‘Saved diligently’: Peter Dutton’s ‘first home at 19’ advice ripped apart

Peter Dutton has been torched over a viral clip during a campaign launch where he proudly reflected on ‘saving diligently’ to buy his first home at 19.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

Peter Dutton says he “saved diligently” to be able to buy his first home at the age of 19.

So is it possible for young people today to just pull themselves up by their bootstraps and follow in the opposition leader’s footsteps? No, not really.

“I have saved diligently over those years and it allowed me to put together a deposit for a house, and I bought my first home at age 19 — one of my proudest achievements,” Mr Dutton said in his unofficial campaign launch in Melbourne last month.

Later in the same speech, however, Mr Dutton said an “issue close to my heart is restoring the dream of home ownership”, which today “is beyond reach for too many”.

“Entering the property market shouldn’t be limited to those who can rely on the bank of mum and dad,” he said.

“That’s why a Coalition government will allow Australians to access up to $50,000 of their super to buy their first home.”

The opposition leader’s comments about buying his first home resurfaced online this week and have been widely mocked, with numerous commentators highlighting the slight change in economic realities for first homebuyers today.

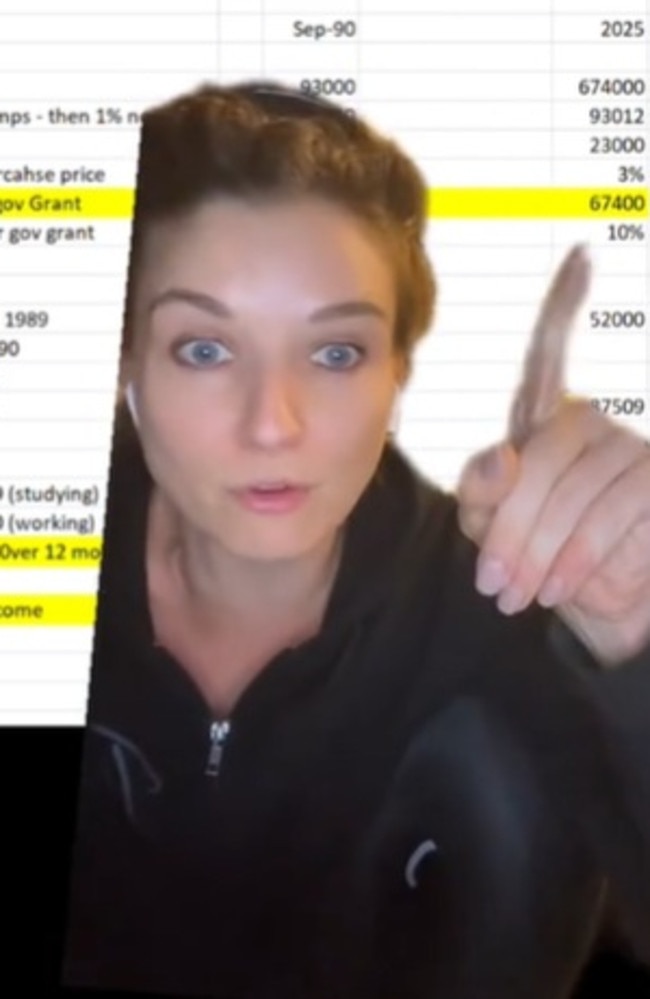

“I’m going to talk you through his number set and tell you why it’s impossible to do today what he did then,” investment analyst Rachel Cole, who runs the popular TikTok channel Get Rich With Rach, said in a video this week giving a detailed breakdown of the figures involved.

In 1990, a two-bedroom unit in Brisbane cost $93,000, requiring a deposit after stamp duty of $10,230. Factoring in the Hawke government’s $7000 first homeowner grant, Mr Dutton would have had to save just $3230.

As a young trainee police officer, Mr Dutton would have been earning just shy of $17,000 a year after tax — meaning he would have had to save just 19 per cent of his income for the deposit.

Moreover, his 90 per cent mortgage would have represented a multiple of just 3.6 times his salary.

In 2025, the same unit costs $674,000, requiring a deposit of $93,012, or $67,400 after government grants.

The same trainee police officer today would take home $44,792 after tax, meaning they would have to save 150 per cent of their annual income.

“What that means is you have to save seven times as much today as Peter Dutton had to save,” Ms Cole explained.

“But that’s just the deposit. That’s the first of your worries, not the biggest one.”

She noted that when Mr Dutton was working, he would have had to borrow just $83,700, which is a “very safe” loan.

“Today, that person has to borrow $606,600,” she said.

“That means this person is borrowing 8.8 times their salary to do the same deal. Let’s say the banks would let you do that, which they won’t … the banks will only lend you five times your salary. So even if you were the world’s most diligent saver, even if you managed to save that 10 per cent deposit in two years, you still couldn’t buy the property because the debt-to-income ratio is too high.”

She noted debt-to-income ratio was the “biggest problem” for young people buying property today.

“So whenever the governments are banging on about it’s a deposit issue, it’s really not, because even if you had the deposit you couldn’t get the loan anyway because the wages are too low relative to the prices,” she said.

“So every single time I hear a politician getting on TV talking about how they did it, I just want you to think about this number set because it drives me insane. It does not matter how much avocado toast you give up because the bank’s not going to lend you 8.8 times your income anyway.”

Mr Dutton talking about “how great he was for buying as a 19-year-old without any recognition of a completely different economic landscape to what people are dealing with today” meant he was “in a different world”, she added.

“I wish every politician who was born before 1980 could understand this.”

MacroBusiness chief economist Leith van Onselen previously shared a similar dissection of Mr Dutton’s numbers, pointing out that the median house price in Brisbane was $113,000 in 1990, compared with more than $1 million today.

“The median house price in Brisbane rose by around 800 per cent between 1990 and 2024,” he wrote last week.

“Home buyers today face far worse affordability challenges than Peter Dutton faced in 1990, making his comments rather hollow. At the national level, home values are tracking at a record share of incomes. The share of median income required to service a mortgage on a median-priced home is also the highest on record. The time taken to save a deposit on the median-priced home is also near record levels. Finally, saving a deposit has become harder thanks to the record share of income required to service rents, which has drained disposable incomes.”

He added, “Like many of his parliamentary colleagues, Peter Dutton has profited greatly from Australia’s soaring property values over the past three decades. It is always a bit rich when politicians like Peter Dutton, who purchased property when it was cheap and have profited from soaring values, wax lyrical about the virtues of saving for a home.”

It comes after revelations Mr Dutton has sold off a property portfolio worth around $12 million since 2020.

Originally published as ‘Saved diligently’: Peter Dutton’s ‘first home at 19’ advice ripped apart