Virgin Money Australia home loan customers are leaving the Bank of Queensland subsidiary after being denied the RBA rate cut

Preschool teacher Kelly Schuppe faces paying $150 a month in extra interest after one bank subsidiary denied home-loan customers a rate cut. She’s not going to cop it.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

EXCLUSIVE: Virgin Money Australia home-loan customers are fleeing the lender after missing out on February’s interest rate cut.

Many of these customers are leaving on the recommendation of irate mortgage brokers who say they were blindsided by the decision to deny.

Virgin Money, which is owned by the Bank of Queensland, is one of only two lenders that has not passed on the 0.25 per cent reduction to interest rates announced by the Reserve Bank of Australia last month.

The other is also a Bank of Queensland subsidiary – BOQ Specialist, whose customers are doctors, dentists and vets.

One of Australia’s top mortgage brokers, Louisa Sanghera of Zippy Financial, told this masthead she was “actively refinancing” all 39 clients of her clients with Virgin Money home loans.

“I’m going to move them if I need to, and in this case I feel we need to,” Ms Sanghera said.

“I can get better elsewhere.”

She expressed disappointment not only with Virgin Money’s decision to keep the rate cut for itself, but also because the business failed to tell brokers directly.

Ms Sanghera said she found out from clients who had read the news.

“We had no communication,” she said.

Ms Sanghera went so far as to question BOQ’s ongoing commitment to the brand.

“I think they are looking to lose the clients,” she said.

One of her customers who is preparing to leave Virgin Money is Sydney preschool teacher Kelly Schuppe.

She and her husband have been with Virgin Money for at least four years.

Its decision to trouser the rate cut would cost the Schuppes more than $150 a month in extra interest.

“We are literally at the one bank which has chosen not to pass on the rate cut,” Mrs Schuppe said. “It’s a pretty big kick in the guts.”

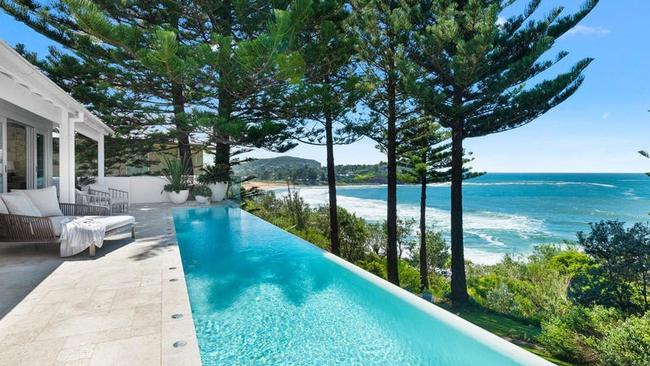

This masthead has previously revealed that BOQ CEO Patrick Allaway’s mortgage is with Westpac, which has passed on the rate cut to all customers. It’s understood Mr Allaway and his “style coach” wife, Libby, took out the loan on their Avalon Beach home before he joined BOQ.

BOQ did not respond to questions about why it did not communicate directly with brokers about holding on to the cut. Nor would it say whether it planned to close down Virgin Money within two years.

A spokesman said the decision to not pass on the rate cut to Virgin Money Australia and BOQ Specialist customers had the effect of “realigning previously discounted rates to current market rates”.

However, Mrs Schuppe said she and her husband had been told they could get 5.79 per cent with another lender – 0.3 percentage points cheaper than their Virgin Money interest rate.

Even after paying exit fees, the couple will be about $2000 a year better off.

Federal Treasurer Jim Chalmers last week encouraged unhappy Virgin Money customers to leave.

More Coverage

Originally published as Virgin Money Australia home loan customers are leaving the Bank of Queensland subsidiary after being denied the RBA rate cut