Emergency Service Levy means insurance premiums are more expensive in NSW than other states

NSW insurance customers are paying almost three times more tax than other states due to an Emergency Services Levy as industry leaders call for its removal. Here’s what it means.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

State government insurance taxes designed to pay for the state’s emergency services are driving up premiums by almost 20 per cent, with the burden becoming worse on policyholders as fewer people take up insurance.

NSW insurance customers are paying almost three times the amount of tax as in other states due to an Emergency Services Levy (ESL) being added to premiums, which are the second highest in the country on average.

The levy is considered by industry as a major disincentive for people to take out home insurance – the Insurance Council of Australia (ICA) estimates that more than 13 per cent of homes in NSW are uninsured, double the rate in Victoria.

The average home insurance premium in NSW is around $2600 – compared to $1654 in Victoria.

As fewer people take out insurance policies, the emergency services tax burden increases for those who have cover.

The ICA has long campaigned for the levy to be scrapped, declaring the tax leaves “businesses and consumers vulnerable in their time of need”.

“A recent report by the Actuaries Institute found that taxation is the second biggest contributor to home insurance premium prices after flood risk,” a spokeswoman said.

“The Emergency Services Levy adds around 18 per cent to home insurance premiums and up to 40 per cent to business cover in NSW.”

Stamp duty and GST are then added, leading to NSW policy holders being “triple-taxed,” the ICA spokeswoman said.

The ICA said scrapping the emergency services tax would immediately reduce premiums by 15 per cent.

“If the government are looking for a way to reduce the burden on cost of living, removing the

ESL from people’s insurance premiums is an easy and effective way to do this.”

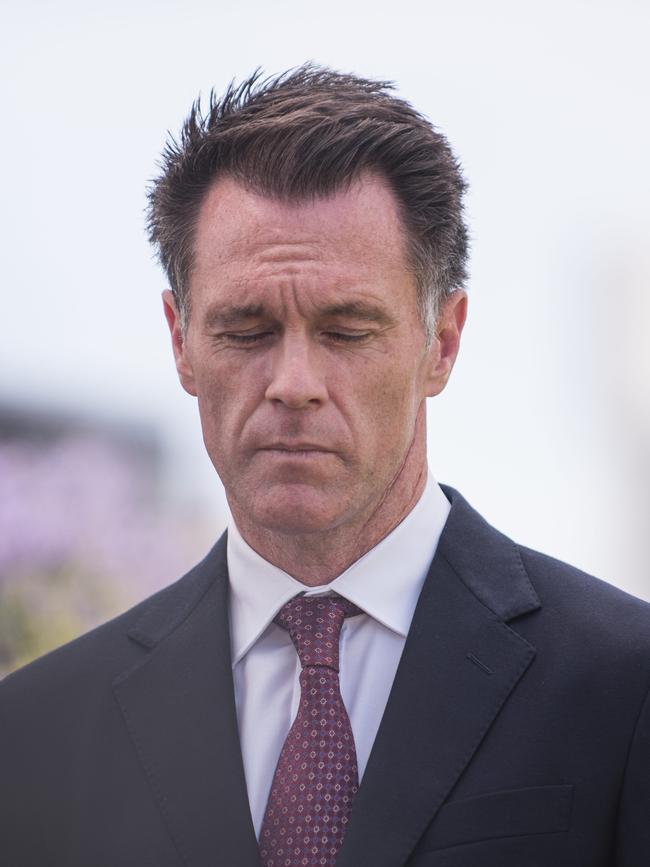

Business NSW CEO Daniel Hunter said that insurance costs have been the leading concern for businesses surveyed by the peak body since 2019, trumping “taxes, energy and wages”.

“For years Business NSW has called on the NSW Government to immediately remove the Emergency Services Levy and stamp duty tax from insurance premiums.”

“The ESL is a deterrent on businesses getting insurance,” he said.

He said scrapping the tax would “tell small enterprises that NSW is open for business”.

The former Coalition government planned to replace the Emergency Services Levy in 2017 with a new fee based on land values, but was forced into a backflip.

At the time, then-Premier Gladys Berejiklian said scrapping the ESL would have “unintended consequences”.

Most banks require mortgage holders to take out home insurance when they apply for a loan, but it is not always compulsory to keep it.

Originally published as Emergency Service Levy means insurance premiums are more expensive in NSW than other states