Insurance Hub at the Townsville Sports Stadium to provide post-disaster support

An Insurance Hub has launched in Townsville, providing face-to-face support for customers adversely impacted by the severe weather event. Read the latest stats and advice.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

An Insurance Hub has swung into action in Townsville, bringing together numerous insurers under the same roof to offer face-to-face assistance to hundreds of customers affected by North Queensland’s severe storms and flooding.

An initiative led by the Insurance Council of Australia (ICA), the Insurance Hub was activated on Wednesday morning at the Townsville Sports Stadium on Stuart Dr, Annandale, and will operate 9am to 4pm daily (including weekends) until Tuesday, February 11.

ICA will have representatives present, able to provide general insurance guidance to property and business owners who have lodged or intend to lodge a claim, while insurers including Suncorp, RACQ, IAG, Hollard, and Allianz will be able to assist customers directly with their claims.

Over the weekend, the ICA declared the storms and flooding a “significant event”, meaning that it has commenced its claims data collection, analysis, and reporting processes in consultation with members, and would continue working with government and agencies to understand impacts on the community and ensure affected residents receive assistance.

While it was too early to estimate the total cost of the adverse weather, the ICA confirmed on Wednesday that insurers had received more than 1400 storm and flood-related claims so far.

As flood waters recede, roads reopen and the clean-up begins, insurers were expecting the number of claims to increase.

If there was a significant increase in claim numbers or complexity, if the geographical spread of this event is extended, or in consultation with insurers, the event could potentially be escalated to the level of “insurance catastrophe”.

Insurance Council of Australia chief executive Andrew Hall said the opening of the Insurance Hub signalled that the recovery and clean-up process was beginning for some.

“Relief hubs provide an opportunity for impacted locals to understand more about the claims process, as well as meet with a representative of their insurer to discuss their claim or the Insurance Council for general information about the claims process,” Mr Hall said.

Suncorp rolls up sleeves for recovery effort

Suncorp Insurance has three staff ready to provide face-to-face assistance to their customers at the hub by arranging emergency support, temporary accommodation, and emergency payments.

The insurer was also closely monitoring the impacts to Ingham and Cardwell using daily satellite flood mapping to understand the extent of current and potential flood inundation.

As of February 4, the insurer, including brands Suncorp Insurance, AAMI, Shannons and Apia, had received 526 claims related to the severe weather event from January 29 to February 4.

They included 402 homes claims, 114 motor claims and 10 commercial property claims, with the Townsville suburbs of Garbutt, Burdell, and Kirwan generating the most claims.

Supported by local qualified tradespeople, Suncorp had more than 200 emergency repairs already underway to prevent further damage, with additional resources on standby to be deployed when safe.

Suncorp’s Chief Executive Consumer Insurance Lisa Harrison said support from the North Queensland-based claims team, assessors and builders will be crucial.

“The impact of severe flooding can be devastating, which is why our team must be on the ground when it’s safe to do so, making sure we are available to support our customers and community,” Ms Harrison said.

“The safety of everyone in the impacted communities is always our top priority. Many roads, homes and businesses remain flooded, and we are closely monitoring the unfolding situation using cutting edge technology at our Disaster Management Centre in Brisbane to help co-ordinate our response.

“We are proactively communicating with impacted customers through phone calls, SMS and radio and our dedicated Lodgement Response Team is ready to ramp up support on the phones if needed.”

Once water receded and residents could safely return to their homes, she said they would start making proactive calls to customers that may require additional support.

“North Queenslanders are known for their resilience, and Suncorp will be here helping when they need us most.”

RACQ brings extra resources into North Queensland

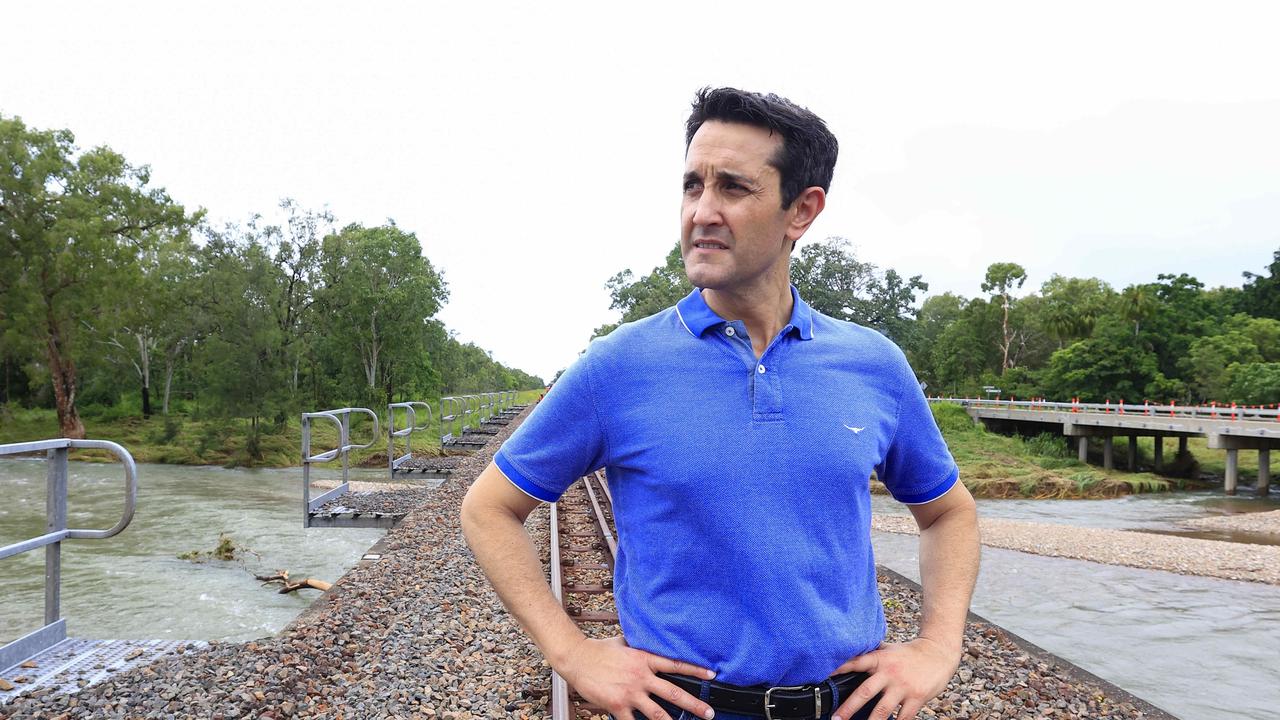

RACQ Chief Executive Insurance Trent Sayers visited Townsville on Wednesday to discuss what his business was doing to support the disaster-affected region.

He said they deployed an additional resources to the city, including eight additional staff, who would work at the Insurance Hub and their Willows Shopping Centre branch.

“We had a very busy day yesterday on the phones, with a large number of claims being lodged as people got back to their homes,” Mr Sayers said.

“At about 11am (on Wednesday), we had somewhere in the vicinity of about 250 claims lodged.

“Across the telephone network, we’ve got hundreds of staff available and ready to go … and that’s on top of our many trades and supplier networks that we already have in Townsville that have all been activated and also been bolstering their resources.”

When the roads were safe to get through, he said RACQ’s mobile member centre would be deployed in Townsville, at a location yet to be confirmed.

“We should get on top of that in the coming days, and we’ll be able to let people know where that’s going to be and when it’s going to get there,” he said.

Of the 250 claims, he said about a third were lodged due to flood water inundations at the ground level, with the bulk of claims linked to water ingress through the roof.

“So you get very different (insurance) cost profiles, but at this stage, it’s still too early to put a number on what we’re seeing until we get some further assessments done, which is happening as we speak,” he said.

“We would urge people to get in touch as possible and get their claim lodged because whether it be telephone, online, or in our branches or in the recovery hub out at the stadium, we’ve got people ready.

“The sooner a claim gets lodged, the sooner we can work through people needing things like temporary accommodation, emergency payments, and start that clean-up process.”

For members anxious to begin the clean-up, he encouraged them to keep photos, videos or a list of items that they were discarding.

“We’ve got a very watchful eye on areas north of Townsville … (where) we are seeing some very nasty damage … so we’ll be ensuring we get the resources up into those areas as well.”

Queensland Country Bank extends financial relief to NQ

Queensland Country Bank is offering a comprehensive financial relief support package to its members impacted by the severe weather.

The support package offers a range of financial assistance options, including the deferment of loan repayments for up to three months, temporary transition to interest-only loan repayments, and loan restructuring to reduce repayments.

There will also be no establishment fees on new personal loans applied for before April 30, 2025, waived break costs on fixed-rate loans paid out with insurance payments, and no early withdrawal penalties on term deposits.

Queensland Country Bank CEO Aaron Newman said they were already assisting flood-affected members through the package, which will help reduce the impacts of financial hardship caused by the flood damage and loss of income over the coming months.

“Many of our team members, including our call centre operators, live and work in the same local communities that are being impacted, so we’re well placed to understand every member’s unique situation and the effects a natural disaster can have on individuals and communities,” Mr Newman said.

“We know from previous natural disasters that offering practical support to our members helps to ease the financial burden during this challenging time.

“Our insurance partner, CGU Insurance, has been actively supporting affected members, and through a co-ordinated approach, our team has been able to reach out with additional support tailored to their individual circumstances.”

For more information, visit: www.queenslandcountry.bank.

Advice for residents returning to weather-affected homes

Regional Queensland-focused insurer Sure Insurance was assisting customers impacted by the significant weather event and had already received a number of claims.

Its loss adjusters were already on the ground, along with a panel of builders, restorers and trades to help customers return to their flood-damaged homes.

Sure Insurance managing director Bradley Heath said it was important that householders with property damage lodged their claim as soon as possible.

“We are prioritising customers with major property damage, and those with special needs or vulnerabilities,” Mr Heath said.

He offered the following advice to householders returning to their flood affected homes to ensure they stayed safe:

• Be aware of potential electrical danger if water has entered the property. Don’t use electrical appliances that have been wet.

• Make your home safe and as comfortable as possible by cleaning away water, mud or small debris that have entered the house.

• Be aware that flood water may contain sewage or other toxic materials and substances.

• Remove and dispose of any items that may present a health hazard to you or your family. Take pictures or a video of property you have disposed of, or for items like carpet keep a small sample. This will help us to settle your claim quickly and fairly.

• Don’t throw away items that could be repairable, unless they are a health risk.

• Contact us before you attempt any major household repairs and do not authorise any building work, as unauthorised work may not be covered by your household insurance policy.

• Keep your home well ventilated to help it dry, but don’t leave your home open while unattended.

For more information, visit: sure-insurance.com.au.

Townsville’s Insurance Hub

• Location: Townsville Sports Stadium – Stuart Dr, Annandale

• Dates: Wednesday 5 February to Tuesday 11 February, including weekends

• Opening hours: 9am to 4pm daily

Originally published as Insurance Hub at the Townsville Sports Stadium to provide post-disaster support