Greens hold strong position on super tax hike plan as Labor slammed for ‘shameless grab’ of Aussies’ money

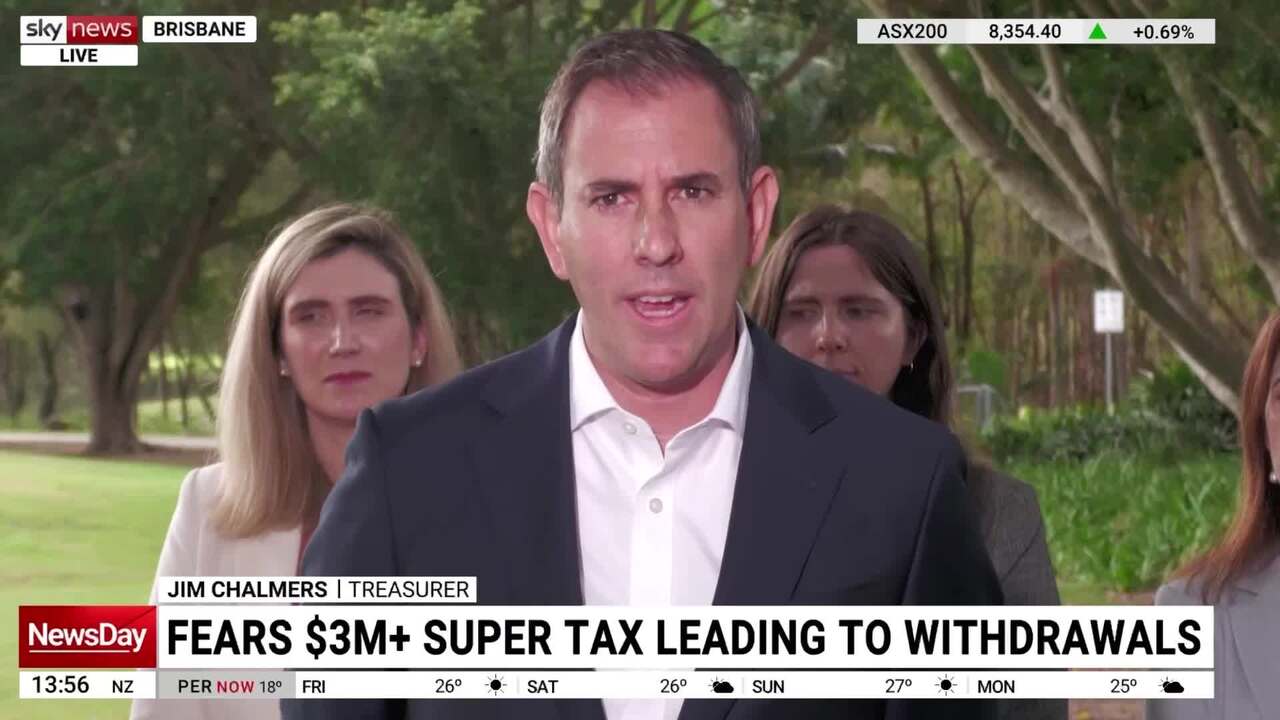

Jim Chalmers defended Labor’s plan to increase the concessional tax rate on super earnings over $3m, as the Coalition likened it to a “robin hood style tax on aspiration”.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

The Greens will be in a strong position to demand concessions from Labor in return for supporting a proposed tax hike on superannuation accounts above $3 million because the Albanese Government has already banked on the “shameless grab” of Australians’ money, the Opposition has warned.

Treasurer Jim Chalmers on Friday defended Labor’s plan to increase the concessional tax rate on superannuation earnings from 15 per cent to 30 per cent for balances over $3m as “modest”, but the Coalition has likened the proposal to a “robin hood style tax on aspiration”.

NSW Senator Andrew Bragg said with Labor counting on the extra revenue from the tax increase, the Greens could secure any number of concessions in return for supporting the legislation in the Senate.

“Labor has already banked the billions from this new tax in the budget, but they need the Greens in the Senate to make this tax law – so what will Labor give the Greens in return for their votes?,” he said.

The superannuation tax increase is forecast to rise an extra $2.3 billion in its first full year in 2027-28, and $40bn over the next decade.

Amid reports wealthy retirees are already starting to sell their assets and restructure their investment portfolios ahead of July 1 when the new tax is due to kick in, Mr Chalmers argued Labor’s proposal was “responsible” and “only applied to a tiny sliver of people”.

He said it was an “important part” of Labor’s efforts to make the budget more sustainable, and fund its “priorities” like Medicare.

The higher tax rate would only apply to about 80,000 super accounts, or about 0.5 per cent, but modelling by AMP deputy chief economist Diana Mousina found the average 22-year-old today would likely hit $3m by retirement.

Mr Chalmers said the new tax rate was still “very concessional” and argued there were many other taxes that were not indexed.

“What that means is governments of either political persuasion into the future can take decisions to lift the threshold,” he said.

But Mr Bragg said Labor’s tax was a “shameless grab” for Australians’ money.

“(Labor is) sending Australians an invoice for money they haven’t even made,” he said.

“An unrealised gain is just that: unrealised.”

Mr Bragg said people would have to sell the newly-taxed assets like shares or an investment property, possibly “even the family farm” to pay the tax.

He said a farmer who owned their property through their super account and who ended up with a balance of above $3m due to increases in land value would owe the additional tax even if their business had not improved.

Mr Chalmers and new Employment and Workplace Relations Minister Amanda Rishworth on Friday made a submission to the Fair Work Commission supporting a wage increase for Australia’s award workers.

“After the Australian Labor Party advocated to the Fair Work Commission during the election campaign, today the government has also made a submission to the FWC recommending they award an economically sustainable real wage increase to Australia’s award workers,” Mr Chalmers said.

Mr Chalmers said Australia’s minimum wage had increased by $143 a week since Labor came to office, and the median wage had increased by $206 per week.

More Coverage

Originally published as Greens hold strong position on super tax hike plan as Labor slammed for ‘shameless grab’ of Aussies’ money