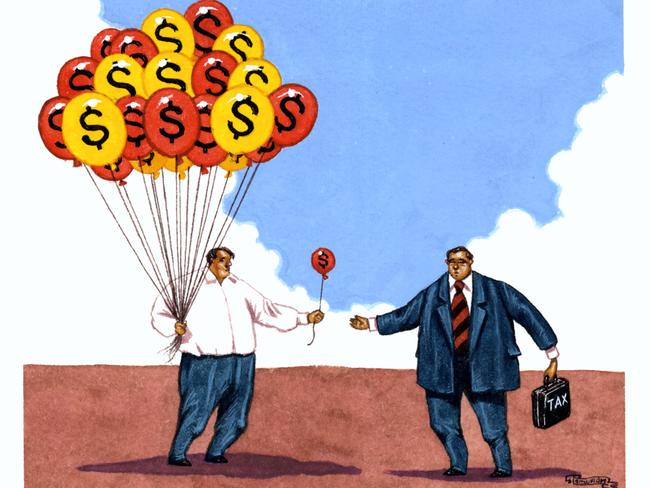

Firstly, because Tasmania’s state taxation revenue is the lowest in Australia, outside of the chronic basket case, the Northern Territory. The concomitant reliance on Commonwealth GST receipts and direct Commonwealth grants is high risk. As we know no one owes Tasmania a living and other states and territories periodically call for a squeeze on this state.

Commonwealth governments cut grants when the going gets tough. In other words, Tasmania is too reliant on revenue sources over which it has little control.

Conveyancing duty and other forms of transfer taxes are, says Eslake, highly distorting. He rightly notes that there is no argument among economists and bodies like the Productivity Commission that levying swingeing stamp duty on property transfers means reduced access to the housing market because of higher prices, older people remaining in large homes because they cannot afford to move, over-investment in upgrading properties, and when there is a property market downturn the duty revenues crash.

A broadbased land tax on the other hand is much more equitable and reliable as a source of revenue so long as governments do not give in the self-serving bleating of interest groups like farmers and churches. The Tasmanian government currently levies a land tax but the number of politically driven exemptions means only 32 per cent of the possible revenue if those exemptions were abolished, is collected. Exemptions from land tax in 2018-2019 amounted to an extraordinary $232 million. The introduction of a broadbased land tax, Eslake argues, would need to be phased in, and take account of recent purchasers of property who had just paid stamp duty. The asset rich income poor group — often elder Tasmanians — would also need to be compensated so they are not worse off.

And what of payroll tax? While employer groups bemoan it, payroll tax if designed without the distortions that come from political interference is a preferable form of taxation to the duties regime. Tasmania, says Eslake, is one of the worst offenders in the nation when it comes to distorting payroll tax. He gives this example. A firm that has a payroll of just under $2 million, which is about 36 employees, pays less payroll tax than in any other jurisdiction except South Australia. However a firm with 180 employees and a payroll of just over $10 million would pay more in payroll tax than any other state except Western Australia. There is no evidence, says Eslake, that the meddling in the payroll tax system by governments in Tasmania has created one job. Employment in small businesses has declined by double the national average since 2007, despite supposed payroll tax advantages.

Eslake’s reforms include an inheritance tax on wealthy estates. It is intriguing that Australia, unlike many nations around the world, thinks it’s OK for upper middle class and rich families to add to their wealth with a windfall from the deceased rich relative. Why shouldn’t there be a tax on this form of income which is not earnt in any way.

Tax reform is not a luxury. It is a necessity if Tasmania is to have any sort of economic future. The cracks papered over by Mr Gutwein and his government are now appearing and they are gaping holes. The Tasmanian economy is in terminal decline unless Mr Eslake’s prescription is adopted.

Hobart barrister Greg Barns SC is a human rights lawyer.