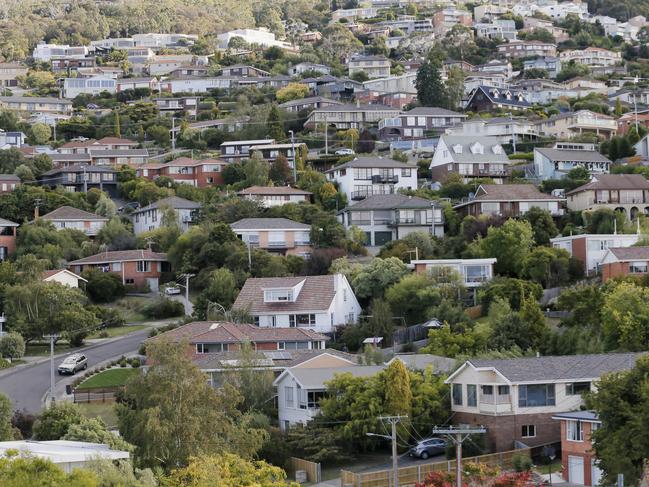

Talking Point: Tasmanian real estate prices defy expectations

The state’s real estate market continued to surge throughout the pandemic, but there are ways to improve the state’s housing affordability, write HAMISH BURRELL and PAUL LIGGINS.

Opinion

Don't miss out on the headlines from Opinion. Followed categories will be added to My News.

HOUSING affordability is a hot topic wherever you go in Australia and in recent years Tasmania has been at the pointy end.

Over the past year residential dwelling prices increased 6.8 per cent in Hobart — trailing only Canberra (8.5 per cent) and Darwin (11.4 per cent). This is well above the capital city average of 1.7 per cent.

Not long ago we wrote a Talking Point article that highlighted median prices in Hobart were only $40,000 less than Perth — Hobart prices are now $40,000 higher than Perth, and are on par with Brisbane.

But it’s not just Hobart which is on the rise. Dwelling prices across regional Tasmania grew even faster at 12.1 per cent — the highest in regional Australia.

A strong housing market was not in forecasters’ minds when COVID-19 first hit.

Expectations were house prices would fall alongside weaker population growth, higher unemployment and lower incomes.

But those dire predictions prompted policy action:

■ Historically low interest rates — borrowing has never been cheaper and Tasmanians have made the most of this with the value of new housing loan commitments for owner occupier housing reaching historical highs.

■ Government support measures for the construction sector — such as the state and federal governments HomeBuilder Grant.

Add to that rebounding consumer confidence, higher household saving and relatively unabated interstate demand for Tasmanian property. These demand-side factors have kept construction activity strong, to the point residential dwelling approvals have hit an all-time high.

There are other reasons housing costs are rising. Compared to a year ago total listings for sale in Hobart have fallen 27 per cent — giving Tasmanians fewer purchase options and pushing up prices.

In addition, when COVID-19 hit, Hobart’s historically tight rental market cooled as short-term accommodation was converted back to longer leases and growth slowed due to border closures. Rental properties became easier to find and cheaper. But this cooling off period appears over.

According to the latest Domain Rental Report, Hobart’s rental market is the tightest of all the capital cities and vacancies are below pre-pandemic levels. Rental prices are back on par with pre-COVID-19 and likely to rise further due to the pandemic rental moratorium recently ending and ongoing supply issues in the market. A scenario very different from the larger mainland capitals.

A strong property market assisted by a tight rental market means times are good for owners and investors, but things are more difficult for those who cannot afford to buy, and find rent increasing.

A recent release from the Australian Bureau of Statistics shows over the past five years, rent and housing (mortgage) costs rose 22 per cent and 16 per cent, respectively, in Hobart. Rents rose by 20 per cent more in Hobart compared to the national average.

As we’ve said before, one long-term reason why housing is more unaffordable is that council planning restrictions limit supply of new housing. Nobody wants uncontrolled development but councils and state government need to recognise the negative impact of restrictions when considering development applications, particularly for people struggling to get into the housing market.

The latest Human Services figures show more than 3500 Tasmanians are on the social housing register and providing housing for a priority applicant takes more than a year.

Across Australia research shows the number of recent low- and moderate-income home purchasers are decreasing, especially families with children and people buying their first home. Few low- and moderate-income purchasers can both buy a home and have kids. Quality, affordable housing is central to community wellbeing. It provides a foundation for family and social stability, and contributes to improved health and educational outcomes and a productive workforce. It is in everyone’s interests for housing to remain affordable.

In recent years the state government introduced measures to ease housing costs, including Tasmania’s Affordable Housing Strategy 2015-2025 (which includes the Private Rental Incentives Program, HomeShare and Streets Ahead Incentive Program) and the announcement in June to deliver up to 1000 new social houses through the Community Housing Growth Program.

These are welcome but the risk is housing affordability will worsen as demand grows. While lower international migration and easing of income support might reduce the rate of increase, more needs to be done to assist Tasmanians with secure housing, and ease the financial burden on those who can least afford it. Increasing the timely supply of housing, particularly through friendlier local and state planning and land release practices, must be a priority.

Paul Liggins is a partner and Hamish Burrell an analyst with Deloitte Access Economics in Hobart.